The Bisphenol A Market encompasses the production, distribution, and utilization of BPA, a chemical compound primarily used as a key building block in manufacturing polycarbonate plastics and epoxy resins. These materials are widely valued for their excellent mechanical properties, such as high impact resistance, durability, and clarity, making them essential in various applications, including automotive parts, electronic devices, food and beverage containers, and construction materials. Despite its extensive use, BPA faces scrutiny due to health concerns as an endocrine disruptor, leading to increased regulatory restrictions and a growing demand for safer, eco-friendly alternatives. The market is characterized by ongoing innovation to balance performance needs with health and environmental safety.

Market Key Players:

SABIC Innovative Plastics

Dow Chemical

Mitsubishi Chemical

Vinmar International

LG Chem

Merck KGaA

Mitsui Chemical Corporation

Chang Chun Group

Nan Ya Plastics Corporation

Covestro AG

Lihuayi Weiyuan Chemical Co. Ltd

Kumho P&B Chemicals

Teijin

Bayer Material Science

Samyang Innochem

Click here for request a sample: https://market.us/report/bisphenol-a-market/request-sample/

By Application:

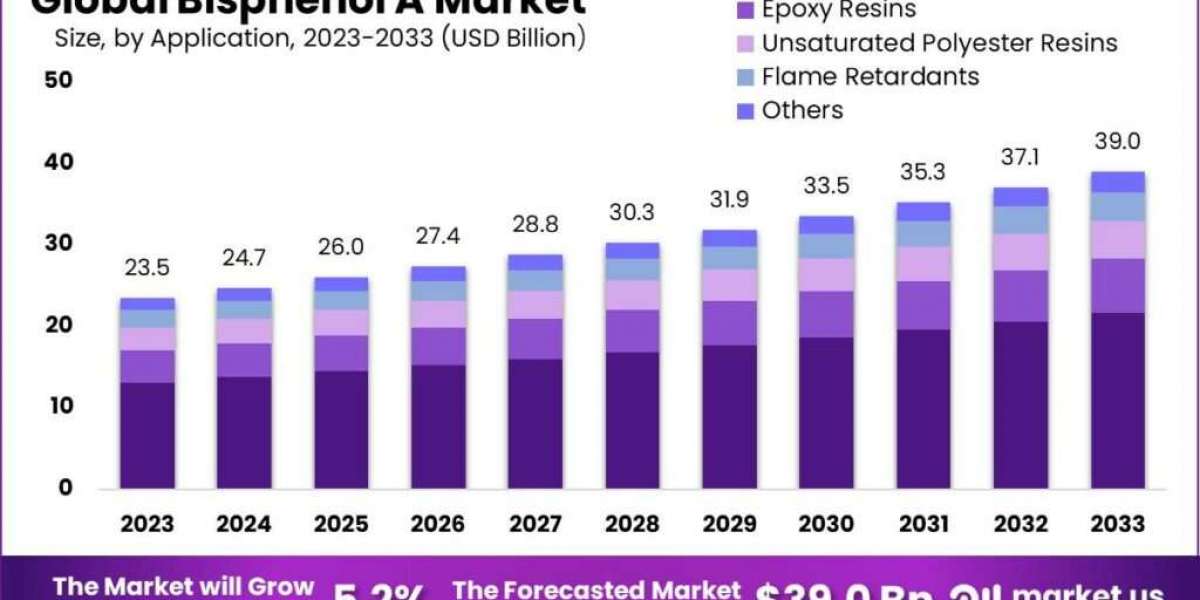

In 2023, Polycarbonate Resins dominated the Bisphenol A market, holding over 55.6% share due to their extensive use in eyewear lenses, electronic components, and automotive parts. Their transparency, strength, and impact resistance make them ideal for safety and durability. Epoxy Resins are vital for coatings and adhesives, especially in construction and electronics, due to their superior adhesive properties and environmental resistance. Unsaturated Polyester Resins, used in fiberglass reinforcements and non-reinforced plastics, play a key role in automotive and marine applications. Flame Retardants enhance fire resistance in consumer and industrial products, crucial for electrical and building safety.

By End-Use Industry:

In 2023, the Electricals & Electronics sector led the Bisphenol A market with over 25.6% share, driven by the need for durable, heat-resistant materials in consumer electronics and appliances. The Packaging industry continues to consume substantial BPA for polycarbonate plastics and epoxy resins, despite regulatory scrutiny and consumer shifts toward BPA-free products. The Automotive industry uses BPA-based materials for strong, clear parts like headlamps and dashboards. In Paints & Coatings, BPA-based epoxy resins protect metal products from corrosion. Building & Construction utilizes BPA in epoxy-based sealants and adhesives for durable building materials. Healthcare relies on BPA for sterile, durable, and transparent medical devices.

Key Market Segments:

By Application

Polycarbonate Resins

Epoxy Resins

Unsaturated Polyester Resins

Flame Retardants

Others

By End-Use Industry

Electricals and Electronics

Packaging

Automotive

Paint and Coatings

Building and Construction

Healthcare

Others

Drivers:

The Bisphenol A (BPA) market is driven by increasing demand in the automotive and electronics industries. BPA-based polycarbonate plastics and epoxy resins are essential for their high impact resistance, durability, and clarity. In the automotive sector, the need for lightweight, strong materials for components like headlights and dashboards boosts BPA demand. Similarly, the electronics industry utilizes BPA-based materials for durable, aesthetic housings in devices like smartphones and laptops. Emerging markets, particularly in Asia-Pacific, offer expansion opportunities due to rapid urbanization and industrialization. Additionally, ongoing innovation in BPA-free alternatives addresses environmental and health concerns, further driving the market.

Restraints:

Health concerns and regulatory restrictions significantly restrain the Bisphenol A (BPA) market. BPA is an endocrine disruptor linked to various health issues, prompting stricter regulations globally. The European Union, Canada, and the FDA have banned BPA in baby bottles and other children’s products. This has led to a consumer shift towards BPA-free products, pressuring manufacturers to find safer alternatives. Continuous research on BPA’s health risks keeps the issue in the public eye, creating a volatile market environment. Manufacturers must navigate existing regulations and anticipate further restrictions, impacting the market's growth prospects.

Opportunity:

The growing demand for eco-friendly BPA alternatives presents a significant opportunity in the Bisphenol A (BPA) market. Consumers and regulators are shifting towards safer materials that mimic BPA’s properties without health risks. This trend drives the development of advanced polymers used in food containers, water bottles, and medical devices. Regulatory incentives for sustainable materials further support this shift. Companies investing in BPA-free alternatives can gain a competitive edge, particularly in emerging markets. Technological advancements enable high-performance alternatives, meeting safety standards and tapping into the growing market for sustainable, health-conscious products.

Trends:

The Bisphenol A (BPA) market is experiencing increased regulatory impact and a shift towards BPA-free products. Health concerns over BPA’s estrogenic effects have led to global legislative actions, particularly banning BPA in food contact materials and children’s products. This regulatory push has driven demand for safer, non-toxic alternatives, reshaping the competitive landscape. Innovations in material science are producing advanced polymers that replicate BPA’s benefits without health risks. Companies are investing in research and development to create sustainable alternatives, responding to consumer advocacy and evolving regulations. This trend emphasizes sustainability and health safety, redefining industry priorities and future market success.