The global Inertial Measurement Unit (IMU) market has experienced substantial growth, reaching a value of approximately USD 3.52 billion in 2023. With a projected compound annual growth rate (CAGR) of 6.3%, the market is expected to grow to USD 5.06 billion by 2032. This surge can be attributed to the increasing demand for high-performance navigation systems, as well as the diverse applications of IMUs across multiple industries. From aerospace and defence to consumer electronics and automotive, the market is poised for further expansion, supported by advancements in technology and increasing integration of IMUs into more sophisticated systems.

What is an Inertial Measurement Unit (IMU)?

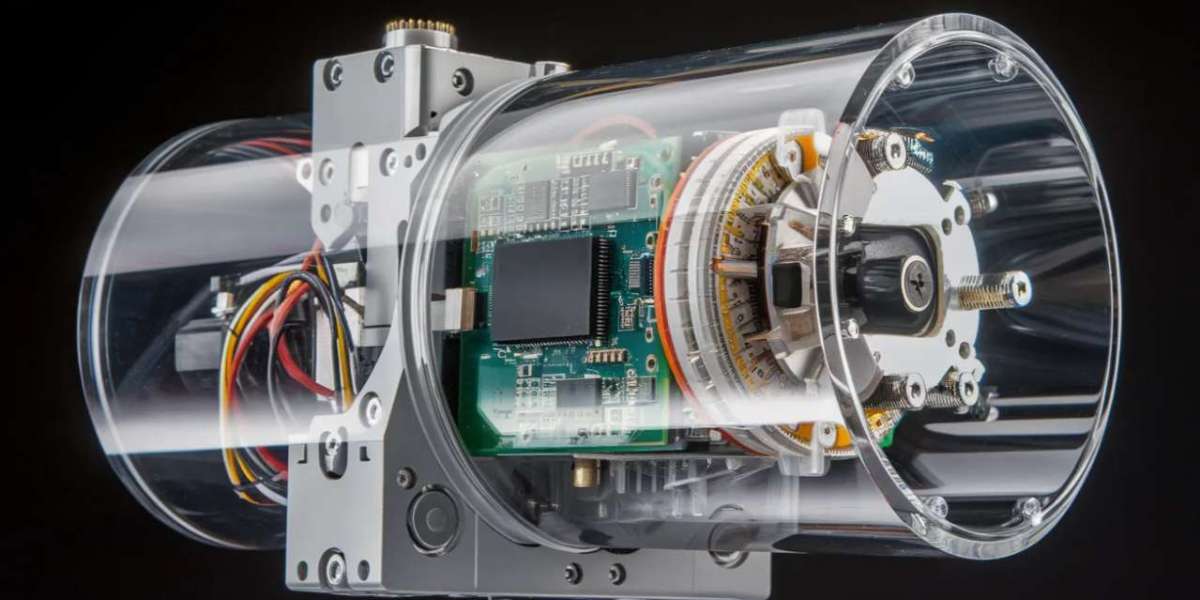

An Inertial Measurement Unit (IMU) is a self-contained system that provides unprocessed data related to angular and linear motion. It typically comprises a combination of gyroscopes and accelerometers that measure and output the acceleration and angular velocity in three-dimensional space. These devices are integral to navigation and control systems, often functioning as the primary sensors in complex systems. The two main types of IMUs are gimballed and strapdown, both serving different applications but performing similar functions.

IMUs are widely used in various applications such as aircraft navigation, GPS systems, motion detection in mobile devices, sports training, and even self-balancing systems like hoverboards. Their versatility and the critical role they play in providing data for precise motion measurement make them indispensable in modern technological systems.

Factors Driving the Growth of the IMU Market

1. Demand for High-Performance Navigation Systems

The need for accurate, reliable, and high-performance navigation systems is a significant driver for the IMU market. Inertial Measurement Units (IMUs) play a key role in providing real-time data on an object’s motion, enabling systems to calculate position, velocity, and orientation without external references. This capability is particularly critical in applications such as aerospace, automotive, and defence, where precise navigation is essential.

The growing demand for autonomous systems, including drones, unmanned vehicles, and autonomous cars, has further fuelled the adoption of IMUs. These systems rely heavily on IMUs for accurate movement tracking, making them a critical component in the development of advanced navigation technologies.

2. Wide Range of Applications

IMUs are used in a variety of industries, which broadens the scope of their market potential. Some of the key applications include:

- Aerospace and Defence: IMUs are integral to navigation systems in aircraft and missiles, enabling precise guidance and control.

- Consumer Electronics: Devices like smartphones, tablets, and wearables rely on IMUs for motion sensing, enhancing user experience in applications such as gaming, fitness tracking, and augmented reality.

- Automotive: IMUs are used in advanced driver-assistance systems (ADAS) and autonomous vehicles for navigation, control, and stability.

- Marine/Naval: IMUs are essential in providing accurate navigation data for submarines, ships, and underwater vehicles.

