Introduction

Rise of Culinary Culture in the UK

The modern British kitchen has transformed into a dynamic social epicentre. No longer confined to the utilitarian act of cooking, kitchens now encapsulate a fusion of functionality, artistry, and lifestyle aspiration. Fuelled by a cultural resurgence in gastronomy, the UK has witnessed an explosion of interest in home cooking. Influences range from YouTube chefs and BBC cookery shows to the growing popularity of global cuisines. This shift has kindled a significant appetite for quality kitchenware.

For more info please visit: https://market.us/report/uk-kitchenware-market/

The Evolving Definition of Kitchenware

Kitchenware today extends far beyond pots and pans. It includes intricately designed bakeware, ergonomically sculpted utensils, smart cooking gadgets, and eco-friendly storage solutions. The boundaries between culinary tool and decor have blurred, as consumers seek utility with aesthetic elegance. In this evolving terrain, even a chopping board is no longer just a chopping board—it’s a statement piece.

Market Overview

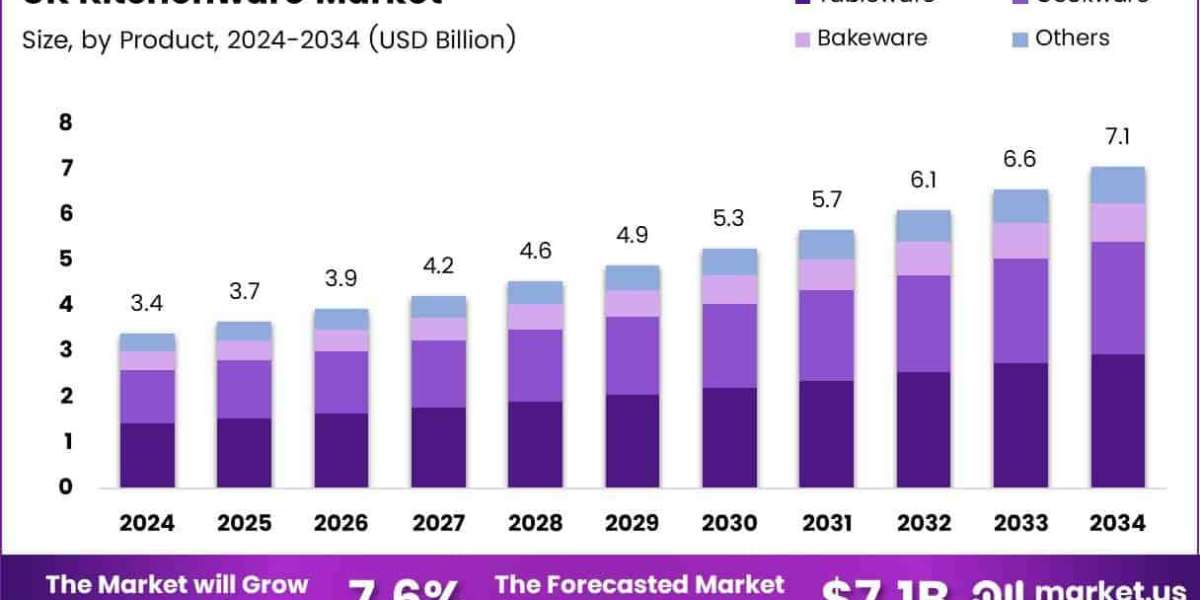

Current Market Size and Forecast (2024–2030)

As of 2024, the UK kitchenware market is estimated to be worth approximately £4.5 billion. Projections suggest a steady CAGR of 4.2%, potentially reaching £5.8 billion by 2030. Growth is underpinned by urbanisation, higher disposable incomes in dual-income households, and the rise of niche culinary hobbies such as fermentation, sous-vide, and artisanal baking.

Key Segments: Cookware, Tableware, and Appliances

The market is segmented into cookware (frying pans, pots, pressure cookers), tableware (cutlery, dinner sets, glassware), and kitchen appliances (blenders, air fryers, induction cooktops). While appliances enjoy rapid innovation cycles, cookware and tableware retain long-term demand, with consumers willing to invest in durability and brand prestige.

