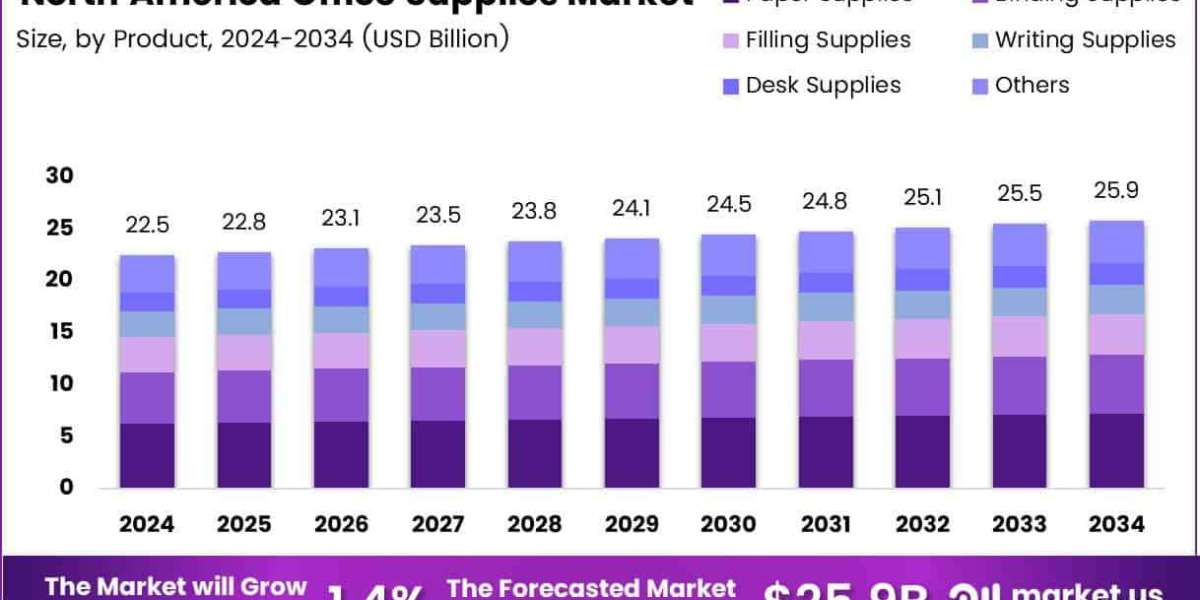

North America Office Supplies Market

Introduction: The Ever-Evolving Landscape of Office Supplies

Office supplies once the overlooked staples of the professional world have undergone a metamorphosis. From the utilitarian paperclip to voice-assisted digital notebooks, the spectrum of workplace tools has expanded and evolved. Historically rooted in cubicles and conference rooms, the office supplies sector is now as relevant at kitchen tables as it is in skyscrapers.

The rise of hybrid and remote work has done more than scatter the workforce; it has redefined what the modern office looks like. In this brave new world, productivity is no longer tethered to geography, and the paraphernalia of work is becoming more personal, portable, and purpose-driven.

For more information please visit site : https://market.us/report/north-america-office-supplies-market/

Market Composition and Segmentation

Core Categories: Paper Products, Writing Instruments, and Beyond

Traditional staples still anchor the market. Paper products, pens, filing systems, and adhesive tools remain evergreen in their utility. Yet, their presence has become more selective, tailored to niche tasks rather than general use. The demand curve now tilts heavily toward high-quality, ergonomic, and aesthetically pleasing tools.

Meanwhile, ancillary categories such as planners, label makers, and desk organizers have experienced an artisanal revival. No longer mere commodities, these items now serve as extensions of personal brand identity curated, stylish, and often Instagram-worthy.

Growth of Digital Integration and Eco-Conscious Alternatives

Digitally enhanced products such as smart notebooks, reusable whiteboards, and wireless charging pads are making paper feel vintage. Augmented utility blending analog familiarity with digital functionality is where much of the innovation thrives. Eco conscious buyers, particularly Gen Z and millennials, are gravitating toward bamboo-based organizers, compostable binders, and refillable pens with minimalist packaging.

