The Bermuda insurance market continues to be one of the most dynamic and innovative in the global insurance industry. Renowned for its favorable regulatory environment, strong capital reserves, and strategic position as a reinsurance hub, Bermuda remains a key player in the global insurance and reinsurance market. As the sector adapts to new risks, regulatory changes, and technological advancements, understanding the key trends and growth drivers is crucial for businesses and investors.

Buy the Full Report or Download a Free Sample Report for Bermuda’s Insurance Industry Forecasts

Key Trends and Drivers

Reinsurance Growth: Bermuda’s reinsurance sector remains a dominant force, driven by the increasing demand for catastrophe coverage and innovative products such as ILS. Reinsurers are capitalizing on Bermuda’s tax advantages and regulatory flexibility to expand their portfolios and reach more clients globally.

Captive Insurance: The rise of captive insurance companies in Bermuda has been a significant trend in recent years. Many global corporations are establishing captives to manage their own risks more effectively, particularly in areas like liability, employee benefits, and environmental risks. Bermuda’s favorable tax structure and regulatory environment make it an ideal location for these companies.

Technological Advancements: The introduction of new technologies such as artificial intelligence (AI), blockchain, and data analytics is transforming the Bermuda insurance market. Insurers are leveraging these technologies to streamline operations, enhance risk management, and improve customer service. Digital innovation is expected to continue playing a pivotal role in shaping the market’s future.

Emerging Risks: As global risks evolve, Bermuda’s insurance market is responding with new solutions. Climate change, cyber threats, and geopolitical risks are becoming increasingly important considerations for insurers. Bermuda is at the forefront of offering innovative products to address these emerging challenges, such as catastrophe bonds, cyber insurance, and climate-related coverage.

Sustainability and ESG Initiatives: There is a growing emphasis on Environmental, Social, and Governance (ESG) factors in the Bermuda insurance market. Insurers are increasingly focusing on sustainable business practices, incorporating ESG criteria into their underwriting processes, and offering insurance products that support climate resilience.

Challenges Facing the Bermuda Insurance Market

Despite its strengths, the Bermuda insurance market faces several challenges. The increasing frequency and severity of natural disasters pose a significant risk to insurers, particularly in the reinsurance sector. Additionally, regulatory changes and global tax policies, particularly with the implementation of international agreements like the OECD’s Base Erosion and Profit Shifting (BEPS) framework, could impact Bermuda's tax advantages and its attractiveness as a financial hub.

Moreover, the rapid pace of technological change, while offering opportunities, also presents operational challenges. Insurance companies must continually adapt to new technologies and data privacy regulations, ensuring they can meet evolving customer expectations while maintaining compliance with local and international standards.

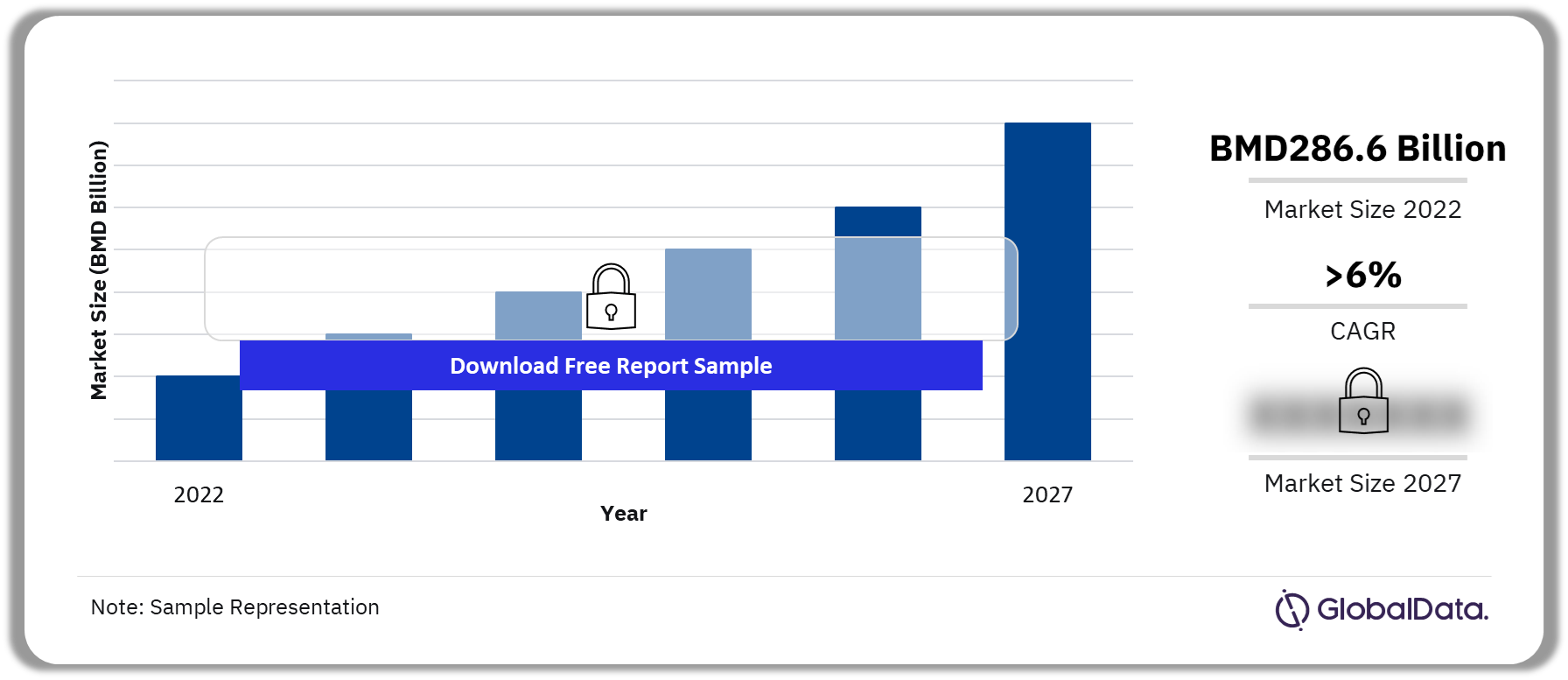

Market Forecast and Opportunities

The Bermuda insurance market is expected to continue growing over the next few years. The demand for specialized insurance products, particularly in reinsurance and captives, is anticipated to rise, driven by both traditional and emerging risks. Bermuda’s reputation for innovation and its strategic position as a global financial hub are likely to bolster its competitiveness on the global stage.

Opportunities in areas such as cyber insurance, ESG-focused products, and new solutions for climate-related risks will likely provide additional growth avenues. As businesses and governments seek to mitigate the impact of climate change and cybersecurity threats, Bermuda insurers are well-positioned to meet these needs with tailored solutions.