Vietnam Fintech Market Overview

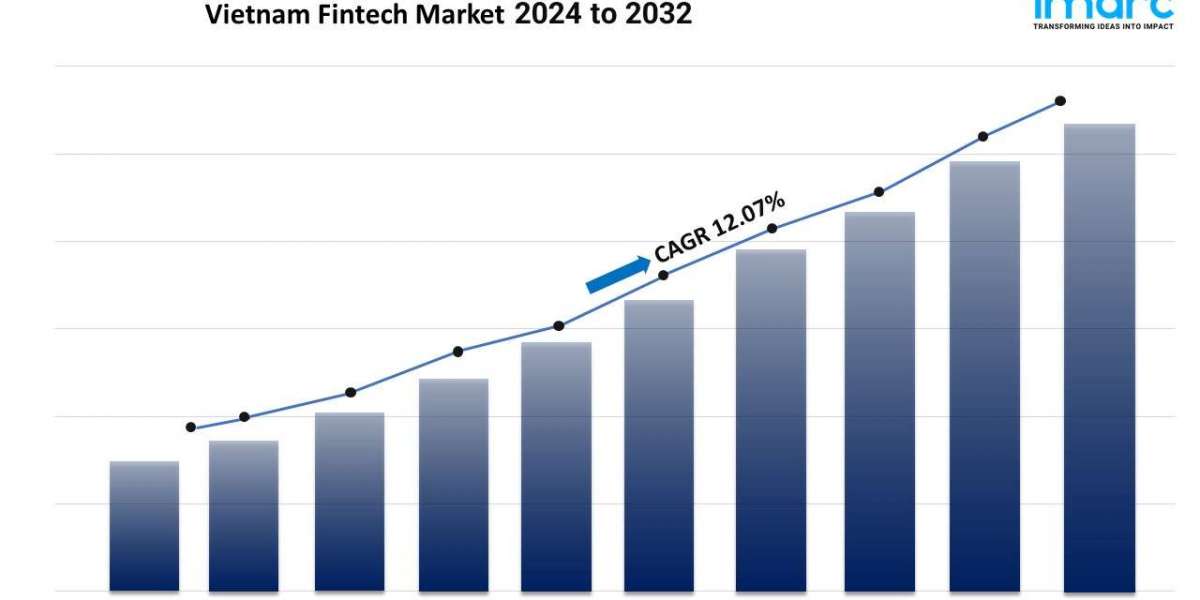

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate:12.07% (2024-2032)

Vietnam's fintech market is booming, driven by the increasing adoption of digital payments and innovative financial services. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 12.07% from 2024 to 2032.

Vietnam Fintech Market Trends and Drivers:

Key trends in the Vietnam fintech market include the rise of digital lending platforms and the increasing use of artificial intelligence (AI) and machine learning (ML) to enhance customer experience. Digital lending platforms are particularly gaining traction due to their ability to provide quick, accessible credit to individuals and small businesses. Additionally, AI and ML are being leveraged to offer personalized financial solutions and improve fraud detection, driving the efficiency of fintech services.

Moreover, the market is witnessing a surge in collaborations between traditional financial institutions and fintech companies, aiming to combine the strengths of both sectors. These partnerships are streamlining financial services, enhancing customer engagement, and expanding service offerings. Besides, the ongoing focus on cybersecurity and data privacy is shaping fintech innovation, as companies seek to build consumer trust by ensuring the security of digital transactions.

The Vietnam fintech market is primarily driven by increasing digitalization and a rising preference for cashless transactions. Additionally, with the government's push toward a cashless society and the strong adoption of mobile payment solutions, the market is influencing market growth. In particular, the growing middle class and the high penetration of smartphones have played a pivotal role in escalating the demand for digital financial services.

Moreover, the COVID-19 pandemic has accelerated the shift toward digital platforms, as consumers and businesses seek more efficient and contactless payment methods. Fintech companies are capitalizing on this trend by offering various services, including digital wallets, peer-to-peer lending, and online banking solutions. Besides, the regulatory support from the Vietnamese government has introduced policies to foster innovation in the financial sector. This includes favorable regulations for fintech startups and initiatives to encourage financial inclusion, particularly in underserved rural areas. Furthermore, the government’s commitment to modernizing its financial infrastructure is also reflected in its support for blockchain technology and digital banking licenses, which are helping to attract local and foreign investments into the fintech ecosystem across Vietnam.

Vietnam Fintech Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Vietnam Fintech Market Share. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

The report has segmented the market into the following categories:

Type Insights:

• Digital Payments

o Online Purchases

o POS (Point of Sales) Purchases

• Personal Finance

o Digital Asset Management Services

o Remittance/ International Money Transfers

• Alternative Financing

o P2P Lending

o SME Lending

o Crowdfunding

• Insurtech

o Online Life Insurance

o Online Health Insurance

o Online Motor Insurance

o Others

• B2C Financial Services Marketplaces

o Banking and Credit

o Insurance

• E-Commerce Purchase Financing

• Others

Regional Insights:

• Northern Vietnam

• Central Vietnam

• Southern Vietnam

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/vietnam-fintech-market/requestsample

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Key highlights of the Report:

• Market Performance (2018-2023)

• Market Outlook (2024-2032)

• COVID-19 Impact on the Market

• Porter’s Five Forces Analysis

• Strategic Recommendations

• Historical, Current, and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Structure of the Market

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC information products include major market, scientific, economic, and technological developments for pharmaceutical, industrial, and high-technology business leaders. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology, and novel processing methods are at the top of the company's expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145