The payroll summary report in QuickBooks Online is a detailed document that consolidates all the payroll-related data for a specific period, such as a pay period, a month, or a year.

It includes information such as employee names, pay rates, hours worked, gross and net pay, and any deductions or taxes withheld. This report is essential for a variety of purposes, including internal reporting, tax preparation, and compliance with labor laws and regulations.

By understanding the structure and contents of the payroll summary report, you can effectively leverage this tool to streamline your payroll management and ensure accurate record-keeping.

In the following sections, we'll dive deeper into the benefits of downloading the payroll summary report and provide a step-by-step guide to help you access this valuable information in QuickBooks Online.

Benefits of downloading the payroll summary report

Downloading the payroll summary report from QuickBooks Online offers numerous benefits for your business. Here are some of the key advantages:

Accurate record-keeping:

The payroll summary report provides a detailed record of all your company's payroll activities, ensuring that you have comprehensive and accurate documentation of your employee compensation and tax obligations. This information is crucial for tax reporting and auditing purposes.

Streamlined payroll management:

By accessing the payroll summary report, you can easily track and monitor your company's payroll expenses, identify any discrepancies or errors, and make informed decisions about your payroll processes. This can help you optimize your payroll workflows and improve overall efficiency.

Compliance with labor laws:

The payroll summary report includes information about employee wages, deductions, and taxes, which are essential for ensuring compliance with labor laws and regulations. This report can serve as a valuable reference when responding to inquiries or audits from government agencies.

Improved financial reporting:

The payroll summary report is a crucial component of your company's financial records. By incorporating this information into your overall financial reporting, you can gain a more comprehensive understanding of your business's financial health and make better-informed decisions.

Regularly updating payroll tax tables in QuickBooks is crucial for maintaining accurate payroll calculations and compliance with tax regulations. This process ensures that your business applies the most current tax rates, withholding amounts, and contribution limits when processing employee paychecks.

Step-by-step guide to downloading the payroll summary report

Now that you understand the benefits of the payroll summary report, let's walk through the process of downloading it from QuickBooks Online. Follow these simple steps:

- Log in to your QuickBooks Online account: Start by accessing your QuickBooks Online dashboard and signing in to your account.

- Navigate to the "Reports" section: Look for the "Reports" option in the left-hand menu or the top navigation bar, and click on it to access the reporting dashboard.

- Locate the "Payroll Summary" report: In the reports menu, you should see an option for "Payroll Summary." Click on this option to open the report.

- Select the desired period: The payroll summary report allows you to generate the report for a specific period, such as a pay period, a month, or a year. Use the date range filters to select the period you want to view.

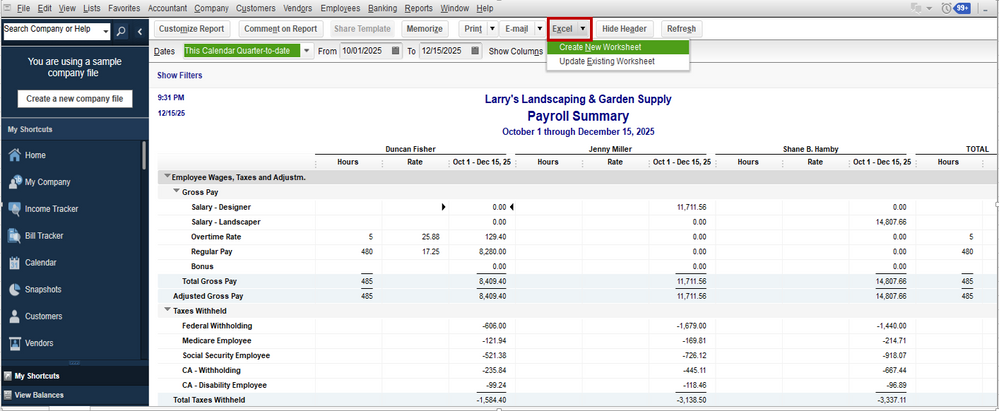

- Customize the report: QuickBooks Online offers various customization options for the payroll summary report. You can choose to include or exclude specific columns, sort the data, and even save your preferred settings for future use.

- Preview and download the report: Once you've made your desired customizations, click the "Run Report" button to generate the payroll summary. Review the report to ensure it contains the information you need, and then click the "Export" button to download the report in your preferred file format (e.g., PDF, Excel, or CSV).

Remember, the specific layout and options available may vary slightly depending on the version of QuickBooks Online you're using, but the general process should remain similar.

In the next section, we'll dig deep into some tips and tricks to help you interpret and analyze the payroll summary report more effectively.

Tips for interpreting and analyzing the payroll summary report

Now that you know how to download the payroll summary report from QuickBooks Online, let's explore some tips and strategies to help you interpret and analyze the information it provides:

Understand the report structure:

Familiarize yourself with the different sections and columns of the payroll summary report. This will help you quickly locate the specific information you need, such as employee wages, deductions, and tax withholdings.

