The hydrochloric acid market involves the production, distribution, and application of hydrochloric acid (HCl), a strong, corrosive mineral acid widely used in various industrial processes. Key applications include pH regulation, chemical synthesis, metal cleaning and pickling, and food processing. It is also crucial in the production of chlorides, fertilizers, and dyes. The market is driven by demand from industries such as steel manufacturing, pharmaceuticals, and oil and gas, where hydrochloric acid is used for refining and extraction. Despite its broad utility, the market faces challenges related to the handling and environmental impact of this highly corrosive substance, prompting advancements in safe production and usage practices.

Market Key Players:

Occidental Petroleum Corporation

BASF SE

Merck KGaA

Covestro AG

Shin-Etsu Chemical Co., Ltd

Solvay

TOAGOSEI CO. LTD

Westlake Chemical Corporation

Nouryon Industrial Chemicals

Inovyn

Vynova Group

Tessenderlo Group

AGC Chemicals

Dongyue Group

ERCO Worldwide

Click here for request a sample: https://market.us/report/hydrochloric-acid-market/request-sample/

By Production Method:

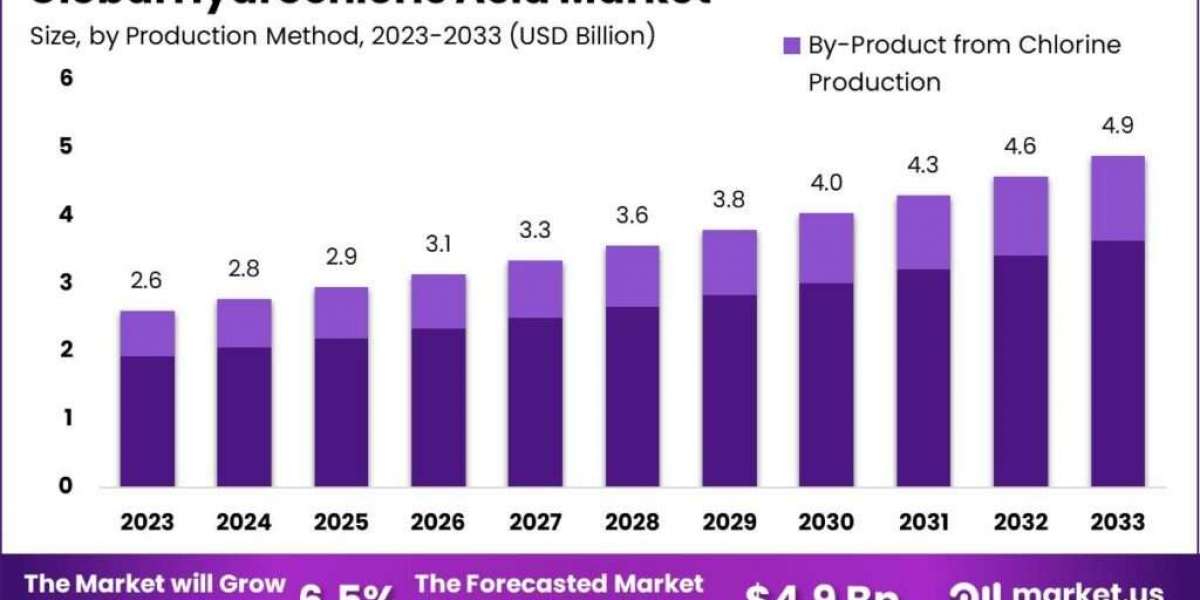

In 2023, Synthetic Production dominated the Hydrochloric Acid market, holding over 74.5% share. This method produces hydrochloric acid as a byproduct from other chemical processes, making it cost-effective and efficient for large-scale industrial use. The Chlorine Production method, which generates hydrochloric acid through the electrolytic production of chlorine gas and caustic soda, captures a smaller market share but is essential where both chlorine and hydrochloric acid are needed, such as in water treatment and textile manufacturing.

By Application:

In 2023, Steel Pickling was the leading application for hydrochloric acid, with over 31.2% market share. It is crucial for removing rust and scale from steel. Water Treatment also plays a significant role, using hydrochloric acid for pH regulation in drinking and wastewater. In Food Processing, hydrochloric acid aids in sugar processing and gelatin production. Chemical Production, Ore Processing, Oil Well Acidizing, and Industrial Cleaning also utilize hydrochloric acid for various essential industrial processes.

By Concentration:

In 2023, hydrochloric acid with a 30-38% concentration led the market, favored for strong acidic reactions needed in steel pickling and oil well acidizing. The 20-30% concentration is important for organic compound production in the chemical industry, while 10-20% is used in water treatment and food applications. Concentrations up to 10% are suitable for household and light industrial cleaning tasks, where a milder acid is appropriate.

By End-Use:

In 2023, the Food & Beverages sector held the largest share of the Hydrochloric Acid market at over 30.8%, using it for pH control and food additive production. The Pharmaceuticals sector also relies on hydrochloric acid for pH adjustment in drug formulation. Textile manufacturing uses it for fiber processing and dyeing. The Steel industry uses hydrochloric acid for steel pickling, while the Oil & Gas sector employs it for well acidizing. The Chemical sector depends on it for producing various chemicals, and Water Waste Management uses it to treat sewage and industrial waste.

Key Market Segments:

By Production Method

Synthetic Production

By-Product from Chlorine Production

By Application

Food Processing

Water Treatment

Steel Pickling

Chemical Production

Ore Processing

Oil Well Acidizing

Industrial Cleaning

Others

By Concentration

Upto 10%

10-20%

20-30%

30-38%

By End-use

Food & Beverages

Pharmaceuticals

Textile

Steel

Oil & Gas

Chemical

Water Waste Management

Others

Drivers:

The expanding applications of hydrochloric acid in the oil and gas industry drive its market growth, particularly for well stimulation and oil well acidizing. Hydrochloric acid dissolves mineral deposits that obstruct oil and gas flow, enhancing well productivity and extending operational life. As global energy demand rises and new oil fields are explored, the need for efficient extraction methods like acidizing increases, boosting hydrochloric acid demand. Additionally, its use in hydraulic fracturing and well rehabilitation further supports market growth in the sector.

Restraints:

Environmental and health concerns significantly restrain the hydrochloric acid market. Its corrosive nature poses risks to human health and ecosystems, necessitating stringent safety and disposal protocols that raise operational costs. Environmental damage from spills and leaks, coupled with increasing regulations and consumer demand for safer chemicals, constrains market growth. These factors prompt a shift towards greener alternatives and stricter regulatory compliance, impacting hydrochloric acid's market dynamics.

Opportunity:

The growing demand for water treatment presents a major opportunity for the hydrochloric acid market. It is vital for pH adjustment, resin regeneration, and impurity removal in water purification processes. Increased investment in water treatment infrastructure, driven by regulatory pressures and industrial expansion, boosts hydrochloric acid demand. Technological advancements in water treatment, such as reverse osmosis and desalination, further enhance market potential, making this sector a key area for growth.

Trends:

A notable trend in the hydrochloric acid market is the advancement in recycling and neutralization technologies. Enhanced recycling methods, such as membrane cell technology and solvent extraction, enable the recovery and reuse of hydrochloric acid, reducing waste and production costs. Improved neutralization techniques also ensure safe disposal of waste acid. These developments support environmental compliance and operational efficiency, creating new opportunities for companies in chemical recovery and waste treatment.