Check Cashing Market: Unveiling Growth Trends, Analysis, and Projections

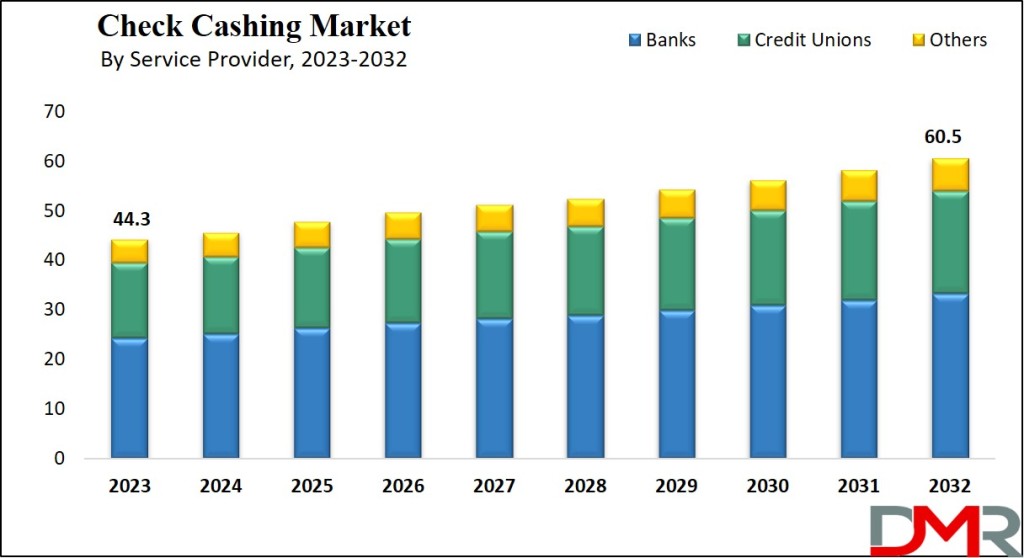

The Check Cashing Market has emerged as a crucial financial service, providing a means for individuals to access funds without the necessity of a traditional bank account. This industry, valued at USD 44.3 billion in 2023, is expected to surge to USD 60.5 billion by 2032, exhibiting a steady Compound Annual Growth Rate (CAGR) of 3.5%.

Grab a Free Sample Here@ https://dimensionmarketresearch.com/report/check-cashing-market/request-sample

Understanding Check Cashing Services

Check cashing services offer a convenient avenue for converting paychecks and various checks into cash, eliminating the reliance on a bank account. Beyond check conversion, these financial service providers offer a spectrum of transactions, including money orders, small-scale loans, electronic bill settlement, and, of course, check cashing.

Check Cashing Market Growth Analysis

Market Dynamics

The check cashing market is witnessing substantial growth, driven by the increasing demand for money transfer services and check cashing facilities. These services play a pivotal role in providing consumers with accessible means to convert checks into cash without the constraints of a traditional bank account. This factor serves as a primary driver propelling the progress of the global check cashing market.

Common Drivers and Challenges

Drivers: Several factors contribute to the market's growth, including collaborations with diverse organizations, the rise of prepaid debit cards, demographic shifts favoring non-banking options, and a substantial presence of the unbanked population.

Challenges: However, challenges persist. The growing adoption of digital payment systems and electronic transactions has led to a decline in paper check use, diminishing the demand for check cashing services. Additionally, stringent regulatory mandates to combat money laundering and fraud present operational challenges and increased expenses for check cashing enterprises.

Research Scope and Analysis

By Service Provider

In the service provider category, banks hold a significant portion of the revenue. Major banks leverage their established financial presence, offering loans at lower interest rates but with higher fees. On the other hand, credit unions display flexibility and a customer-centric approach, contributing to their growth within the check cashing market.

By Type

Emerging as a dominant factor within the type segment are payroll checks, contributing significantly to market growth in 2023. These checks facilitate the distribution of employee earnings, offering the convenience of direct deposit, minimizing the need for physical checks.

By End User

The commercial sector commands a substantial market share, contributing significantly to the overall market growth. Businesses, requiring effective transaction channels, often resort to check-based payments, especially in the form of commercial checks associated with company names.

Key Takeaways:

- Market Growth: The Global Check Cashing Market is set to reach USD 60.5 billion by 2032, exhibiting a steady CAGR of 3.5%, with a current valuation of USD 44.3 billion in 2023.

- Diverse Services: Check cashing services offer a range of financial transactions, including money orders, small-scale loans, electronic bill settlement, in addition to converting various checks into cash.

- Market Drivers: Growth is propelled by collaborations, prepaid debit card escalation, demographic shifts favoring non-banking, and the presence of the unbanked population.

- Challenges: The market faces challenges from the rise of digital payments, regulatory mandates, and the emergence of alternative financial service providers, impacting overall demand.

Recent Developments in the Check Cashing Market (2022-2023):

Market Growth and Trends:

- Steady growth: The global check cashing market is projected to reach a CAGR of 3.4% from 2023 to 2032, reaching a value of USD 56.4 billion by 2032.

- North American dominance: The North American market, particularly the US, remains a major player due to high adoption and established players.

- Technological advancements: Adoption of advanced software and digital solutions is streamlining operations and attracting new customers.

Buy This Report Here@ https://dimensionmarketresearch.com/checkout/check-cashing-market

Regional Analysis

North America leads the global check cashing market with a market share of approximately 34.8%, attributing its growth to the presence of key market players and the increasing adoption of alternative financial services. This dominance is projected to persist throughout the forecasted period.

Prominent Players

Some of the key players in the Global Check Cashing Market include:

- Walmart Inc

- Encore Capital Group

- PHH Corp

- Black Knight Inc

- Film Finances Inc

- Waterman Inc

- Navient Solutions LLC

- Ocwen Financial Corp

- Harrison Vickers

- Currency Exchange International Corp

- Other Key Players

Frequently Asked Questions (FAQs)

Q1: What is the expected market value of the Global Check Cashing Market by 2032?

A1: The Global Check Cashing Market is anticipated to reach a market value of USD 60.5 billion by 2032, with a CAGR of 3.5%.

Q2: What challenges does the market face in the era of digital payments?

A2: The market encounters challenges such as the decline in paper check use due to the growing adoption of digital payment systems, resulting in reduced demand for check cashing services.

Q3: What factors contribute to the growth of banks in the service provider category?

A3: Banks benefit from their established financial presence, offering loans at lower interest rates, albeit with comparatively higher fees. Credit unions, on the other hand, display flexibility and a customer-centric approach.

Q4: Which type of check significantly contributes to the market growth in 2023?

A4: Payroll checks emerge as a dominant factor within the type segment, contributing significantly to the market growth in 2023.

Q5: Why does North America lead the global check cashing market?

A5: North America leads due to the presence of key market players and the increasing adoption of alternative financial services, contributing to its market share of approximately 34.8%.

Conclusion

In conclusion, the Check Cashing Market is navigating a dynamic landscape, influenced by factors such as the rise of digital payments, regulatory challenges, and shifting consumer preferences. As key players continue to innovate and adapt, the industry is poised for growth, catering to the diverse financial needs of consumers across different sectors.