Reinsurance Market - United States

Market Statistics

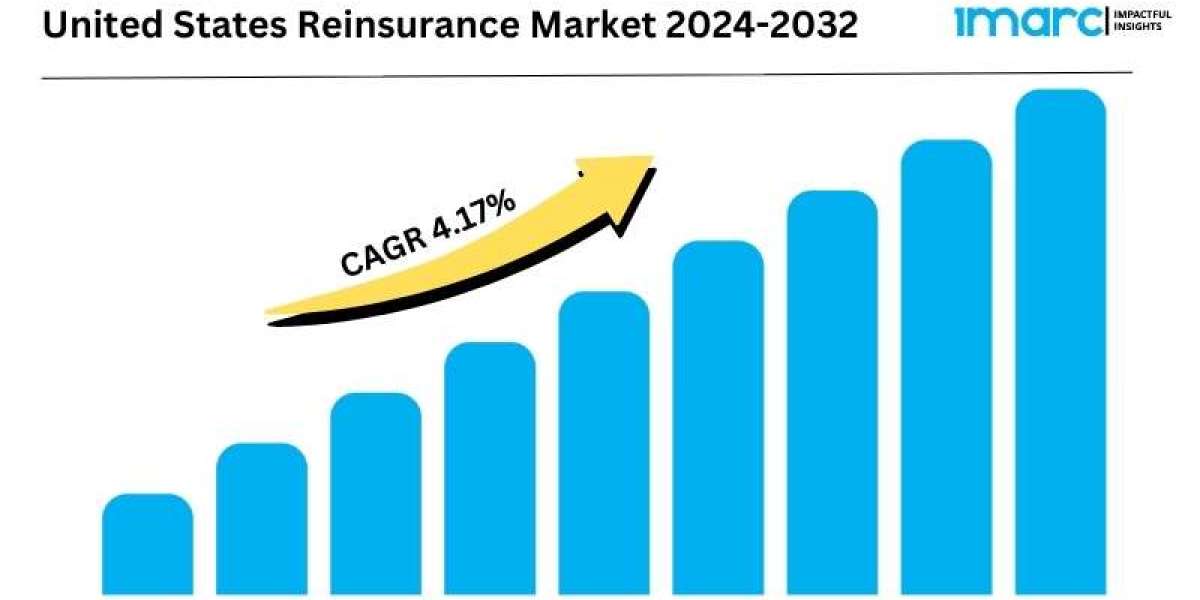

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 4.17% (2024-2032)

The growth of the United States reinsurance market size is driven by expanding economic activities, escalating natural disasters, and evolving regulatory landscapes. According to the latest report by IMARC Group, The United States reinsurance market size is projected to grow at a CAGR of 4.17% from 2024 to 2032.

United States Reinsurance Industry Trends and Drivers:

The United States reinsurance market is experiencing growth and evolution due to several key drivers and trends. Below is a summary of the market's growth factors and trends presented in bullet points.

Key Drivers of Market Growth

- Expanding Economic Activities:

- The growth of construction and infrastructure projects in the expanding U.S. economy is increasing the demand for reinsurance to protect against large-scale losses.

- Escalating Natural Disasters:

- The increasing frequency and severity of catastrophic events like hurricanes, wildfires, and floods are driving primary insurers to seek more robust reinsurance coverage.

- Climate Change Awareness:

- Heightened awareness of climate change and its impacts is further boosting the demand for reinsurance solutions to manage related risks.

- Low-Interest Rates and Favorable Investment Conditions:

- The reinsurance market is attracting more capital inflows due to low-interest rates and favorable investment conditions.

- Emerging Risks and Specialized Reinsurance Products:

- There is a growing demand for specialized reinsurance products tailored to emerging risks such as cyber threats and pandemics.

- Advancements in Data Analytics and Modeling Technologies:

- The market is benefiting from technological advancements that enhance risk assessment and modeling capabilities.

- Attractiveness for Global Reinsurers:

- The well-established legal frameworks and transparency in the U.S. market make it an attractive destination for global reinsurers.

Key Market Trends

- Increased Focus on Alternative Capital Sources:

- The use of alternative capital sources like catastrophe bonds and insurance-linked securities (ILS) is on the rise, providing insurers with more flexibility and capacity in managing risk portfolios.

- Adoption of InsurTech Solutions:

- The market is seeing a growing adoption of InsurTech solutions, including digital platforms and advanced analytics, to enhance risk management and operational efficiency.

- Shift Towards Sustainability:

- Reinsurers are increasingly integrating environmental, social, and governance (ESG) factors into their underwriting practices and investment strategies.

- Growth in Cyber Reinsurance:

- As the digital economy expands, there is a specific emphasis on cyber reinsurance to address the rising cyber risks.

- Demand for Health and Life Reinsurance:

- The aging population is driving increased demand for reinsurance solutions in the health and life insurance sectors.

- Impact of the COVID-19 Pandemic:

- The pandemic has highlighted the need for robust reinsurance arrangements, leading to a reevaluation of risk models and a stronger focus on pandemic-related coverages, expected to shape the market's future.

These factors and trends indicate that the United States reinsurance market is poised for continued growth, driven by economic activities, the need for risk management in the face of natural disasters and emerging threats, and technological advancements.

Download sample copy of the Report: https://www.imarcgroup.com/united-states-reinsurance-market/requestsample

United States Reinsurance Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Facultative Reinsurance

- Treaty Reinsurance

- Proportional Reinsurance

- Non-proportional Reinsurance

Mode Insights:

- Online

- Offline

Distribution Channel Insights:

- Direct Writing

- Broker

Application Insights:

- Property and Casualty Reinsurance

- Life and Health Reinsurance

- Disease Insurance

- Medical Insurance

Regional Insights:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Request for customization: https://www.imarcgroup.com/request?type=report&id=20397&flag=F

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145