Money Transfer Services Market: Facilitating Global Financial Transactions

Introduction

In an increasingly interconnected world, the Money Transfer Services Market plays a crucial role in facilitating seamless financial transactions across borders. With the rise in globalization, migration, and technological advancements, the demand for efficient and reliable money transfer services has surged. This article explores the dynamics, growth drivers, market segmentation, regional analysis, and competitive landscape of the Money Transfer Services Market.

Market Overview

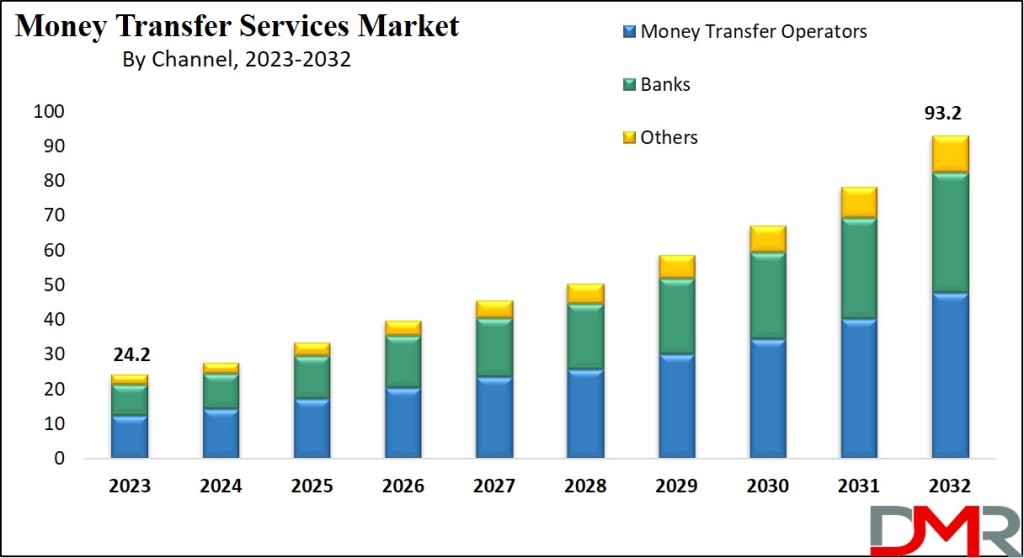

The Global Money Transfer Services Market is on a trajectory of significant growth, projected to reach USD 24.2 billion in 2023 and expected to soar to USD 93.2 billion by 2032, reflecting a robust CAGR of 16.2%. Money transfer services encompass a range of financial activities aimed at gathering funds from senders and delivering them to rightful recipients. This can include local transactions within a single country or extend to cross-border or international transfers connecting multiple nations.

Get a Totally Free PDF Sample Copy Here@ https://dimensionmarketresearch.com/report/money-transfer-services-market/request-sample.aspx/

Growth Analysis

The globalization of businesses and individuals relocating abroad for work and education has fueled the demand for cross-border money transfers. This surge in demand has driven further expansion within the Money Transfer Services Market. The integration of leading digital technologies such as mobile devices and the Internet has streamlined the money transfer process, enhancing accessibility and convenience.

Market Dynamics

While digital advancements have revolutionized money transfers, financial institutions face challenges in ensuring compliance with regulatory frameworks. Verification protocols are established to prevent fraudulent activities and validate the authority of transferred funds, safeguarding against illegal activities. Despite these challenges, the market continues to grow, driven by evolving consumer preferences and technological innovations.

Key Takeaways

- Globalization Driving Demand: Globalization and increased migration are driving the demand for cross-border money transfer services, fueling market growth.

- Technological Advancements: Continuous technological advancements, such as mobile devices and digital platforms, are streamlining the money transfer process, enhancing accessibility and efficiency.

- Regulatory Compliance: Compliance with regulatory frameworks is essential to prevent fraudulent activities and ensure the security of transferred funds, emphasizing the importance of robust verification protocols.

- Role of Money Transfer Operators: Money transfer operators play a pivotal role in providing comprehensive solutions to underserved populations, catering to diverse financial needs.

- Personal and Small Business Segments: The personal and small business segments emerge as significant revenue drivers, benefiting from global migration trends and the adoption of digital payment services.

- Regional Market Dynamics: North America leads in market share, while the Asia-Pacific region exhibits substantial growth potential, driven by rapid digital adoption and expanding financial services.