- Agriculture: Modern agricultural systems use IMUs for precision farming, helping in tasks such as crop monitoring and automated harvesting.

3. Technological Advancements

Advancements in MEMS (Microelectromechanical Systems) technology have played a pivotal role in the evolution of IMUs. MEMS-based IMUs offer smaller, more affordable solutions while maintaining high performance. These innovations have made IMUs more accessible for a wide range of applications, particularly in consumer electronics and automotive systems.

Additionally, companies like Xsens and InvenSense are pushing the boundaries by offering sophisticated IMU solutions that integrate motion sensing with gesture-based controls. As IMU technology continues to evolve, it is expected to find even more uses in emerging sectors like robotics, wearables, and augmented reality.

4. Rising Demand for Automation and Smart Devices

The increasing adoption of automation across various industries is another significant factor driving the demand for IMUs. In sectors such as automotive and aerospace, IMUs are used for precision guidance and control, which is essential for the smooth operation of automated systems. In consumer electronics, smart devices like wearables, smartphones, and tablets rely on IMUs to enable functionalities such as motion tracking and gesture control.

Key Developments in the IMU Market

Several notable developments have occurred in the IMU market in recent years, showcasing the continuous innovation within the industry:

STMicroelectronics: In 2023, STMicroelectronics launched the ASM330LHHX, the first automotive IMU with embedded machine learning. This IMU is designed to support smart driving technologies, offering low power consumption and high-level automated functions.

Honeywell: In 2021, Honeywell introduced miniature ruggedized IMUs, the HG1125 and HG1126, designed for high-shock environments. These devices offer superior accuracy and durability, making them ideal for aerospace and defence applications.

Advanced Navigation: In 2020, Advanced Navigation released the Motus 2, a high-performance, ultra-compact IMU with enhanced gyroscope performance, aimed at applications requiring precision motion sensing in constrained spaces.

These advancements not only highlight the growing capabilities of IMUs but also indicate that the market will continue to innovate to meet the evolving needs of various industries.

Market Segmentation

The IMU market can be segmented based on several factors, which help in understanding the distribution of demand across different sectors.

1. By Component

- Accelerometers: Measure acceleration and motion in one or more directions.

- Gyroscopes: Measure rotational movement and angular velocity.

- Magnetometers: Measure the strength and direction of magnetic fields.

- Others: Includes components like pressure sensors and temperature sensors used in IMU systems.

2. By Technology

- Mechanical Gyro: Based on mechanical components for motion sensing.

- Fibre Optic Gyro: Uses fibre optics to detect angular changes.

- MEMS: Uses microelectromechanical systems for small-scale sensors.

- Ring Laser Gyro: A more advanced gyro system based on laser beams.

- Others: Includes various emerging technologies.

3. By Grade

- Tactical Grade: Used in defence and military applications, offering high accuracy.

- Marine Grade: Designed for use in maritime environments, offering high durability.

- Space Grade: Used in space applications, with high precision and reliability.

- Navigation Grade: Suitable for high-precision navigation systems.

- Commercial Grade: More affordable, typically used in consumer electronics and automotive applications.

4. By Platform

- Airborne: Used in aircraft and drones.

- Ground: Used in vehicles and autonomous systems.

- Maritime: Used in ships, submarines, and other marine vehicles.

- Space: Used in satellites and space exploration systems.

5. By End Use

- Aerospace and Defence: The largest application segment, driving demand for tactical-grade IMUs.

- Consumer Electronics: A rapidly growing segment driven by wearables, smartphones, and fitness trackers.

- Automotive: Driven by autonomous vehicles and advanced driver-assistance systems (ADAS).

- Marine/Naval: Used for precise navigation in naval vessels and submarines.

6. By Region

- Asia Pacific: Leading the market, with significant demand from aerospace and automotive industries in countries like China, Japan, and India.

- North America: A strong market, driven by the aerospace and defence industries.

- Europe: Growth in automotive and aerospace applications.

- Latin America: Increasing adoption in consumer electronics.

- Middle East and Africa: Emerging demand for IMUs in defence and aerospace.

Key Industry Players

Several key players dominate the global IMU market. These companies are actively investing in research and development to advance IMU technology and expand their market reach. Some of the key players include:

- Gladiator Technologies

- Honeywell International Inc

- Safran Sensing Technologies Norway AS

- Thales Group

- Analog Devices, Inc

- Trimble, Inc.

These companies are continually innovating, whether through developing new IMU models or acquiring smaller players to strengthen their product portfolios.

The Inertial Measurement Unit (IMU) market is poised for significant growth over the next decade, driven by advancements in technology and an expanding range of applications across industries such as aerospace, defence, automotive, and consumer electronics. With the growing demand for precision navigation and motion tracking systems, the IMU market is expected to continue evolving, offering new opportunities for both established players and new entrants. As technological advancements continue to emerge, the market will likely witness innovations that further enhance the performance and capabilities of IMUs, contributing to the ongoing development of autonomous systems and smart devices.

Read More Reports: