Introduction

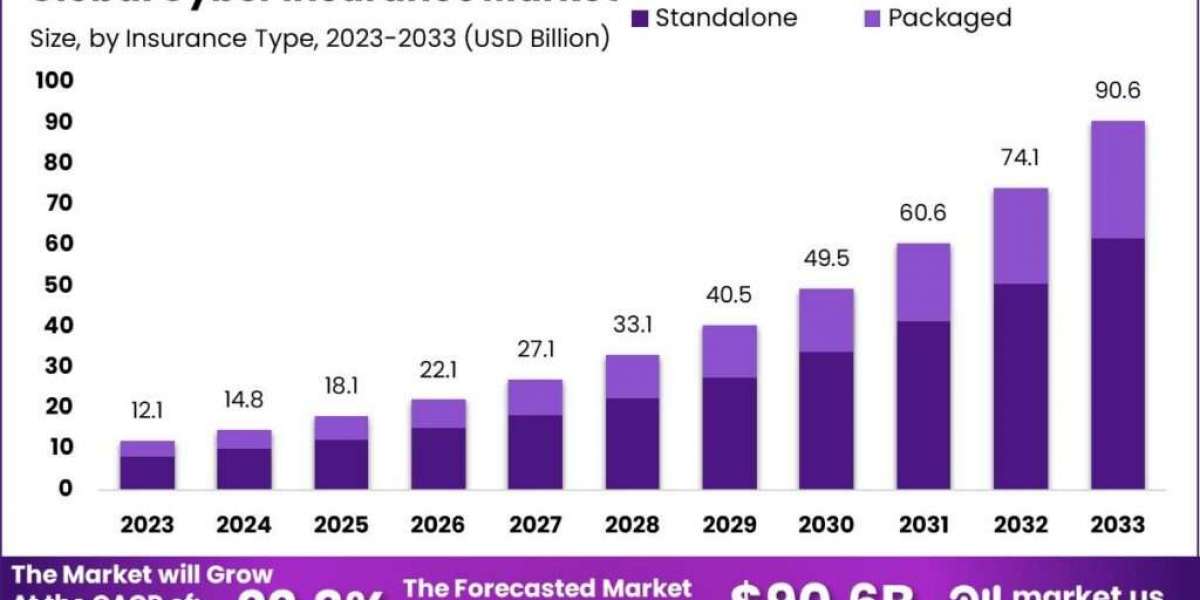

The cyber insurance market has seen rapid growth in recent years, driven by the increasing frequency and sophistication of cyber threats. As businesses across various sectors become more reliant on digital infrastructure, the risk of cyberattacks has surged, necessitating robust cybersecurity measures and insurance coverage to mitigate potential financial losses.

Read More - https://market.us/report/cyber-insurance-market/

Key growth factors include heightened awareness of cybersecurity risks, regulatory mandates, and the rising costs of data breaches. However, challenges such as the complexity of underwriting cyber risks, limited historical data, and the dynamic nature of cyber threats pose significant hurdles.

For new entrants, the market offers opportunities to innovate with specialized products and leverage advancements in cybersecurity technologies to provide more comprehensive coverage.

Emerging Trends

- Rise of Ransomware Insurance: With ransomware attacks becoming more prevalent, insurers are developing specialized policies to cover ransom payments, business interruption, and recovery costs.

- Integration with Cybersecurity Services: Insurers are increasingly partnering with cybersecurity firms to offer integrated solutions that include risk assessments, incident response, and insurance coverage.

- Parametric Insurance Models: These models offer quicker payouts based on predefined parameters, such as the downtime of critical systems, enhancing the attractiveness of cyber insurance.

- Increased Focus on Small and Medium Enterprises (SMEs): SMEs are recognizing their vulnerability to cyber threats, leading to a growing demand for affordable and tailored cyber insurance products.

- Adoption of Advanced Analytics and AI: Insurers are utilizing AI and big data analytics to better assess risk, detect fraud, and streamline claims processing.

Top Use Cases

- Data Breach Response: Coverage for costs associated with data breaches, including notification expenses, legal fees, and credit monitoring services.

- Business Interruption: Insurance against loss of income and additional expenses incurred due to cyber incidents that disrupt business operations.

- Cyber Extortion: Policies that cover ransom payments and related costs in the event of a ransomware attack.

- Third-Party Liability: Protection against claims from third parties affected by a cyber incident, including legal defense costs.

- Regulatory Compliance: Assistance with fines, penalties, and costs associated with regulatory investigations and compliance requirements following a cyber incident.

Major Challenges

- Evolving Threat Landscape: The rapid evolution of cyber threats makes it difficult for insurers to accurately assess and price risks.

- Lack of Historical Data: Limited historical data on cyber incidents hampers the development of reliable actuarial models.

- High Cost of Claims: The increasing severity of cyberattacks can lead to substantial claims, affecting the profitability of insurers.

- Underwriting Complexity: Assessing the cybersecurity posture of diverse organizations requires specialized expertise and resources.

- Regulatory Uncertainty: Varying regulations across different jurisdictions create complexities in policy offerings and compliance.

Market Opportunity

- Expanding Digital Economy: As more businesses digitize their operations, the demand for cyber insurance is expected to grow significantly.

- Increasing Regulatory Requirements: Stricter data protection laws and regulations drive organizations to seek cyber insurance for compliance.

- Growing Awareness and Education: Enhanced awareness campaigns and education about cyber risks can boost market penetration.

- Technological Advancements: Innovations in cybersecurity technologies present opportunities for insurers to offer more comprehensive and dynamic coverage options.

- Partnerships and Ecosystems: Collaboration with cybersecurity firms and tech companies can lead to the development of integrated and value-added insurance solutions.

Conclusion

The cyber insurance market is poised for substantial growth as the digital landscape continues to expand and cyber threats become more pervasive. While the market faces challenges such as evolving threats and underwriting complexities, opportunities abound for new entrants and existing players to innovate and capture market share.

By leveraging emerging trends, such as the rise of ransomware insurance and the integration of cybersecurity services, insurers can enhance their offerings and meet the increasing demand for robust cyber risk protection. As businesses and regulatory bodies place greater emphasis on cybersecurity, the cyber insurance market is set to play a crucial role in safeguarding the digital economy.