- Innovation and Collaboration: Collaboration and innovation are critical for market players to maintain competitiveness and drive growth amidst evolving consumer preferences and technological advancements.

Key Factors

- Globalization and Migration: Increasing globalization and migration patterns contribute to the growing demand for cross-border money transfer services.

- Technological Innovation: Continuous technological innovation, including mobile devices and digital platforms, revolutionizes the money transfer process, enhancing convenience and accessibility.

- Regulatory Environment: Adherence to regulatory frameworks is crucial to ensure compliance, prevent fraud, and maintain the security of transferred funds.

- Market Fragmentation: The market exhibits moderate fragmentation, with key players focusing on diverse strategies such as product innovation, partnerships, and mergers acquisitions.

- Customer Preferences: Understanding evolving customer preferences is essential for designing tailored money transfer solutions and enhancing user experience.

- Economic Factors: Economic factors such as exchange rates, inflation rates, and GDP growth influence the demand for money transfer services and market dynamics.

- Technological Adoption: The rate of technological adoption, especially in emerging markets, significantly impacts market growth and penetration.

- Competition Landscape: Intense competition among key players drives innovation, pricing strategies, and service differentiation, shaping the competitive landscape of the market.

Targeted Audience

- Individual Consumers: Individuals seeking to send money domestically or internationally to family, friends, or for personal expenses.

- Small Businesses: Small businesses involved in international trade or requiring cross-border payment solutions for transactions.

- Financial Institutions: Banks, credit unions, and other financial institutions offering money transfer services to their customers.

- Money Transfer Operators: Companies specializing in providing money transfer services, including remittance companies and mobile payment platforms.

- Government Regulatory Bodies: Regulatory authorities responsible for overseeing and enforcing compliance within the money transfer services industry.

- Investors and Analysts: Investors and financial analysts interested in understanding market trends, growth potential, and investment opportunities.

- Technology Providers: Companies developing innovative solutions and technologies to enhance money transfer services and address market challenges.

- International Organizations: Organizations focused on financial inclusion and cross-border transactions, seeking insights into global money transfer trends and developments.

Customize Your Request with our Experts@ https://dimensionmarketresearch.com/enquiry/motorcycle-market

Market Size Analysis

Regional Analysis

North America secures a significant market share, driven by notable financial service and communication firms and a growing immigrant population. The Asia-Pacific region exhibits substantial growth potential, with countries like China and India embracing digital payment solutions. Europe, Latin America, and the Middle East Africa regions also contribute to the market's growth trajectory.

Competitive Landscape

The Money Transfer Services Market demonstrates moderate fragmentation, with key players adopting diverse approaches such as product innovation, partnerships, research development, and mergers acquisitions. Recent developments, such as the technical preparations between India and Singapore to connect their fast payment systems, underscore the market's evolution towards enhanced cross-border payment solutions.

Research Scope and Analysis

By Type

The outward digital transfer sector emerges as a major driver within the global Money Transfer Services Market. Individuals residing abroad often send financial aid to their families back home, driving demand for secure and quick cross-border money transfers. Financial institutions and banks prioritize the execution of competitive fee structures and broad customer reach to facilitate international outbound transfers.

By Channel

Money transfer operators (MTOs) maintain dominance in revenue distribution, offering comprehensive solutions such as cash-to-cash transfers, bank transactions, and mobile money transfers. MTOs serve individuals lacking access to traditional banking services, including immigrants and rural residents. This segment is poised for significant growth, fueled by increasing demand for convenient money transfer options.

By End User

The personal segment emerges as a major revenue driver, fueled by new and enhanced products and services catering to personal financial demands. Global migration trends have led to the adoption of digital payment services by individuals seeking to send money back to their homeland. Additionally, small businesses increasingly rely on money transfer services for international trade and payments.

Recent Development

In November 2022, India and Singapore successfully completed technical preparations to connect their fast payment systems, UPI (Unified Payments Interface) and Pay Now. This milestone facilitated instant and low-cost fund transfers between the two countries, benefiting migrant workers and enhancing cross-border payment efficiency. Led by the Reserve Bank of India (RBI) and Singapore's Monetary Authority of Singapore (MAS), this integration effort exemplifies the commitment to fostering seamless cross-border transactions and improving financial accessibility for individuals and businesses.

Conclusion

In conclusion, the Money Transfer Services Market continues to evolve, driven by globalization, technological advancements, and changing consumer preferences. As the market expands, stakeholders must navigate regulatory challenges and embrace digital innovations to meet the evolving needs of customers worldwide.