The Ghana insurance market, a rapidly growing sector in West Africa, is witnessing significant transformation driven by economic growth, regulatory reforms, and increasing public awareness. With a steady rise in demand for insurance products, Ghana’s insurance industry is poised for growth, offering opportunities for both local and international investors. This article explores key trends, growth opportunities, challenges, and factors influencing Ghana’s insurance landscape.

Overview of Ghana’s Insurance Sector

Ghana’s insurance sector is governed by the National Insurance Commission (NIC), which oversees insurance policies and promotes a transparent, customer-centric regulatory framework. Recent reforms, such as increased minimum capital requirements, aim to strengthen insurers’ financial stability, encouraging market competitiveness and ensuring policyholder protection.

The market is divided into two main segments: life and non-life insurance. Life insurance covers savings, retirement plans, and life protection, while non-life insurance primarily includes motor, property, health, and liability insurance. Ghana’s life insurance segment has seen notable growth as more individuals seek long-term financial security and savings solutions, a trend fueled by increased disposable income and growing financial literacy.

Key Trends Shaping the Ghana Insurance Market

- Digital Transformation

Technology is reshaping the Ghanaian insurance market. Insurtech innovations, such as mobile and online platforms, have simplified premium payments, claims processing, and policy management. This trend aligns with Ghana’s rising mobile penetration and fintech expansion, enhancing accessibility to insurance services, especially for younger demographics. - Microinsurance Expansion

With a significant portion of Ghana’s population in the informal sector, microinsurance has emerged as a critical growth area. Low-cost, easily accessible insurance solutions cater to low-income households and provide coverage for agriculture, health, and basic property protection. Microinsurance helps reduce financial vulnerability and increases insurance penetration rates in previously underserved segments. - Increasing Health Insurance Demand

Health awareness has surged in Ghana due to the COVID-19 pandemic, leading to a rise in demand for health insurance products. Private health insurance complements the National Health Insurance Scheme (NHIS) by covering advanced treatment options and enhancing access to quality healthcare. Health insurance providers are now tailoring products to meet diverse customer needs, from families to individuals with chronic conditions. - Regulatory Reforms and Compliance

NIC’s recent reforms, including increased capital requirements, aim to safeguard policyholders and attract investors by ensuring that insurance providers are financially resilient. These measures encourage consolidation within the market, potentially reducing the number of players but enhancing industry stability and public confidence. - Green Insurance Initiatives

Ghana’s focus on sustainable development has brought about green insurance products, aligning with global sustainability goals. Green insurance includes coverages tailored to environmental risks, such as climate-resilient agricultural policies and eco-friendly transportation. This niche market aligns with the government’s environmental goals and supports climate resilience efforts.

Growth Opportunities in Ghana’s Insurance Market

- Untapped Market Segments

A substantial portion of Ghana’s population remains uninsured or underinsured, especially in rural areas. Targeting rural communities and providing affordable insurance products can drive market penetration and growth. Customized products addressing unique local needs, such as agricultural and health-related risks, can help insurers expand their reach. - Mobile Insurance Solutions

The high penetration rate of mobile technology offers insurers a powerful channel to reach customers. Mobile insurance, including USSD and mobile app solutions, simplifies processes and minimizes distribution costs. Collaborations between insurers and telecom companies can enhance reach, allowing insurers to scale their services even in remote areas. - Corporate Insurance Demand

As Ghana’s economy grows, so does the demand for corporate insurance products, including employee benefits, liability coverage, and business interruption insurance. With increasing foreign investments and local entrepreneurship, insurers can create tailored solutions for businesses, providing comprehensive risk coverage that meets regulatory and corporate standards. - Bancassurance Partnerships

Partnerships between insurance providers and banks (bancassurance) offer significant growth potential. Bancassurance enables customers to access insurance products through banking channels, providing convenience and fostering customer trust. This model also allows insurers to leverage banks’ established networks and client relationships.

