The polypropylene market encompasses the production, distribution, and sale of polypropylene, a versatile thermoplastic polymer used extensively in various applications due to its durability, chemical resistance, and recyclability. It is commonly utilized in packaging, automotive parts, textiles, and consumer goods. The market is driven by the increasing demand for lightweight and sustainable materials, particularly in packaging and automotive industries. Innovations in production processes and the development of bio-based polypropylene are also influencing market growth. This sector is characterized by significant regional variations, with Asia-Pacific being the largest and fastest-growing market

Market Key Players:

BASF SE

Borealis AG

Braskem

Chevron Phillips Chemical Company DuPont

Westlake Chemical Corp.

Eastman Chemical Company

ExxonMobil

Reliance Industries Limited

Sinopec

LyondellBasell Industries

SABIC

Bayer Material Science

Fulton Pacific

INEOS

TotalEnergies SE

Washington Penn Plastic Company Inc.

PetroChina Company Limited

Qatar Petrochemical Company

Japan Polypropylene Corporation

Others

Click here for request a sample: https://market.us/report/polypropylene-market/request-sample/

By Type:

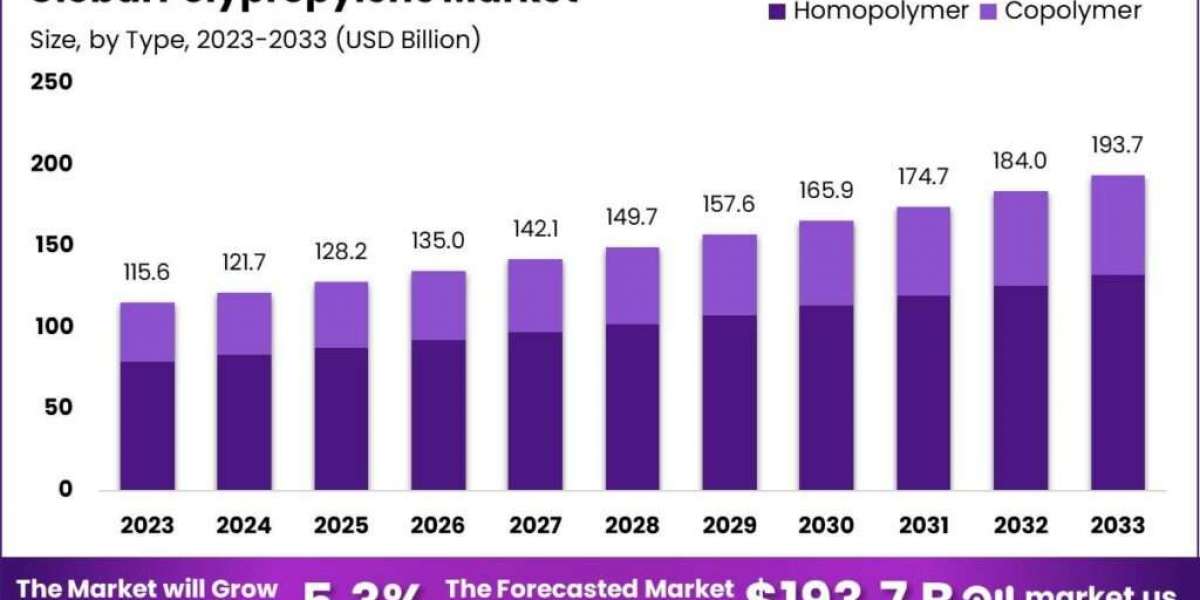

In 2023, homopolymers held a dominant 68.5% share of the polypropylene market due to their strength, high-temperature resistance, ease of production, and cost-effectiveness, making them ideal for packaging, textiles, and household goods. Copolymers, including block and random types, offer enhanced impact resistance and are valued in the automotive and consumer goods sectors for their durability. Random copolymers, with improved clarity and low-temperature impact strength, are popular in food packaging and medical applications. Impact copolymers are used in products requiring high toughness, like automotive parts and industrial containers.

By Application:

In 2023, injection molding captured a 41.5% share of the polypropylene market due to its efficiency in producing complex, precise shapes for automotive parts, household goods, and consumer electronics. Blow molding is significant for creating lightweight, durable hollow objects such as bottles and containers, crucial for the beverage and pharmaceutical industries. Polypropylene’s resistance to chemicals and wear makes it ideal for textiles, carpets, and industrial fabrics in the fibers and filaments segment. Films and sheets are vital for food packaging, agricultural films, and retail packaging due to their moisture barrier properties and strength.

By End-Use Industry:

In 2023, packaging dominated the polypropylene market with a 36.7% share, driven by the need for durable, lightweight, and recyclable packaging solutions, particularly in food and beverage sectors. The automotive industry uses polypropylene for its chemical resistance, low cost, and flexibility, aiding in vehicle weight reduction and fuel efficiency. Consumer goods benefit from polypropylene’s versatility in household items and toys. In electrical and electronics, its insulative properties are crucial for components and appliances. Agriculture relies on polypropylene for irrigation systems and mulch films due to its water and chemical resistance, while building and construction use it for pipes and membranes due to its toughness and durability.

Key Market Segments:

Type

Homopolymer

Copolymer

Random Copolymer

Impact Copolymer

Application

Injection Moulding

Blow Moulding

Fibres & Filaments

Films & Sheets

Others

End-Use Industry

Packaging

Automotive

Consumer Goods

Electrical & Electronics

Agriculture

Building & Construction

Others

Drivers:

The polypropylene market is driven by the growing demand in the packaging and automotive industries. Polypropylene’s strength, flexibility, chemical resistance, and recyclability make it ideal for packaging that preserves product integrity and extends shelf life. In the automotive sector, polypropylene helps reduce vehicle weight for better fuel efficiency and lower emissions. The rise of e-commerce and increased hygiene awareness post-COVID-19 have further boosted demand for durable and lightweight polypropylene packaging.

Restraints:

Environmental concerns and regulatory pressures challenge the polypropylene market. Polypropylene is not biodegradable, contributing to long-term pollution. Despite being recyclable, low recycling rates due to infrastructure and economic challenges exacerbate this issue. Increasing regulations and consumer demand for sustainable materials are pushing companies to find alternatives or improve recycling practices. Compliance with varied global regulations increases costs and complexity for manufacturers.

Opportunity:

Advancements in recycling technologies present a significant opportunity. New sorting technologies and chemical recycling methods enhance the efficiency and quality of recycled polypropylene, making it comparable to virgin material. These advancements support a circular economy, reduce dependence on virgin materials, and meet growing regulatory and consumer demands for sustainable products. Investing in these technologies can provide competitive advantages and align with corporate sustainability goals.

Trends:

The shift towards bio-based polypropylene is a major trend, driven by environmental concerns and the need for sustainable materials. Bio-based polypropylene, made from renewable resources like vegetable oils and sugarcane, reduces reliance on fossil fuels and lowers greenhouse gas emissions. Improved processing technologies make bio-based polypropylene comparable to conventional types in performance. Strategic partnerships and government support further encourage the adoption of bio-based alternatives, aligning with circular economy goals and regulatory requirements.