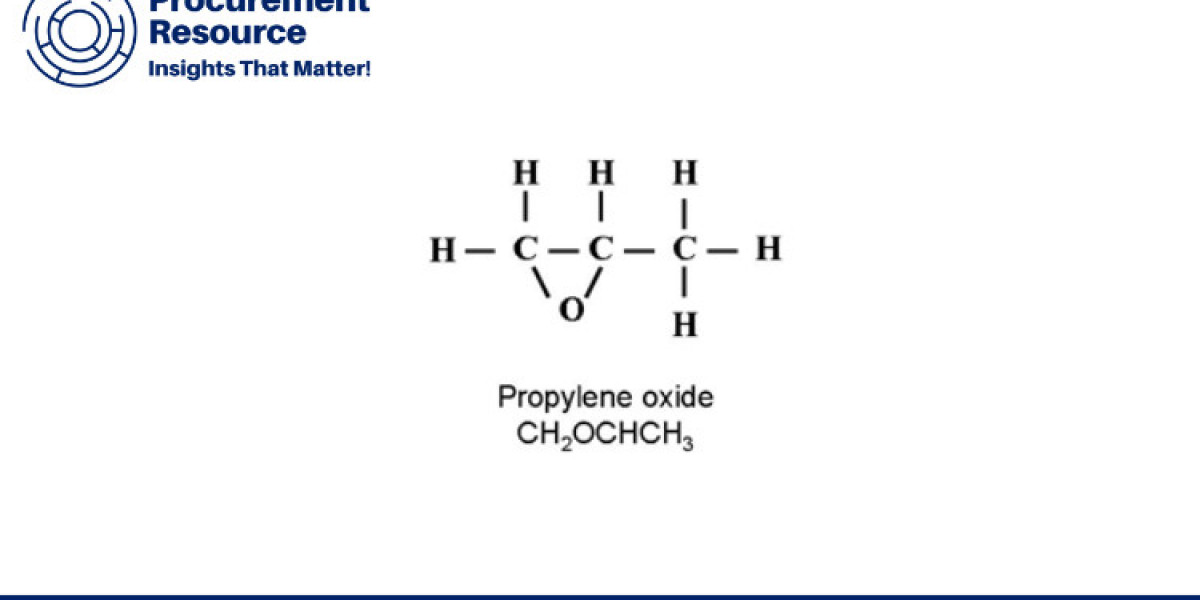

Propylene oxide (PO) is a vital intermediate in the production of various industrial chemicals, including polyether polyols and propylene glycol, which are extensively used in manufacturing polyurethane plastics, detergents, and solvents. The propylene oxide market is influenced by a multitude of factors, ranging from raw material availability to geopolitical events, making its price trends a critical area of study for industry stakeholders. Understanding the price trend of propylene oxide is essential for manufacturers, suppliers, and consumers to make informed decisions. This blog delves into the recent propylene oxide price trends, providing a comprehensive forecast, market analysis, and insights into the latest news affecting the market.

Propylene Oxide Price Trend

The price of propylene oxide has been on a fluctuating trajectory over the past few years, reflecting the dynamic nature of its market. In recent times, the prices have been influenced by factors such as feedstock costs, supply chain disruptions, and changes in demand from end-use industries.

Request For Sample: https://www.procurementresource.com/resource-center/propylene-oxide-price-trends/pricerequest

In 2023, the average price of propylene oxide saw significant volatility. At the beginning of the year, prices were relatively stable, supported by steady demand from the polyurethane sector. However, as the year progressed, prices began to rise due to increased costs of propylene, the primary feedstock for propylene oxide production. This increase was exacerbated by supply constraints caused by maintenance shutdowns at major production facilities and logistical challenges.

The second half of 2023 witnessed a further surge in prices, driven by robust demand from the automotive and construction industries, which are major consumers of polyurethane. Additionally, the energy crisis in Europe, coupled with the ongoing geopolitical tensions, contributed to the rising prices by affecting the availability and cost of raw materials. By the end of the year, prices had peaked, reflecting the tight supply and strong demand dynamics.

