The oil and gas industry's sensors market has been expanding gradually as a result of rising automation, digitization, and operational efficiency requirements. According to recent reports, the integration of IoT (Internet of Things) solutions and developments in sensor technology are projected to drive its continued expansion.

The Compound Annual Growth Rate (CAGR) for the Global Sensors Oil and Gas Market is predicted to be 6.5% from 2024 to 2034. The industry is projected to reach USD 17,976.43 million in 2034 based on an average growth pattern. 2024 is expected to have a valuation of USD 9,924.73 million for this market.

The industrial segment devoted to the manufacturing, distributing, and utilizing of diverse kinds of sensors in the oil and gas industry is known as the global sensors market. These sensors are essential parts that are used to keep an eye on, manage, and improve operations throughout the whole oil and gas value chain.

Increasing automation, strict safety and environmental protection regulations, the need for operational efficiency, and developments in sensor technologies are some of the reasons driving the market.

Get a Sample Copy of Report, Click Here@ https://wemarketresearch.com/reports/request-free-sample-pdf/global-sensors-in-oil-and-gas-market/1522

Sensors in Oil and Gas Market Trends and Dynamics

Digital Transformation: The oil and gas industry is embracing digital transformation, with a focus on integrating advanced sensor technologies and data analytics to drive operational excellence.

Sustainability and Environmental Concerns: With increasing emphasis on sustainability, sensors play a crucial role in monitoring environmental impact, reducing emissions, and enhancing energy efficiency.

Remote Monitoring and Automation: The trend towards remote monitoring and automation is driving the adoption of sensors, allowing for real-time monitoring and control of operations from centralized control centers.

Sensors in Oil and Gas Market Challenges and Opportunities

Integration with Legacy Systems: Integrating advanced sensors with existing legacy systems can be challenging, requiring careful planning and investment.

Cybersecurity: As sensor networks become more interconnected, ensuring the security of these systems against cyber threats is critical.

Cost-Benefit Analysis: While the initial investment in advanced sensor technologies can be high, the long-term benefits in terms of efficiency, safety, and cost savings make it a worthwhile investment.

Sensors in Oil and Gas Market Segments

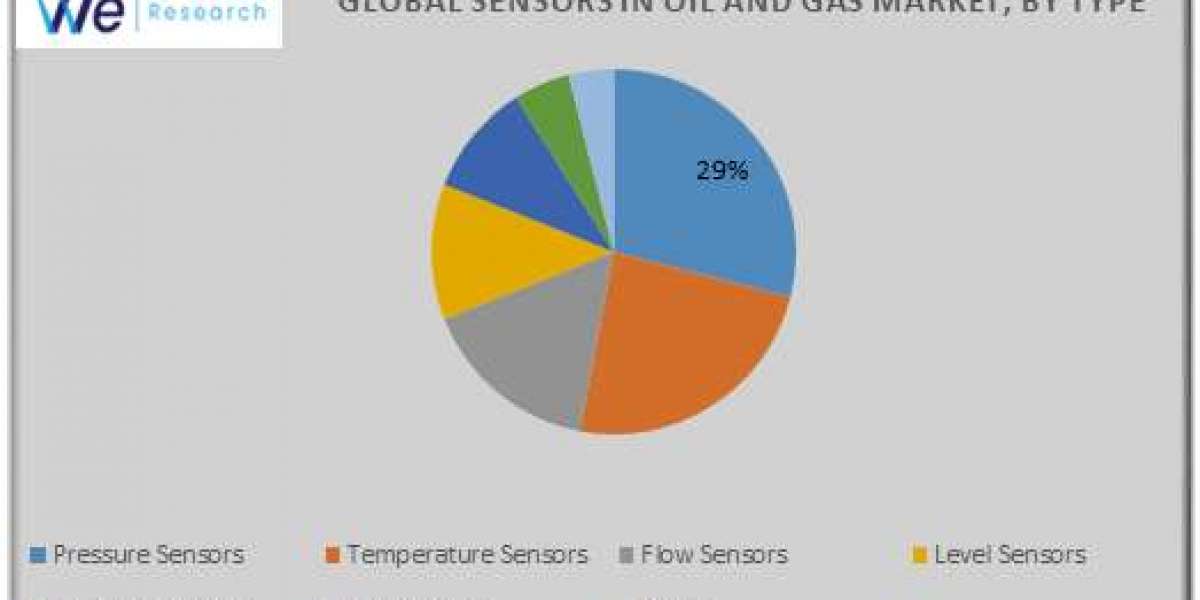

By Type

Pressure Sensors

Temperature Sensors

Flow Sensors

Level Sensors

Vibration Sensors

Gas Sensors

Others

By Application

Pipeline Monitoring

Asset Management

Environmental Monitoring

Condition Monitoring

Remote Monitoring

Others

By Sector

Upstream

Midstream

Downstream

Top companies in the Sensors in Oil and Gas Market are,

Honeywell International Inc

AMADA HOLDINGS CO., LTD.

TE Connectivity Ltd

Robert Bosch GmbH

ABB Ltd

Siemens AG

Emerson

Rockwell Automation

Fortive

General Electric

iot squared

Fluke Corporation

Yokogawa Electric Corporation

Other

Purchase a Copy of this Global Sensors in Oil and Gas Market research report at@ https://wemarketresearch.com/purchase/global-sensors-in-oil-and-gas-market/1522?license=single

Sensors in Oil and Gas Industry: Regional Analysis

Forecast for the North American Market

With over 35% of the global market share in 2023, North America is the dominant region in the Sensors in Oil and Gas industry. Thanks to considerable upstream exploration and production activities, a thriving midstream and downstream sector, and extensive upstream exploration, North America—especially the United States and Canada—represents a sizable market for sensors in the oil and gas industry. North America has the advantages of cutting edge technologies and highly automated oil and gas operations.

Forecast for the Europe Market

The oil and gas industry in Europe is well-established and concentrates on both traditional and renewable energy sources. Strict environmental laws are emphasized in the area, which encourages the use of cutting-edge sensor technologies. Europe's leading nations in pipeline infrastructure and offshore oil and gas production include Norway, the United Kingdom, and Germany.

Forecasts for the Asia-Pacific Market

The oil and gas sector in Asia Pacific is expanding significantly, propelled by developing nations like China and India. The area also has a high demand for energy and infrastructure spending. The need for sensors is increasing as a result of countries like China, India, Australia, and Southeast Asian countries increasing their exploration and production of oil and gas.

Frequently Asked Questions

How big will the oil and gas industry be for sensors in 2024?

How big will the oil and gas industry be for sensors in 2024?

Which are the leading businesses in the industry?

Which geographical area leads the oil and gas sensors market?

Conclusion

The integration of advanced sensor technologies is transforming the oil and gas industry, making it more efficient, safe, and sustainable. As the industry continues to evolve, the adoption of sensors will be pivotal in addressing the challenges and opportunities of the future. Investing in these technologies today will ensure a more resilient and competitive oil and gas sector tomorrow.

The market for sensors in the oil and gas sector has been steadily growing due to the growing demands for operational efficiency, automation, and digitization. Recent assessments state that the Internet of Things' (IoT) integration and advancements in sensor technology will propel the IoT's ongoing growth.