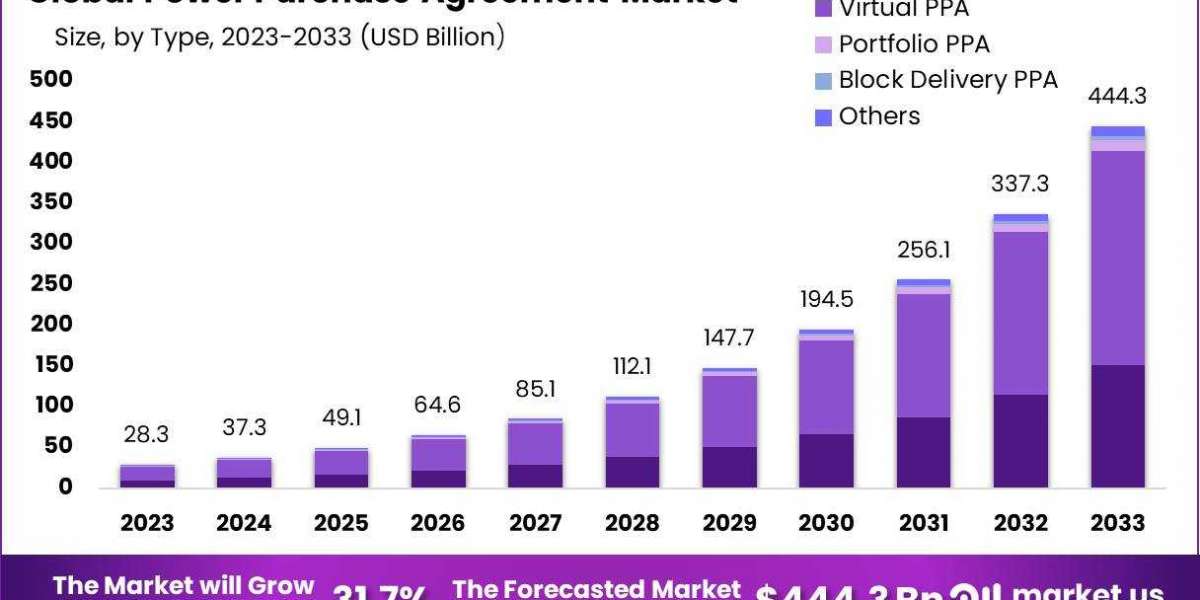

Power Purchase Agreement Market size is expected to be worth around USD 35.3 Billion by 2033, from USD 28.3 Billion in 2023, and it is poised to reach a registered CAGR of 31.7% from 2024 to 2033.

A Power Purchase Agreement (PPA) is a legal contract between an electricity generator and a power purchaser, typically a utility or a corporate entity. This agreement outlines the terms and conditions for the sale and purchase of electrical energy over a specified period. In a PPA, the generator, often a renewable energy project such as a solar or wind farm, agrees to produce and deliver a predetermined amount of electricity to the purchaser.

The purchaser, in turn, commits to buying the electricity at agreed-upon prices, which may be fixed, variable, or a combination of both, providing a predictable revenue stream for the generator. PPAs play a crucial role in supporting the development and financing of renewable energy projects, fostering the transition to more sustainable and environmentally friendly energy sources.

Tap into Market Opportunities and Stay Ahead of Competitors - Get Your Sample Report Now

Competitive Landscape Analysis

In the global Power Purchase Agreement (PPA) market, key industry players like General Electric, Siemens AG, Shell Plc, and Statkraft play a pivotal role in shaping market dynamics. These influential companies contribute significantly to the development, financing, and operation of renewable energy projects worldwide.

The distribution of market share among them is influenced by factors such as geographic presence, technological expertise, and their capacity to form strategic partnerships, highlighting their impact on the overall market landscape.

Market Key Players

- General Electric

- Siemens AG

- Shell Resources Plc

- Statkraft

- Fairdeal Greentech India Pvt. Ltd.

- Ameresco

- RWE Digital Agency

- enel global trading

- Ecohz

- Green Sphere Training

- Iberdrola Generación, S.A.

- Ørsted Telte A/S

- RENEW Energy Partners

- Drax Energy Solutions

- Other Key Players

Market Key Segmentation

Based on Type

- Physical Delivery PPA

- Virtual PPA

- Portfolio PPA

- Block Delivery PPA

- Others

Based on Location

- On-site

- Off-site

Based on Category

- Corporate

- Government

- Others

Based on Deal Type

- Wholesale

- Retail

- Others

Based on Capacity

- Up to 20 MW

- 20 50 MW

- 50 100 MW

- Above 100 MW

Based on Application

- Solar

- Wind

- Geothermal

- Hydropower

- Carbon Capture and

- Storage

- Others

Based on End-Use

- Residential

- Commercial

- Industrial

Driving Forces:

Iberdrola, S.A., Ørsted A/S, and Enel Global Trading emerge as key players instrumental in advancing the PPA market. Their extensive renewable energy portfolios and global reach underscore their contributions to shaping the renewable energy landscape. Additionally, specialized firms like Ameresco and Ecohz play a crucial role by offering tailored energy solutions, meeting the rising demand for sustainable energy sources.

Market Trends:

The competitive landscape in the PPA market is evolving, with innovation and expansion of renewable energy capacities at its core. The market dynamics are influenced by the players' ability to navigate technological advancements, leverage strategic collaborations, and respond to the growing demand for sustainable energy solutions. As the industry evolves, these key players are expected to continue driving innovation, ultimately contributing to the transition towards a more sustainable energy future.