Challenges Facing Ghana’s Insurance Market

- Low Public Awareness and Trust

Despite growth efforts, there is still limited awareness about insurance benefits in some segments. Misconceptions and lack of trust deter potential customers, especially in rural areas. Education campaigns, community outreach, and transparent communication are crucial to bridging this gap. - Economic Volatility

Economic fluctuations can impact disposable incomes, reducing people’s ability to afford insurance premiums. Inflation and currency fluctuations further add financial strain, affecting both insurers’ profitability and customers’ affordability. - Fraud and Claims Management

Fraudulent claims remain a challenge in Ghana’s insurance market, potentially impacting profitability and customer trust. Insurers are increasingly investing in data analytics and fraud detection technologies to mitigate this issue and ensure efficient claims management. - Regulatory Compliance Costs

While beneficial for market stability, regulatory reforms also mean increased compliance costs. Smaller firms, particularly those unable to meet new capital requirements, may find it challenging to remain competitive. However, these reforms could lead to a more stable and sustainable insurance industry in the long term.

Future Outlook for Ghana’s Insurance Market

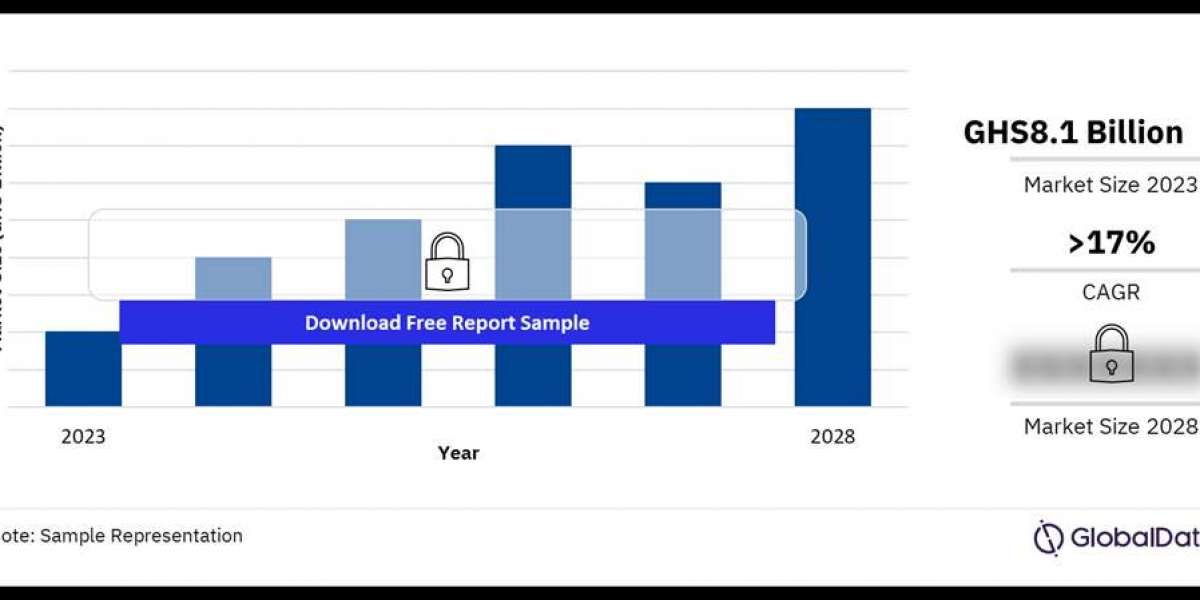

The future of Ghana’s insurance market looks promising, with projected growth driven by digital transformation, product innovation, and increased insurance awareness. Leveraging technology to offer accessible, affordable insurance products is essential for expanding market reach and attracting young, tech-savvy consumers. The demand for microinsurance and mobile insurance solutions will likely continue to rise, helping to cover a broader range of income levels.

Ghana’s insurance sector also has opportunities to lead in sustainable practices, especially through green insurance products that align with national and global sustainability goals. As the industry matures and insurers develop products that meet diverse customer needs, Ghana’s insurance market will become an increasingly attractive option for investors, playing a key role in supporting the nation’s financial security and economic resilience.

Buy the Full Report for More Insights into the Ghana Insurance Market Forecast

Download a Free Report Sample