Distribution Channels: From High-Street Retailers to E-commerce Giants

Traditional brick-and-mortar outlets such as John Lewis, Argos, and Debenhams continue to hold relevance, especially for tactile products. Yet, the e-commerce boom—led by Amazon, Lakeland, and niche platforms like Notonthehighstreet—has recalibrated purchase behaviours. Customers now expect seamless digital experiences and doorstep convenience.

Consumer Behaviour and Emerging Trends

Sustainability and Eco-Conscious Purchasing

Environmental awareness is no longer peripheral; it’s pivotal. British consumers, particularly millennials and Gen Z, actively seek kitchenware made from recycled, biodegradable, or ethically sourced materials. Brands offering bamboo utensils, ceramic-coated cookware, and refillable dispensers are gaining traction. Packaging minimalism and carbon-neutral production also influence decision-making.

The Shift Towards Premium and Aesthetic Kitchenware

Design-led purchasing is rising steeply. Consumers treat their kitchens as extensions of personal identity. Matte finishes, pastel palettes, Scandi minimalism, and artisanal craftsmanship define current preferences. Functionality is essential, but form is now non-negotiable. Instagrammability often trumps tradition.

Influence of Social Media and Home Cooking Shows

Digital content has become the modern cookbook. Whether it’s Nigella’s immersive narratives or TikTok’s 30-second hacks, visual media guides consumer appetites. Influencer collaborations and limited-edition collections launched via Instagram further drive impulse buys, especially among younger demographics. Kitchenware is no longer sold; it's staged.

Competitive Landscape

Dominant Players and Local Artisans

Established names like Le Creuset, Tefal, and Joseph Joseph dominate shelf space, but the market is far from monolithic. A renaissance of UK-based craft artisans—selling hand-thrown ceramics or bespoke wooden tools—is carving out a loyal, niche customer base. These micro-brands often rely on storytelling, quality, and ethical manufacturing to stand out.

Innovation and Design as Market Differentiators

Innovation in the UK kitchenware space is not solely tech-driven. Yes, there are app-controlled air fryers, but there’s also silent drawer systems, space-optimised stackables, and modular storage that enhances both form and function. Ergonomics, weight distribution, and heat retention engineering have become hallmarks of premium brands.

Private Labels vs Branded Offerings

Supermarkets and department stores are leaning heavily into private label offerings, aiming to provide cost-effective alternatives with elevated design. Marks & Spencer and Waitrose have introduced house-brand cookware lines that rival national names on both performance and price. However, brand loyalty persists, especially in higher-income segments.

Opportunities and Challenges

Green Materials and Circular Design Initiatives

The industry is on the cusp of a material revolution. Brands are experimenting with mushroom mycelium packaging, upcycled plastics, and even algae-based bioplastics. Circular design—where products are designed to be disassembled and reused—is gaining regulatory and consumer attention. There's an open runway for brands ready to lead.

Inflation, Cost-of-Living Pressures, and Demand Volatility

Economic strain remains a wildcard. With inflation impacting household budgets, there’s growing polarisation: luxury items thrive among the affluent, while value-for-money dominates the mainstream. Retailers must balance inventory carefully to prevent overstocking high-cost lines during lean quarters.

Brexit’s Lingering Effects on Imports and Regulation

Though several years have passed since Brexit’s implementation, its ripple effects continue. Tariffs, border checks, and product certification changes have complicated supply chains. EU-made goods face longer lead times and higher costs, nudging some retailers to source domestically or from Commonwealth nations.

For more info please visit: https://market.us/report/uk-kitchenware-market/

Conclusion

Strategic Imperatives for Growth

To flourish in this layered market, brands must blend tradition with trailblazing. Investing in digital channels, embracing sustainable materials, and creating emotionally resonant designs will be essential. A data-driven understanding of consumer micro-segments will separate market leaders from followers.

The Future of British Kitchens

The British kitchen is no longer a place of mere sustenance—it is a theatre of taste, style, and sustainability. As the line between culinary necessity and lifestyle expression continues to dissolve, the UK kitchenware market stands poised for a bold and creative evolution.