Identify key metrics:

Focus on the critical metrics in the report, such as total gross pay, total net pay, total deductions, and total taxes withheld. These figures will give you a high-level understanding of your company's payroll expenses and help you identify any significant changes or anomalies.

Analyze employee-level data:

Examine the individual employee data within the report, looking for any discrepancies in pay rates, hours worked, or deductions. This can help you identify potential errors or inconsistencies in your payroll processing.

Compare to previous periods:

Compare the current payroll summary report to those from previous periods, such as the same pay period or month in the previous year. This can help you identify trends, seasonal fluctuations, or any unexpected changes in your payroll expenses.

Reconcile with other financial reports:

Cross-reference the payroll summary report with your company's other financial reports, such as the income statement or general ledger. This can help you ensure that your payroll data is accurately reflected in your overall financial records.

Identify opportunities for optimization:

Analyze the payroll summary report to identify areas where you can optimize your payroll processes, such as reducing unnecessary deductions, adjusting pay rates, or streamlining time-tracking methods.

Collaborate with your accountant:

If you work with an external accountant or bookkeeper, share the payroll summary report with them. They can provide valuable insights and guidance on interpreting the data and ensuring compliance with tax and labor regulations.

Customizing the payroll summary report in QuickBooks Online

One of the great features of the payroll summary report in QuickBooks Online is its customizability. Here are some ways you can customize the payroll summary report:

- Adjust the date range: As mentioned earlier, you can select the period you want to view in the payroll summary report. This allows you to generate reports for specific pay periods, months, or even the entire year.

- Select the columns to display: QuickBooks Online allows you to choose which columns you want to include in the payroll summary report. You can show or hide columns such as employee names, pay rates, hours worked, gross pay, deductions, and taxes.

- Sort and filter the data: You can sort the payroll data by various criteria, such as employee name, pay date, or department. Additionally, you can apply filters to the report to focus on specific employees, pay types, or deduction categories.

- Customize the report layout: QuickBooks Online offers options to adjust the layout of the payroll summary report, including changing the font size, adding or removing gridlines, and adjusting the column widths.

- Save custom report settings: Once you've configured the payroll summary report to your liking, you can save your preferred settings for future use. This way, you can quickly generate the report with your custom settings, saving you time and effort.

- Export the report in various formats: The payroll summary report can be exported in different file formats, such as PDF, Excel, or CSV. This allows you to easily share the report with your accountant, bookkeeper, or other stakeholders, or integrate the data into your other financial systems.

You may also read:- HOW TO CREATE A COPYRIGHT PAYROLL SUMMARY REPORT

Troubleshooting common issues when downloading the payroll summary report

While downloading the payroll summary report from QuickBooks Online is generally a straightforward process, you may occasionally encounter some challenges. Here are a few common issues and how to address them:

Report not generating:

If the payroll summary report fails to generate or displays an error message, there are a few things you can try:

- Ensure that you have the necessary permissions to access the report.

- Check your internet connection and try refreshing the page.

- Clear your browser's cache and cookies, then try generating the report again.

- if the issue persists, contact QuickBooks Online customer support for further assistance.

Incomplete or missing data:

If the payroll summary report is missing some data or appears to be incomplete, consider the following:

- Verify that you have selected the correct date range for the report.

- Check if all your employees have been properly set up and their payroll information is correctly entered in QuickBooks Online.

- Ensure that you have not excluded any relevant columns or filters in the report customization.

- If the issue is specific to a particular employee or pay period, double-check the corresponding payroll records.

Formatting or layout issues:

If the payroll summary report's formatting or layout is not to your liking, try the following:

- Explore the available customization options to adjust the report's appearance, such as changing the font size, adding or removing gridlines, and resizing columns.

- Save your preferred report settings for future use to ensure consistent formatting.

- If you're still experiencing issues, try exporting the report to a different file format, such as Excel, which may provide more flexibility in formatting and layout.

Difficulty sharing or accessing the report:

If you're having trouble sharing the payroll summary report with your accountant or other stakeholders, consider the following:

- Ensure that you have the necessary permissions to export the report in your desired file format.

- Check the email or file-sharing settings in your QuickBooks Online account to ensure that you can successfully send the report.

- If you're using a shared QuickBooks Online account, make sure that the other users have the appropriate access rights to view and download the report.

By addressing these common issues, you can ensure a smooth and efficient process when downloading the payroll summary report from QuickBooks Online.

Final Thought

In this comprehensive guide, we've explored the process of downloading the payroll summary report from QuickBooks Online, a crucial tool for small business owners and accountants alike. By understanding the benefits of the payroll summary report, mastering the step-by-step process, and learning how to interpret and analyze the data, you can unlock the full potential of this powerful feature.