Forecast

Looking ahead, the propylene oxide market is expected to remain volatile, with prices influenced by a combination of market forces and external factors. In the short term, prices are likely to experience upward pressure due to the persistent supply chain disruptions and high feedstock costs. The ongoing geopolitical tensions, particularly in regions crucial for petrochemical feedstock, are expected to keep the market on edge.

In the medium to long term, the market is projected to stabilize as new production capacities come online and supply chain issues are gradually resolved. Several major players in the industry have announced plans to expand their production capacities, which is expected to alleviate some of the supply constraints. Additionally, advancements in production technologies and the increased use of bio-based feedstocks could contribute to more stable pricing.

However, the demand side of the equation will continue to play a crucial role in price determination. The automotive and construction sectors are expected to drive significant demand for propylene oxide, supported by the growing need for lightweight and durable materials. Moreover, the expanding use of propylene oxide in the production of specialty chemicals and pharmaceuticals will further bolster demand.

Overall, while short-term price fluctuations are anticipated, the long-term outlook for propylene oxide prices remains cautiously optimistic, with potential stabilization driven by supply-side expansions and technological advancements.

Market Analysis

The global propylene oxide market is characterized by a few key players who dominate production and supply. Major producers include Dow Chemical, LyondellBasell, and BASF, who together account for a significant share of the market. These companies are strategically expanding their production capacities and investing in innovative production processes to meet the growing demand.

The production of propylene oxide primarily involves two methods: the chlorohydrin process and the hydroperoxide process. The latter, also known as the PO/SM process, co-produces styrene monomer, providing an additional revenue stream for producers. This method is gaining preference due to its relatively lower environmental impact compared to the chlorohydrin process.

Regionally, Asia-Pacific remains the largest market for propylene oxide, driven by rapid industrialization and increasing demand from end-use industries in countries like China and India. North America and Europe also represent significant markets, with substantial consumption in the automotive and construction sectors. However, these regions are currently facing challenges related to high energy costs and stringent environmental regulations, which could impact production and pricing dynamics.

In terms of application, the polyurethane sector accounts for the largest share of propylene oxide consumption, followed by propylene glycol and glycol ethers. The versatility of polyurethane in various applications, including automotive interiors, insulation materials, and coatings, underscores its critical role in driving propylene oxide demand.

Latest News

The propylene oxide market has been abuzz with several significant developments in recent months. One of the notable news items is the announcement by Dow Chemical to expand its propylene oxide production capacity in Texas, USA. This expansion is part of Dow’s broader strategy to meet the growing demand for polyurethanes and other derivatives. The new facility is expected to be operational by 2025 and will significantly enhance the company’s production capabilities.

Another major development is the strategic partnership between BASF and SINOPEC, aimed at expanding their joint venture in China. This collaboration will see the construction of a new propylene oxide and ethylene oxide plant in Nanjing, leveraging the latest production technologies to improve efficiency and reduce environmental impact. This move is expected to strengthen the supply chain and cater to the burgeoning demand in the Asia-Pacific region.

In Europe, LyondellBasell announced its plans to modernize its propylene oxide production facility in the Netherlands. This initiative focuses on adopting sustainable production practices and reducing carbon emissions, aligning with the company’s commitment to environmental sustainability.

Additionally, the market has witnessed increased interest in bio-based propylene oxide production. Companies like Repsol and Braskem are investing in research and development to produce propylene oxide from renewable sources, which could revolutionize the market by offering more sustainable alternatives.

In conclusion, the propylene oxide market is navigating through a period of significant change, driven by supply chain challenges, geopolitical tensions, and evolving demand patterns. While the short-term outlook remains uncertain, the long-term prospects are promising, supported by capacity expansions and technological advancements. Staying abreast of these trends and developments is crucial for industry stakeholders to make informed decisions and capitalize on emerging opportunities.