Overview

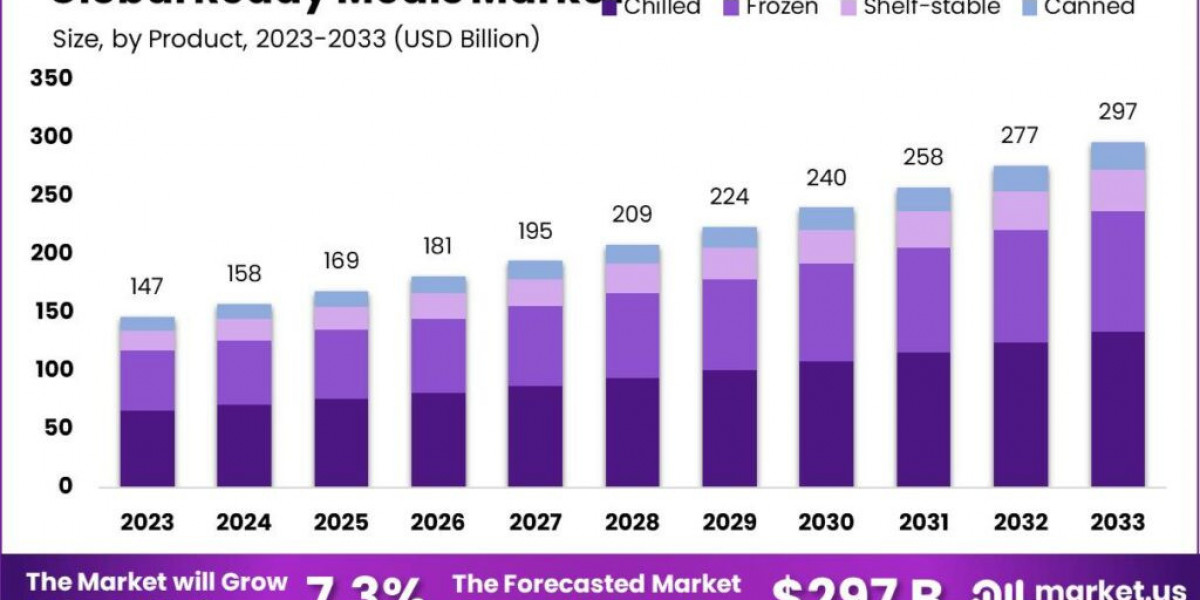

Global Ready Meals Market size is expected to be worth around USD 297 Billion by 2033 from USD 147 Billion in 2023, growing at a CAGR of 7.3% during the forecast period from 2023 to 2032.

The ready meals market refers to the segment of the food industry that provides pre-prepared, packaged meals that require minimal preparation, usually just heating, before consumption. These meals are designed for convenience, catering to the needs of busy individuals and families who may not have the time or desire to cook from scratch. The market includes a wide variety of cuisines and dietary options, from traditional comfort foods to healthy and gourmet selections.

Demand for ready meals has grown significantly due to changing lifestyles, increased urbanization, and the rise in dual-income households. Consumers value the convenience, time-saving aspects, and the variety of choices available. Ready meals are available in supermarkets, convenience stores, and through online retailers.

Technological advancements in food preservation and packaging have also contributed to the growth of this market. Innovations such as vacuum sealing, freeze-drying, and microwave-safe containers have improved the quality, taste, and shelf-life of ready meals, making them more appealing to consumers.

However, the ready meals market faces challenges, including concerns about nutritional content, preservatives, and environmental impact due to packaging waste. Producers are increasingly focusing on healthier ingredients, clean labels, and sustainable packaging to address these issues and meet the evolving preferences of health-conscious and environmentally aware consumers.

Key Market Segments

By Product

Chilled

Frozen

Shelf-stable

Canned

By Meal Type

Vegan

Vegetarian

Non-vegetarian

By Age Group

18-24 Years

25-34 Years

35-44 Years

45-54 Years

Above 55 Years

By End-use

Residential

Food Services

By Distribution Channel

Convenience Stores

Supermarkets & Hypermarkets

Online

Others

Download a sample report in MINUTES@https://market.us/report/ready-meals-market/

In 2023, chilled ready meals led the market with a 45.6% share, driven by their freshness and minimal processing, appealing to consumers seeking convenient and nutritious options with a shorter shelf life. Vegan ready meals held a 40.3% share, driven by growing interest in plant-based diets for health and environmental reasons, appealing to those seeking cruelty-free and sustainable food options.

The 18-24 years age group dominated the ready meals market, securing a 45.3% share, as young adults and college students prioritize convenience and quick meal solutions due to busy lifestyles and limited cooking skills. Food services emerged as the dominant segment, capturing a 65.4% share, including restaurants, cafeterias, catering services, and other food service providers catering to a wide range of consumers.

Supermarkets and hypermarkets dominated the retail segment of the ready meals market with a 46.7% share, offering a wide variety of ready meals and catering to diverse consumer preferences due to their convenient locations, extensive product range, and one-stop shopping experience.

Market Key Players

Nestlé

General Mills, Inc.

2 Sisters Food Group

Conagra Brands Inc.

Dr. Oetker

Green Mill Foods

Hormel Foods Corporation

Iceland Foods Ltd

McCain Foods Limited

Nomad Foods

The Campbell Soup

The JM Smucker Co.

The Kraft Heinz

Tyson Foods Inc

Tyson Foods, Inc.

Unilever

Driver: The primary driver for the ready meals market is the shift in consumer lifestyles towards more hectic and busy schedules, increasing the demand for convenient and time-saving meal options. Additionally, rising disposable incomes globally contribute to the growing popularity of ready meals, as consumers are more willing to spend on convenience.

Restraint: Fresh foods are considered superior alternatives to ready meals, and the rising popularity of fresh foods due to health consciousness and lifestyle disorder concerns serves as a significant restraint. The preference for fresh over packaged ready meals has been accelerated by recent developments during the COVID-19 pandemic.

Opportunity: The increasing popularity of ready meals, coupled with rising disposable incomes, presents lucrative growth opportunities for the market over the forecast period. Manufacturers can capitalize on this trend by introducing a variety of ready meal options that cater to diverse consumer preferences and dietary needs.

Challenge: The main challenge for the ready meals market is balancing convenience with health and nutritional value. As consumers become more health-conscious, ready meal producers must innovate to offer healthier options that compete with the perceived benefits of fresh foods. Ensuring high-quality, nutritious, and appealing ready meals is crucial to overcoming this challenge.