Sustainability is no longer an accessory it’s a mandate. Products boasting carbon-neutral production, recycled content, or plastic-free packaging are winning shelf space and consumer trust in equal measure.

Regional Dynamics and Consumer Behavior

U.S. Dominance and Canada’s Steady Ascent

The United States holds the lion’s share of the North American office supplies market, bolstered by a dense network of educational institutions, corporate ecosystems, and retail giants. However, Canada is quietly carving a niche, with its emphasis on clean design and sustainable practices. Provincial school systems and small business growth are fueling steady, albeit less flashy, consumption.

Behavioral Shifts Among Enterprise vs. Home-Office Consumers

Enterprise buyers remain structured, favoring bulk procurement, uniformity, and brand reliability. In contrast, home-office consumers are driving a renaissance of personalization. They’re mixing practicality with design flair, often splurging on premium items that enhance both function and mood. This bifurcation is reshaping how brands segment and market their offerings.

The demand for comfort—think standing desks, lumbar cushions, ambient lighting is blending into the definition of office supplies. The line between furniture and stationery is becoming delightfully blurred.

Key Players and Competitive Landscape

Dominant Brands and Emerging Disruptors

Titans like Staples, Office Depot, and 3M continue to shape the market with expansive portfolios and vast distribution networks. Yet, their dominance is being challenged by digital-native brands offering customization, subscription models, and eco-ethos. Companies like Baronfig, Poppin, and Ugmonk are injecting creativity and authenticity into the ecosystem.

Innovation isn’t just about product it’s about positioning. Microbrands are building cult followings with curated storytelling, limited editions, and impeccable packaging.

Private Labels and the Rise of Direct-to-Consumer Models

Retailers are investing in private labels offering competitive pricing, in-house quality control, and exclusive designs. These products often sidestep traditional supply chains, reaching consumers via direct-to-doorstep fulfillment.

The direct-to-consumer model thrives on speed and specialization. It creates a feedback loop where consumer data shapes rapid iterations, keeping the offerings fresh and hyper-relevant.

Trends Shaping the Future

Sustainability as a Core Purchase Driver

Sustainability has transitioned from buzzword to baseline. Buyers are scrutinizing life-cycle impacts and demanding transparency. Whether it’s carbon-offset delivery options or zero-waste manufacturing, green credentials are influencing purchasing decisions like never before.

The Smartification of Traditional Office Tools

The integration of tech into everyday tools think pens that transcribe, planners that sync with calendars, or scissors with built-in lasers—points to an era of enhanced productivity. The office is no longer just analog or digital. It’s a hybrid, and so are the tools.

Subscription Models and the Convenience Economy

Replenishment fatigue is real. Monthly or quarterly subscription boxes offering curated office essentials tailored to professional needs and aesthetic tastes are gaining traction. Convenience, coupled with discovery, is proving irresistible.

Challenges and Roadblocks

Inflationary Pressures and Supply Chain Volatility

Material costs have surged post-pandemic. Everything from pulp for paper to plastic for folders is subject to global shocks. These fluctuations are compressing margins and forcing brands to either raise prices or redesign products for leaner material use.

Shipping bottlenecks, labor shortages, and raw material scarcities continue to plague the supply chain. Strategic stockpiling, nearshoring, and AI-driven forecasting are among the coping mechanisms being deployed.

Digital Substitution and Declining Legacy Demand

As digital workflows become the norm, traditional staples like notepads, physical calendars, and filing cabinets face declining relevance. Educational institutions and corporate offices are increasingly adopting paperless policies, squeezing demand further.

To stay relevant, many companies are reimagining their identity not as stationery suppliers, but as productivity enablers.

For more information please visit site : https://market.us/report/north-america-office-supplies-market/

Conclusion: A Market in Metamorphosis

The North America Office Supplies Market is not in decline it’s in transformation. As the very definition of “office” evolves, so too does the toolkit that supports it. What was once mundane has become meaningful. Utility now dances with creativity, and necessity finds harmony with aesthetics.

This market isn’t about paper and pens anymore. It’s about the architecture of productivity, the psychology of space, and the emotional resonance of well-designed tools. The future of office supplies is not static it is beautifully dynamics.