Market Estimation & Definition

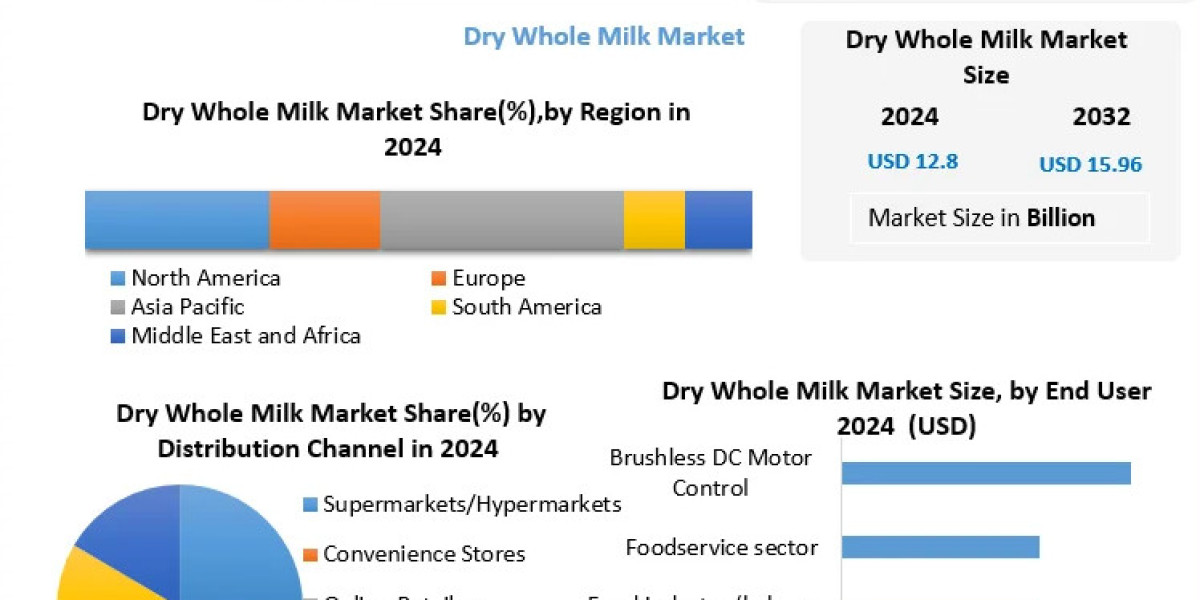

The Dry Whole Milk Industry was valued at approximately USD 12.8 billion in 2024, and is projected to reach nearly USD 15.96 billion by 2032, riding a compound annual growth rate (CAGR) of 3.2% from 2025 to 2032. This market encompasses key product formats such as spray-dried milk powder, roller-dried milk powder, and fortified whole milk powders—serving uses across food processing, dairy applications, bakery, confectionery, and infant nutrition.

Gain Valuable Insights – Request Your Complimentary Sample Now @ https://www.maximizemarketresearch.com/request-sample/194843/

Market Growth Drivers & Opportunity

Several core factors propel the dry whole milk market forward:

Technological advancements in drying processes have enhanced product quality, prolonging shelf life and sensory appeal.

Strong consumer preference for longer-lasting, versatile dairy offerings aligns well with dry whole milk’s benefits.

Cost optimization: The removal of water reduces transportation and waste costs, boosting operational efficiency.

Sustainability: Dry milk production uses less water and energy relative to liquid milk, appealing to eco-conscious consumers and producers.

Opportunities include meeting organic and clean-label demand, expanding into emerging markets, and developing novel product formats with unique flavors and nutrients.

Feel free to request a complimentary sample copy or view a summary of the report: https://www.maximizemarketresearch.com/request-sample/194843/

What Lies Ahead: Emerging Trends Shaping the Future

The sector is witnessing compelling trends:

Shelf-stable dairy demand is rising across retail, foodservice, and humanitarian channels.

Increased focus on infant and clinical nutrition broadens applications for fortified milk powders.

Clean-label and sustainability commitments are driving producers to adopt transparent practices and ingredient labeling.

Channel expansions like e-commerce and direct-to-consumer are heightening accessibility, particularly in urban and remote areas.

Segmentation Analysis

The dry whole milk market is segmented as follows:

By Category: Conventional vs. Organic

By Packaging: Plastic containers vs. Stand-up pouches

By End-User: Households, Food industry (e.g., bakery, confectionery), Foodservice (cafes, restaurants, hotels)

By Distribution Channel: Supermarkets/hypermarkets, Convenience stores, Online retailers, Specialty stores

These dimensions offer insight into consumer behavior, retail dynamics, and innovation potential.

Dive deeper into the market dynamics and future outlook: https://www.maximizemarketresearch.com/request-sample/194843/

Country-Level Analysis: USA & Germany

In the United States, the market reflects maturity with both conventional and organic product formats widely available. Packaged in containers and pouches, dry whole milk is distributed through large supermarkets, convenience stores, online retailers, and foodservice outlets. Strong demand also comes from households and food processing industries.

In Germany, segmentation spans the same categories—category, packaging, end-user, and distribution channel. German consumers are increasingly leaning toward organic options and sustainable packaging, making the market well-positioned to capitalize on Europe’s broader clean-label and eco-friendly trends.

Key Players in Global Dry Whole Milk are:

North America

1. Dairy Farmers of America (USA)

2. Dean Foods (USA)

3. Kraft Heinz Company (USA)

4. Schreiber Foods (USA)

5. Land O'Lakes (USA)

6. Saputo Inc. (Canada)

7. Conagra Brands Inc. (USA)

8. Agropur Dairy Cooperative (Canada)

Europe

9. Nestlé S.A. (Switzerland)

10. Danone S.A. (France)

11. Lactalis Group (France)

12. Arla Foods (Denmark)

13. FrieslandCampina (Netherlands)

14. Müller Group (Germany)

15. Glanbia plc (Ireland)

16. Valio Ltd. (Finland)

Conclusion

In summary, the global Dry Whole Milk Market—valued at USD 12.8 billion in 2024 and forecasted to grow to nearly USD 15.96 billion by 2032—stands poised for steady expansion, supported by advances in processing, cost efficiencies, sustainability, and evolving consumer preferences.

The market’s robust segmentation by category, packaging, end-user, and distribution channel provides a granular roadmap for both emerging and established markets like the United States and Germany. Fierce competition from vertically integrated dairy leaders, coupled with recent investments in eco-friendly production and digital channels, underscores a landscape rich in innovation and growth potential.

About Us