Managing finances efficiently is crucial for any business. One key aspect of this is handling accounts payable, a task that ensures your suppliers and vendors are paid on time. Understanding and utilizing Accounts Payable Services can streamline your financial operations, saving you time and resources.

What Are Accounts Payable Services?

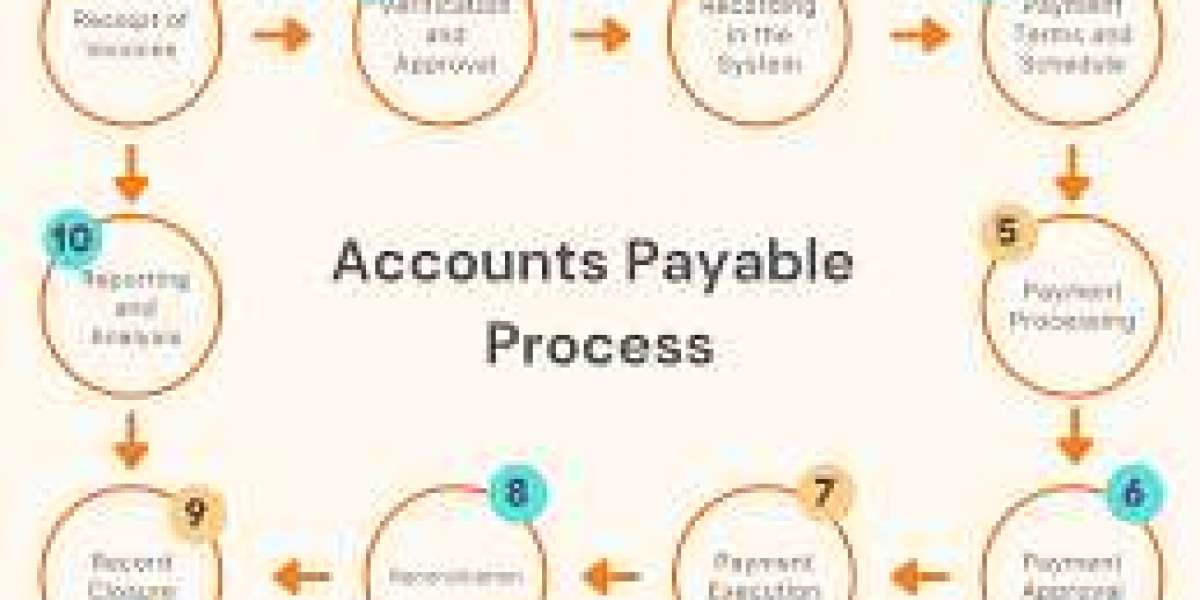

Accounts Payable Services involve the management and processing of a company's outgoing payments to suppliers. This service includes invoice processing, payment scheduling, and managing vendor relationships. By outsourcing this function, businesses can ensure that their payments are timely, accurate, and efficient.

The Significance of Accounts Payable in Business Operations

Accounts payable goes beyond a simple financial obligation; it's a vital element of your cash flow management. Delayed payments can disrupt your operations, damage supplier relationships, and incur late fees. With professional Accounts Receivable & Payable Services, you can ensure smooth operations and maintain healthy business relationships.

Benefits of Outsourcing Accounts Payable Services

There are several advantages to outsourcing AR and AP services:

Efficiency: Specialized service providers have the expertise and technology to process payments quickly and accurately.

Cost-Effectiveness: Reducing the need for an in-house team can lower operational costs.

Focus on Core Activities: By delegating financial management to experts, businesses can focus on their primary operations.

Improved Accuracy: Professional services minimize the risk of errors, ensuring that all payments are made correctly and on time.

Enhanced Vendor Relationships: Timely payments foster trust and strengthen partnerships with suppliers.

Integrating Accounts Receivable & Payable Services

Many businesses find value in integrating Accounts Receivable & Payable Services into a single streamlined process. This integration allows for better cash flow management, as the inflow and outflow of funds are closely monitored and controlled. By managing both AR and AP together, businesses can have a clearer financial picture and make informed decisions.

Choosing the Right AR and AP Services Provider

When selecting a provider for AR and AP Services, consider the following factors:

Experience and Expertise: Choose a provider with a proven track record in financial management.

Technology: Ensure the provider uses up-to-date software and systems for efficient processing.

Customer Support: Dependable assistance is crucial for addressing any issues that might occur.

Customization: The provider should be able to tailor their services to your business’s specific needs.

Conclusion

Efficient management of accounts payable is essential for maintaining smooth business operations. By outsourcing Accounts Payable Services and integrating them with Accounts Receivable & Payable Services, businesses can enhance their financial management, reduce costs, and focus on growth. Ensure you select a dependable provider to fully leverage the advantages of these services.