Fintech, which stands for financial technology, is a rapidly evolving industry that uses innovative technologies to improve and automate financial services. It covers a wide range of applications, including mobile banking, peer-to-peer lending, block chain, and robo-advisors. Fintech is changing the way people and organizations handle their finances by streamlining operations, lowering prices, and increasing accessibility. The proliferation of digital wallets and cryptocurrencies has altered the financial environment, making transactions faster and more secure. Fintech's continued growth brings both exciting potential and challenges, like as regulatory issues and the need for cybersecurity precautions.

According to SPER Market Research, ‘Russia FinTech Market Size- By Technology, By Deployment, By End User, By Application- Regional Outlook, Competitive Strategies and Segment Forecast to 2033’ states that The Russia FinTech Market is estimated to reach USD XX Billion by 2033 with a CAGR of XX%.

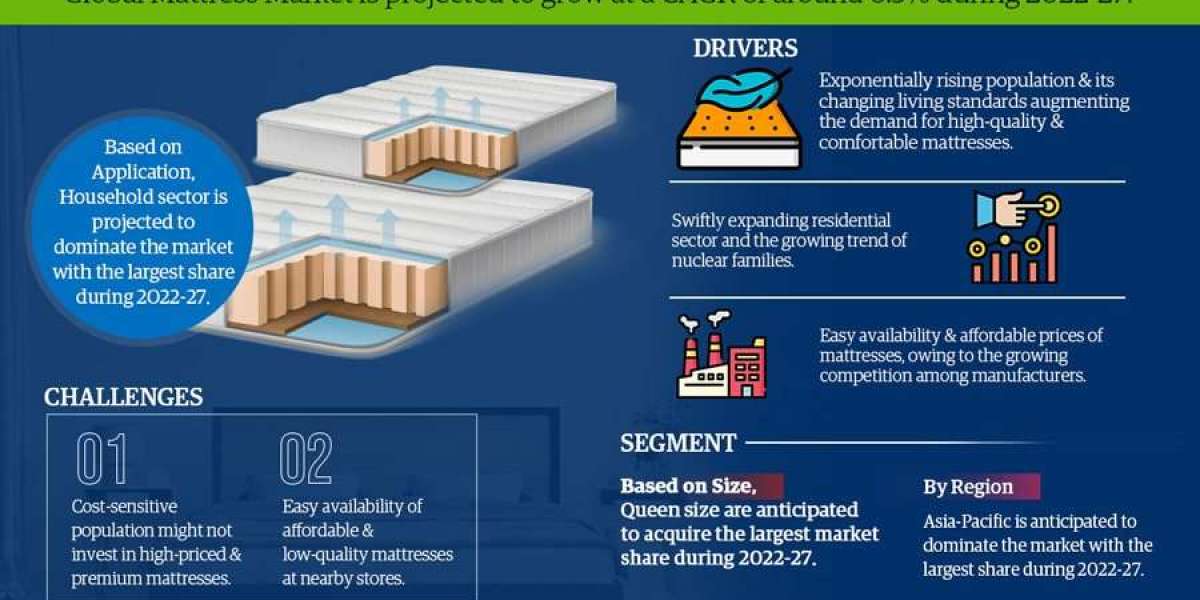

Drivers:

The FinTech industry in Russia is expanding due to a number of important causes. The rise in the number of people using digital banks is indicative of a change in customer behaviour whereby they are using online platforms for investing and banking services. Furthermore, the Central Bank of Russia's regulatory sandbox is one example of how the government supporting innovation the financial sector. The increase in funding for FinTech businesses is another element fueling expansion. Venture capital firms showed a strong interest in promising technologies like blockchain and artificial intelligence in 2021, which led to a significant funding inflow for Russian FinTech startups. This inflow of capital is expected to spur further innovation and the creation of new financial products.

Challenges:

There are various obstacles facing Russia's FinTech industry that could hinder its expansion. One of the main issues is the regulatory environment, which is frequently seen as complicated and dynamic. Inconsistent regulatory frameworks can stifle innovation and discourage foreign investment, which makes it challenging for startups to grow successfully. Cybersecurity presents another important challenge. The proliferation of digital financial services is accompanied by an increase in cybercriminals' risks. Attacks that are more sophisticated are increasingly aimed at Russian financial institutions, putting private customer information at risk and eroding confidence in online platforms. Furthermore, the FinTech industry is experiencing increased rivalry as new and established institutions compete for market share. Due to security concerns, many Russian customers still favour traditional banking methods.

Request for Free Sample Report @ https://www.sperresearch.com/report-store/russia-fintech-market.aspx?sample=1

The Covid-19 epidemic has had a tremendous impact on Russia's FinTech business. Initially, the pandemic caused an increase in demand for internet banking and payment systems as lockdown measures forced people to adjust to remote contacts. In reaction to the epidemic, traditional banks and financial institutions increased their digital products to remain competitive and fulfil new consumer demands. The epidemic also drove an increase in FinTech firms, particularly those focused on healthtech and e-commerce solutions. The hazards connected with cyber-attacks grew in tandem with the expansion of digital financial services. Looking ahead, the pandemic's long-term impacts will most certainly continue to shape the Russian FinTech sector. The rising acceptance of digital solutions is projected to continue, pushing additional innovation and collaboration between traditional banks and Fintech firms.

In Russia Fintech Market, Moscow dominates the market due to the presence of Large number of banks and Financial Institution. The key players in the market are Artquant Ltd, B2Broker, Double Data, Gazprombank, Mandarin and others.

Russia FinTech Market Segmentation:

By Technology:

- Application Programming Interface

- Artificial Intelligence, Blockchain

- Data Analytics

- Robotic Process Automation

By Deployment:

- Cloud-Based

- On-premise

By End User:

- Banking

- Insurance

- Securities

- Others

By Application:

- Insurance and Personal Finance

- Loans

- Payment and Fund Transfer

- Wealth Management

- Others

By Region:

- North Region

- South Region

- West Region

For More Information, refer to below link: –

Related Reports:

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

Sara Lopes, Business Consultant – USA

SPER Market Research

+1-347-460-2899