The Dolomite Market refers to the global trade and utilization of dolomite, a mineral composed of calcium magnesium carbonate (CaMg(CO3)2). Widely used across various industries, dolomite is valued for its applications in construction, agriculture, glass and ceramics production, and as a refractory material. In construction, it serves as a key component in cement and concrete, while in agriculture, it is used as a soil conditioner and feed additive. The market is driven by increasing infrastructure development, agricultural activities, and industrialization, with significant contributions from regions rich in dolomite deposits. Environmental regulations and advancements in mining and processing technologies also play crucial roles in shaping the dynamics of the dolomite market.

Маrkеt Kеу Рlауеrѕ:

Calcinor

Carmeuse

Imerys

Lhoist

Omya AG

RHI Magnesita

Sibelco

Vardar Dolomite

Other Key Players

Click here for request a sample : https://market.us/report/dolomite-market/request-sample/

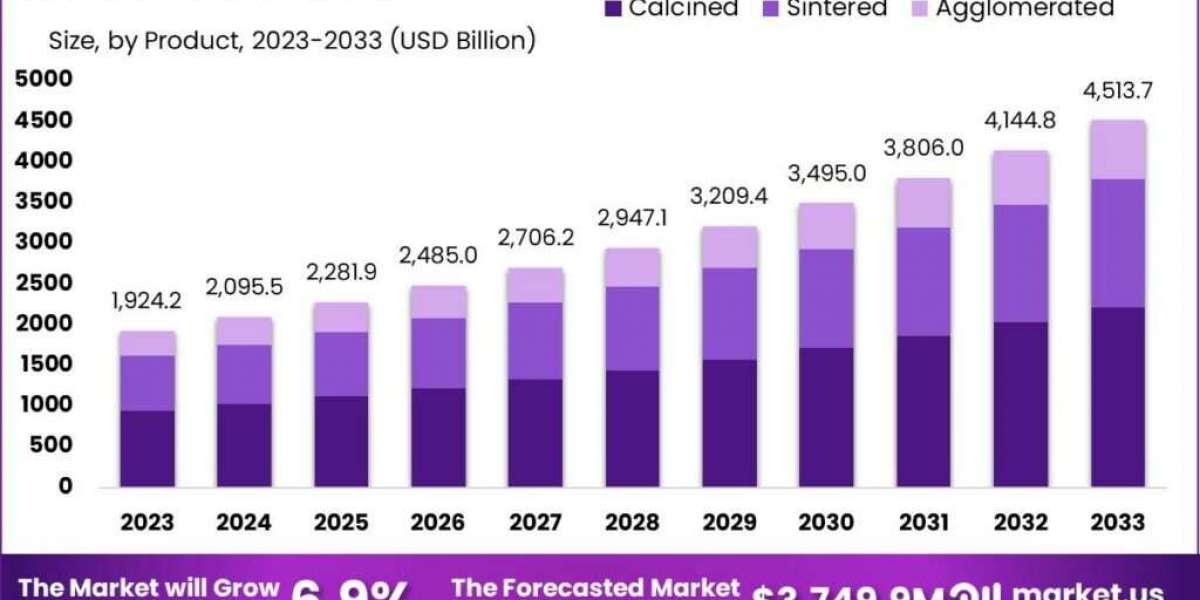

Product Analysis:

In 2023, the calcined dolomite segment dominated the market with over 49% share. Calcined dolomite, made from calcium carbonate and magnesia through calcination, is used in the iron and steel industries as refractory insulation protectors and scorifiers, and in agriculture for water and soil treatment. Another key segment, sintered limestone, known for its high refractoriness, is used in bricks for LD converter lining, being heated above 1,650°C to achieve maximum density and hydration resistance. Increased investment in the steel industry, such as the Indian Union Ministry of Steel's $70 billion plan for an integrated steel hub in the iron ore and coal-rich eastern region, is expected to boost product demand.

End use analysis:

In 2023, the iron and steel industry was the top segment for dolomite sales, accounting for 60% of the market, driven by the demand for various steel applications. Dolomite is essential as a refractory material in steelmaking converters, furnaces, and heater walls. The market saw expansion in production capacity, such as RHI Magnesita's €20 million investment in its China dolomite operation in 2018. The COVID-19 pandemic caused a decline in refractory demand, disrupting supply chains and sales. However, the glass and ceramics market is poised for a 4.4% revenue increase, with dolomite enhancing glass's resistance to erosion and strength. The growing need for glass vials for vaccines, driven by companies like SiO2 Materials Science's $163 million investment in packaging plants, is expected to benefit the global market.

Кеу Маrkеt Ѕеgmеntѕ

By Product

Calcined

Sintered

Agglomerated

By End-Use

Construction

Agriculture

Glass & Ceramics

Iron & Steel

DriversThe dolomite market is driven by its versatility across industries, especially in construction for creating durable materials and in steelmaking for refining metals. Rising demand for iron, particularly in construction, is expanding the market, with the Asia-Pacific region leading in usage. Dolomite is also crucial in animal feed, providing essential minerals like magnesium and calcium, which improve farm animal health. Its application in agriculture enhances soil quality, boosting crop yields. Additionally, dolomite's adaptability in energy production and environmental cleanup opens new opportunities, particularly as the Asia-Pacific region continues to experience significant growth in demand and production.

Restraints

The dolomite market faces challenges due to the shift towards using cheaper, lower-grade phosphate in fertilizers, reducing demand for dolomite. When used in fertilizers, dolomite can activate harmful heavy metals like cadmium, chromium, copper, lead, and zinc, posing health risks. Contaminants such as lead and arsenic in dolomite-based fertilizers can cause serious health issues if consumed. Additionally, stringent regulations regarding heavy metals and environmental impact add complexity for companies, and concerns over long-term health effects from exposure to these metals hinder market growth, especially in the agricultural sector.

Opportunity

Despite challenges, the dolomite market holds promise with increased focus on eco-friendly farming and safer fertilizers, potentially boosting its demand if processed without harmful metals. Its role in the growing construction and steelmaking industries offers significant growth opportunities. Ongoing research into dolomite's applications in energy generation and environmental remediation could unlock new uses. The expanding Asia-Pacific market, with improved access and efficient utilization methods, presents further potential for market expansion into new regions.

Challenges

The dolomite market faces hurdles such as reduced demand from increased use of low-grade phosphate rock in fertilizers, impacting its role as a fertilizer component. Production often involves activating harmful heavy metals, raising food safety and health concerns. Meeting stringent regulatory standards on heavy metals and environmental impact is challenging, requiring compliance while maintaining product safety and effectiveness. Long-term health issues linked to arsenic and lead exposure from dolomite-based fertilizers further constrain market growth. Addressing these challenges necessitates innovative solutions, strict regulatory adherence, and efforts to mitigate health risks for sustainable market development.