Chile is the world leader in copper mining, a key player in both supply and global market influence. With vast reserves, advanced mining infrastructure, and a favorable geological environment, Chile contributes around 28% of the world’s copper output, solidifying its role as an indispensable copper supplier. The industry’s impact on Chile’s economy is profound, driving exports, employment, and infrastructure development. This article provides a comprehensive overview of the Chile copper mining market, exploring trends, challenges, and growth opportunities.

The Significance of Chile’s Copper Reserves

Chile boasts the largest known copper reserves globally, primarily located in the Atacama Desert, with the majority of production coming from open-pit mines such as Escondida, Collahuasi, and El Teniente. These reserves not only supply copper to global markets but also attract foreign direct investments from leading mining companies worldwide. Chile’s high-grade deposits and relatively low extraction costs make its copper sector competitive, maintaining its relevance in international markets.

Key Players in the Chilean Copper Mining Market

Several prominent players dominate Chile’s copper mining sector:

- Codelco (Corporación Nacional del Cobre de Chile): As the world’s largest copper-producing company, state-owned Codelco plays a pivotal role in Chile’s copper market, significantly influencing national revenue.

- BHP Billiton and Rio Tinto: Both companies own substantial stakes in the Escondida mine, the largest copper mine in the world, producing a significant portion of Chile’s copper.

- Anglo American and Glencore: These companies also contribute to Chile’s copper production with significant operations and investments in several large mines across the country.

These multinational companies bring not only capital but also advanced mining technologies that help enhance production efficiency and reduce environmental impact.

Market Dynamics and Trends in Chile’s Copper Industry

The Chile copper mining market is shaped by various trends, including:

- Rising Demand for Green Energy: The global shift towards renewable energy and electric vehicles has intensified demand for copper, a critical component in these technologies. Electric vehicles and wind turbines require considerable amounts of copper, and Chile stands poised to capitalize on this growing need.

- Investment in Technological Innovation: Chile’s mining companies are increasingly adopting advanced technologies to improve operational efficiency. Innovations like automation, big data analytics, and machine learning are being integrated to optimize production, predict equipment maintenance needs, and minimize environmental damage.

- Focus on Sustainable Mining Practices: Environmental concerns are prompting Chile’s copper industry to adopt sustainable practices. Companies are investing in water-efficient technologies, minimizing water consumption in desert regions, and reducing carbon emissions through renewable energy sources in mining operations.

Challenges Facing Chile’s Copper Mining Sector

Despite its strengths, the Chilean copper mining market faces several challenges:

- Environmental Regulations and Water Scarcity: Mining activities, especially in water-scarce regions, have led to growing regulatory scrutiny. New regulations mandate sustainable water usage, pushing mining companies to innovate but also increasing operational costs.

- Labor Shortages and Strikes: Labor shortages, coupled with frequent strikes, have occasionally disrupted production. Skilled labor remains essential for operating advanced mining technologies, yet Chile’s labor market is struggling to meet this demand.

- Global Market Volatility: Fluctuating copper prices, driven by international trade tensions and changing demand, impact Chile’s copper revenues. These price fluctuations can challenge mining companies’ profitability and create budgetary constraints on public infrastructure investments reliant on copper exports.

Economic Impact of Chile’s Copper Mining Market

Copper mining is the cornerstone of Chile’s economy, contributing to around 10% of the GDP and nearly half of the country’s total exports. The sector provides direct and indirect employment to thousands, driving socio-economic development in mining regions. Moreover, taxes and royalties from copper companies are crucial to Chile’s government revenues, funding public services and infrastructure projects.

Future Outlook for Chile’s Copper Mining Industry

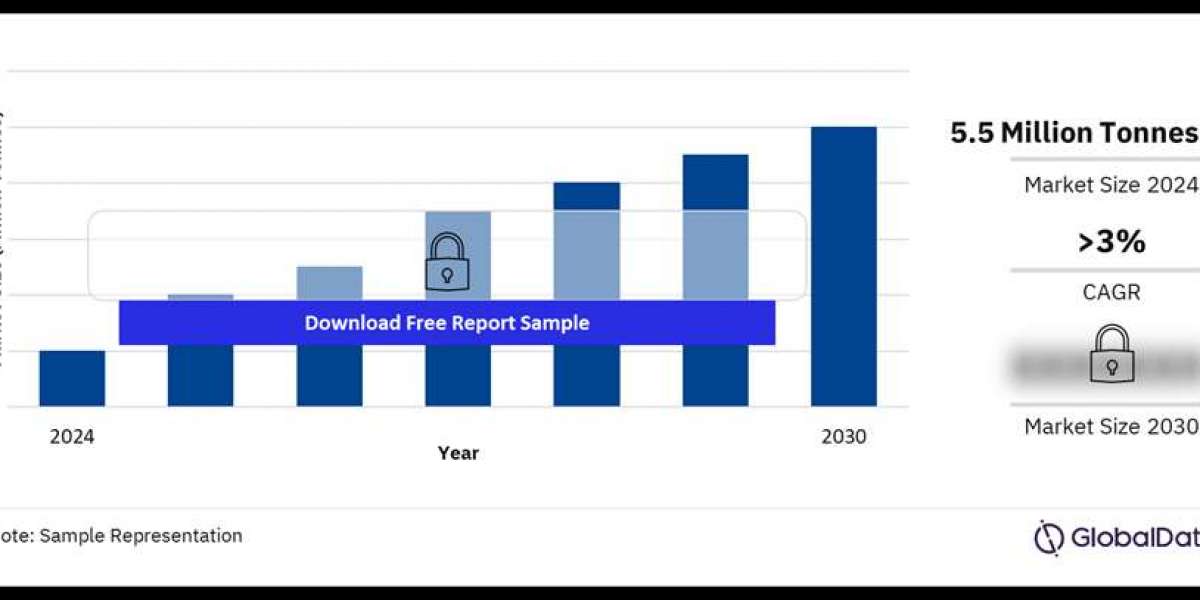

The future of the Chile copper mining market looks promising yet complex. Global demand for copper is projected to rise steadily, driven by renewable energy projects, electric vehicle production, and increasing infrastructural needs in developing economies. For Chile to maintain its competitive edge, it must continue innovating and improving sustainability practices to comply with evolving regulations and market expectations.

- Expansion Projects: Chile’s leading copper producers are planning expansions to boost production capacities. For example, Codelco is investing in new projects to maintain its market share and modernize its operations, aiming to extend the life of aging mines.

- Increased Focus on Environmental, Social, and Governance (ESG) Standards: Chilean mining companies are prioritizing ESG standards, aligning their operations with global sustainability benchmarks. Adopting cleaner energy sources, recycling water, and reducing carbon emissions are becoming standard practices to ensure sustainable production.

- Development of New Mines: With continuous exploration, new copper deposits are being discovered. Developing these deposits could secure Chile’s position as a long-term global copper supplier, especially as aging mines face declining ore grades.

Buy the Report for More Insights on the Chile Copper Mining Market Forecast