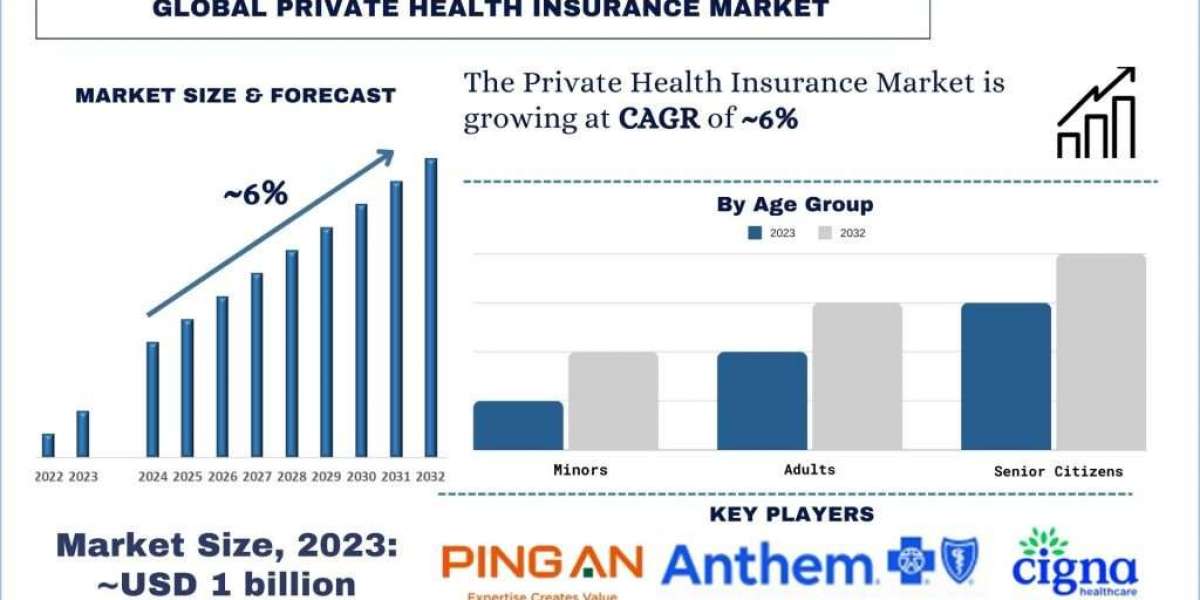

The private health insurance market is experiencing rapid transformation, influenced by technological advancements, changing consumer expectations, and evolving regulatory landscapes. As healthcare costs continue to rise and the need for comprehensive health coverage becomes more pressing, insurers are innovating to stay competitive and meet the demands of a diverse and growing customer base. According to the UnivDatos Market Insights Analysis, As the global population ages, the demand for health insurance coverage increases, particularly for chronic diseases and long-term care needs. This will drive the scenario of private health insurance and as per their “Private Health Insurance Market” report, the market was valued at USD ~1 billion in 2023, growing at a CAGR of ~6% during the forecast period from 2024 - 2032.

Request Free Sample Pages with Graphs and Figures Here - https://univdatos.com/get-a-free-sample-form-php/?product_id=60268

The Rise of Telehealth and Digital Health Services

One of the most significant trends reshaping the private health insurance market is the rise of telehealth and digital health services. The COVID-19 pandemic accelerated the adoption of telehealth, as social distancing measures and lockdowns necessitated alternative ways for patients to access healthcare. Telehealth allows patients to consult with healthcare providers remotely, reducing the need for in-person visits and making healthcare more accessible and convenient.

Private health insurers are increasingly incorporating telehealth services into their plans. Many insurers now offer 24/7 access to virtual consultations, which can be particularly beneficial for managing chronic conditions, mental health services, and routine check-ups. This shift not only improves access to care but also helps reduce costs associated with traditional healthcare delivery.

In addition to telehealth, digital health services such as mobile health apps and wearable devices are gaining traction. These technologies enable continuous health monitoring and provide valuable data that can be used to personalize healthcare plans. Insurers are leveraging these tools to offer wellness programs and preventive care initiatives, encouraging policyholders to adopt healthier lifestyles and potentially reducing long-term healthcare costs.

Personalized Health Insurance Plans

Consumer demand for personalized and customizable health insurance plans is on the rise. Traditional one-size-fits-all insurance plans are no longer sufficient to meet the diverse needs of modern consumers. Today’s policyholders expect health insurance plans that are tailored to their specific health conditions, lifestyles, and financial situations.

To address this demand, insurers are offering a range of customizable options. For example, individuals can select from various coverage levels, add or remove specific benefits, and choose plans that best suit their health needs and budgets. This personalization extends to wellness programs that are designed to address individual health goals, such as weight management, smoking cessation, and chronic disease management.

The use of data analytics and artificial intelligence (AI) is critical in developing personalized health insurance plans. By analysing data from electronic health records, wearable devices, and other sources, insurers can gain insights into policyholders’ health risks and behaviours. This information allows insurers to create tailored plans that provide better value and outcomes for their customers.

Regulatory Changes and Healthcare Reforms

The regulatory environment is a major driver of change in the private health insurance market. In the United States, the Affordable Care Act (ACA) brought significant reforms aimed at expanding coverage, reducing costs, and improving healthcare quality. Recent discussions around healthcare reform continue to influence the market, with potential changes to the ACA and other regulations being closely monitored by insurers.

One of the ongoing debates in the U.S. centers around the future of the ACA, including issues such as the individual mandate, essential health benefits, and Medicaid expansion. Changes in these areas could have significant implications for the private health insurance market, affecting everything from coverage options to premium pricing.

In Canada, while the public healthcare system provides universal coverage, there is an ongoing discussion about the role of private insurance in supplementing public healthcare. Regulatory changes at the provincial level can impact how private insurers operate, particularly in areas such as prescription drug coverage and extended health benefits.

Globally, regulatory trends are also influencing the market. For instance, the European Union is working towards greater harmonization of health insurance regulations to facilitate cross-border healthcare. This initiative aims to increase competition among insurers and improve access to care for EU citizens.

Related Reports-

Digital Twin in Healthcare Market: Current Analysis and Forecast (2024-2032)

Minimally Invasive Cosmetic Procedures Market: Current Analysis and Forecast (2024-2032)

The Impact of Insurtech

Insurtech, or insurance technology, is transforming the private health insurance market by introducing innovative solutions that enhance efficiency, reduce costs, and improve customer experiences. Startups and established insurers alike are leveraging insurtech to streamline operations and develop new products and services.

Artificial intelligence and machine learning are being used to analyze vast amounts of health data, enabling insurers to identify trends, predict risks, and create personalized health plans. AI-powered chatbots and virtual assistants are improving customer service by providing instant support and guidance to policyholders.

Blockchain technology is also gaining traction in the insurance industry. It offers the potential to improve transparency, security, and efficiency in processes such as claims management and policy administration. By using blockchain, insurers can reduce fraud, streamline transactions, and enhance trust between parties.

Moreover, mobile applications and online platforms are making it easier for consumers to purchase and manage their health insurance plans. These digital tools provide a seamless experience, allowing users to compare plans, file claims, and access healthcare services from their smartphones or computers.

Conclusion

The private health insurance market is undergoing significant transformation, driven by technological advancements, changing consumer expectations, and evolving regulatory landscapes. The rise of telehealth and digital health services, the demand for personalized health insurance plans, and the impact of insurtech are reshaping the market and creating new opportunities for insurers.