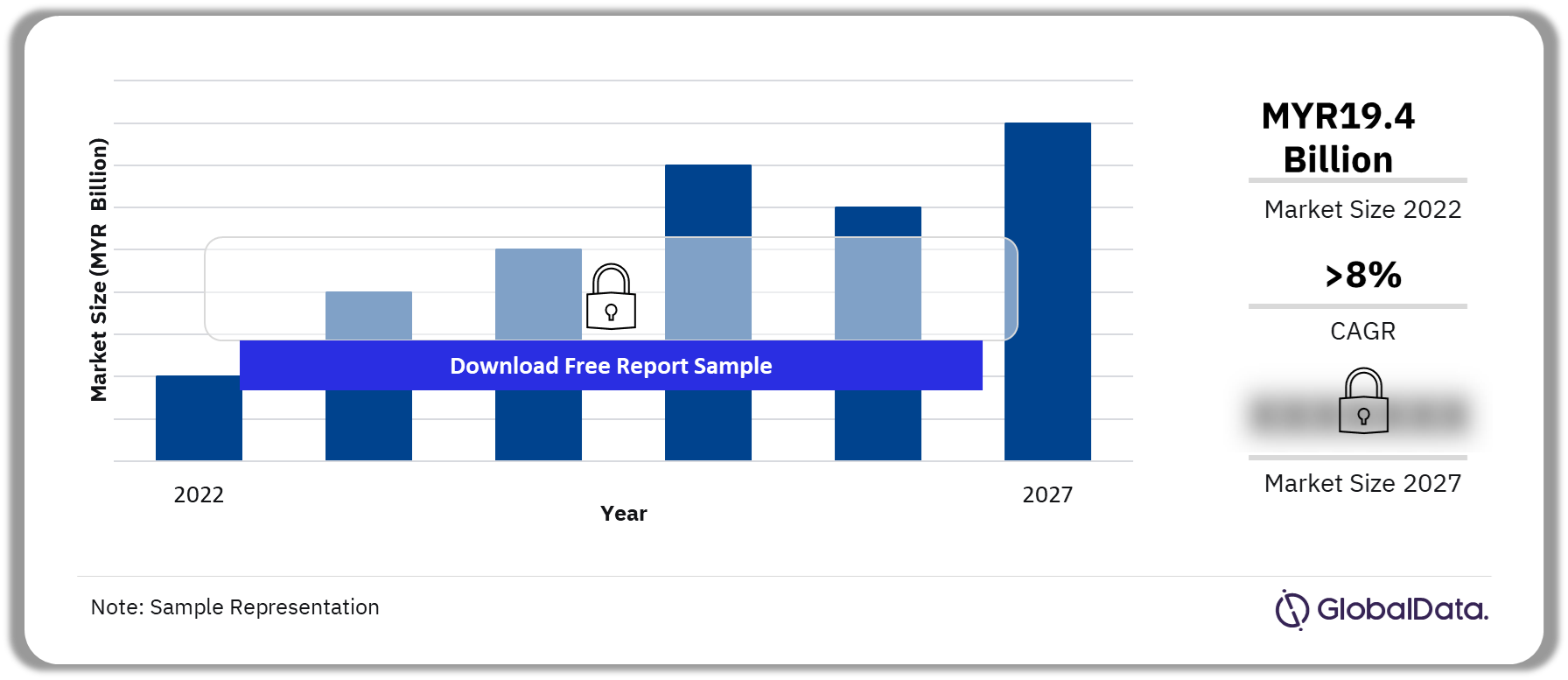

The Malaysian general insurance market was valued at approximately MYR 19.1 billion in 2023, with projections indicating a compound annual growth rate (CAGR) of 5.2% from 2024 to 2029. The industry is highly competitive, with both local and international insurers competing to capture market share. The market is regulated by Bank Negara Malaysia (BNM), which oversees compliance with industry standards and ensures the stability of the insurance sector.

Buy Full Report for More Information about the Malaysia General Insurance Market Forecast Download a Free Report Sample

Motor insurance continues to dominate the general insurance landscape, followed by property insurance, health insurance, and marine insurance. The growth of the Malaysian economy, coupled with rising consumer affluence, has resulted in increased demand for diverse insurance products.

Key Trends Shaping the General Insurance Market

1. Digital Transformation and InsurTech

The advent of digital technologies has revolutionized the insurance sector, and Malaysia’s general insurance market is no exception. The increasing adoption of InsurTech (insurance technology) is driving operational efficiency, enhancing customer experiences, and expanding product offerings. Digital platforms are enabling insurers to offer personalized products, improve claims processing, and provide better customer support.

Telematics, data analytics, and artificial intelligence (AI) are playing a significant role in transforming how insurers assess risk and tailor policies. For instance, telematics-based motor insurance policies, where premiums are calculated based on driving behavior, are gaining popularity among Malaysian consumers. Digital tools are also facilitating the growth of online insurance sales, particularly for younger and tech-savvy customers.

2. Rising Demand for Health and Medical Insurance

The growing awareness of healthcare needs and rising medical costs have driven an increased demand for health and medical insurance in Malaysia. With an aging population and heightened health consciousness following the COVID-19 pandemic, more Malaysians are seeking comprehensive health coverage. The government has also introduced initiatives to encourage the adoption of private health insurance, reducing the strain on public healthcare services.

Insurance providers are responding to this demand by offering health policies with more extensive coverage, including outpatient treatments, critical illness plans, and wellness programs. As healthcare costs continue to rise, health insurance will remain a key growth driver in the general insurance sector.

3. The Emergence of Microinsurance

Microinsurance, designed to offer affordable coverage to low-income individuals, is gaining traction in Malaysia. This segment provides basic insurance services, covering risks such as accidents, health emergencies, and property damage, at a lower cost compared to traditional policies. With an emphasis on financial inclusion, microinsurance is seen as a way to extend insurance services to underserved communities, including those in rural areas.

Technology, particularly mobile insurance platforms, is playing a pivotal role in making microinsurance accessible to more Malaysians. Insurers are partnering with telecommunications companies and financial service providers to offer microinsurance products via mobile apps, reaching a wider audience.

4. Regulatory Developments

Bank Negara Malaysia continues to play a crucial role in shaping the insurance landscape through regulatory reforms aimed at protecting consumers and ensuring market stability. In recent years, the regulator has introduced measures to enhance transparency in product offerings, improve claims processes, and promote competition among insurers.

One of the significant regulatory changes in the motor insurance segment was the gradual liberalization of tariffs. The detariffication process has enabled insurers to offer more flexible and competitive premiums, encouraging innovation in product design. This shift has also allowed insurers to price policies more accurately based on individual risk factors, such as driving history and vehicle usage.