The green hydrogen market refers to the sector dedicated to the production, distribution, and utilization of hydrogen generated through renewable energy sources, such as wind, solar, or hydro power, rather than from fossil fuels. This form of hydrogen, known as "green hydrogen," is produced via electrolysis, which splits water into hydrogen and oxygen using electricity from renewable sources. Green hydrogen is considered a key component in the transition to a low-carbon economy due to its potential to reduce greenhouse gas emissions across various industries, including transportation, power generation, and industrial processes. As global efforts intensify to combat climate change and achieve sustainability goals, the green hydrogen market is expected to grow significantly, driven by advancements in technology, supportive policies, and increasing investments in clean energy infrastructure.

Market Key Players:

Green Hydrogen Systems

Solena Group

Air Products Inc.

Siemens Energy

Cummins Inc.

FuelcellWorks

Plug Power

Fuelcell Energy

Hydrogenics

Ballard Power Systems

Nikola Motors

Linde Plc

Plug Power Inc.

Syzygy Plasmonics

Other Key Players

Click here for request a sample : https://market.us/report/green-hydrogen-market/request-sample/

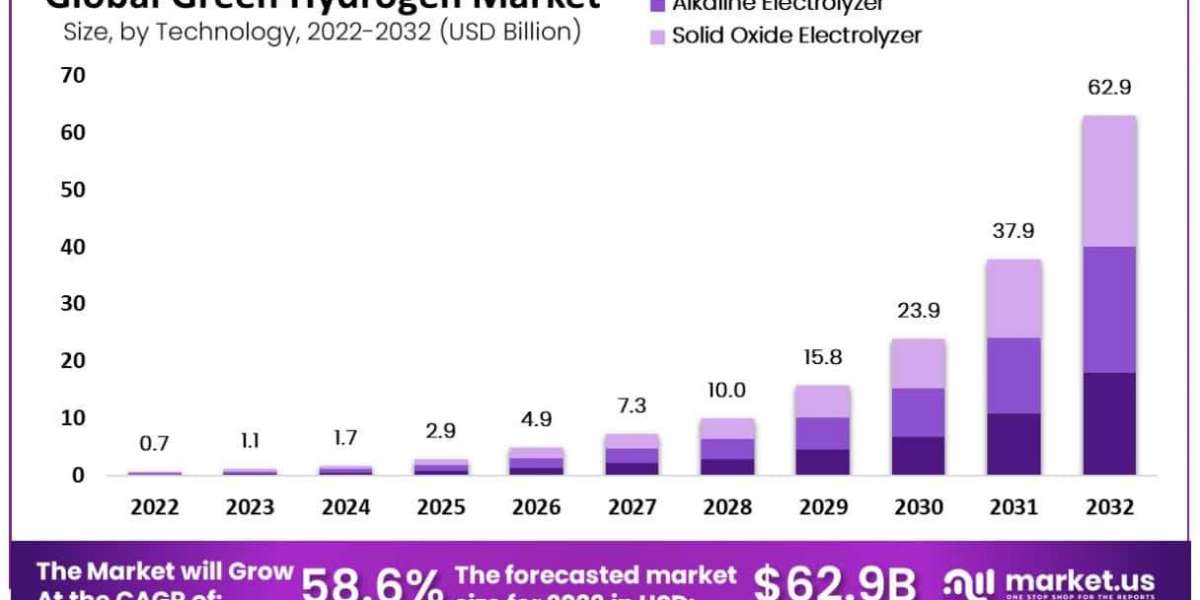

By Technology Analysis:

The alkaline electrolyzer segment leads the global green hydrogen market, holding the largest market share during the forecast period. This dominance is attributed to the advantages of alkaline electrolysis, such as the use of inexpensive and widely available electrolytes, and its efficiency in producing green hydrogen. While solid oxide electrolyzers, which have low corrosive effects and a longer lifespan, are expected to see significant growth, alkaline electrolysis remains the primary technology due to its effective hydrogen ion diffusion and overall market presence.

By Application Analysis:

The transportation segment is the dominant force in the global green hydrogen market, holding the largest share during the forecast period. Hydrogen is utilized in fuel cells and internal combustion engines for transportation, with fuel cells offering 2-4 times higher efficiency than traditional engines. Notably, Airbus plans to introduce a hydrogen-powered aircraft by 2035, which is expected to further boost market growth in the transportation sector.

By End-User Analysis:

The petrochemical segment is the leading end-user in the global green hydrogen market, commanding the largest market share throughout the forecast period. Hydrogen fuel cells used in the petrochemical industry produce only water as an emission, making them a carbon-free alternative compared to traditional fuels. The demand for green hydrogen in this sector is anticipated to rise due to its potential for reducing carbon emissions and supporting rapid development in petrochemical applications.

Key Market Segments

Based on Technology

Proton Exchange Membrane Electrolyzer

Alkaline Electrolyzer

Solid Oxide Electrolyzer

Based on Application

Power Generation

Transport

Others

Based on End-User

Food & Beverages

Medical

Chemical

Petrochemicals

Glass

Others

Driving Factors:

The growth of the green hydrogen market is significantly driven by the decreasing variable electricity costs associated with renewable energy. Over recent decades, the costs of generating renewable energy from sources like solar and wind have dropped due to advancements in technology, increased efficiency, and reduced raw material costs. As these costs continue to decline, the production cost of green hydrogen will decrease correspondingly, further boosting market growth.

Restraining Factors:

The high initial investment required for establishing and maintaining hydrogen infrastructure poses a significant restraint on the green hydrogen market. While renewable energy is essential for hydrogen production, tracking energy sources and managing high infrastructure costs present challenges, particularly for plants reliant on grid power. These financial barriers to infrastructure development and maintenance impede overall market growth.

Growing Opportunities:

The rapid decrease in electrolyzer costs, which have fallen by over 50% in the past five years, presents a key opportunity for the green hydrogen market. This trend is expected to continue, driven by advancements in technology and increased research and development investments. The reduction in electrolyzer costs, coupled with declining renewable energy prices, is likely to enhance market prospects.

Latest Trends: Rising awareness of hydrogen as a clean energy carrier is propelling market growth. Hydrogen fuel cells, which produce only heat and water as byproducts, are gaining popularity due to their lack of greenhouse gas emissions and pollutants. As environmental concerns increase, the efficiency and environmental benefits of hydrogen fuel cells drive greater market interest and adoption.