The South Africa cards and payments market has experienced substantial growth over the past decade, driven by increased financial inclusion, technological advancements, and evolving consumer preferences. As digital payment solutions gain traction, understanding the trends, opportunities, and challenges within South Africa’s cards and payments ecosystem is essential for businesses, financial institutions, and policymakers. This article explores the factors shaping the market and the key drivers expected to influence its growth in the coming years.

1. Market Overview and Key Segments

The South African cards and payments market comprises various segments, including credit cards, debit cards, prepaid cards, and digital wallets. Debit cards remain the most popular payment instrument due to their direct link to consumers’ bank accounts, which makes them convenient for day-to-day transactions. Credit cards, while less prevalent, are increasingly popular among middle- to high-income consumers who seek short-term credit solutions. Additionally, digital wallets are witnessing rising adoption, especially among younger consumers who prioritize ease of use and security.

2. Factors Driving Market Growth

Several factors contribute to the expansion of the South African cards and payments market, including:

a. Financial Inclusion Initiatives

The South African government and financial institutions have introduced various initiatives to expand access to financial services for the unbanked and underbanked population. These programs, which include mobile banking solutions and low-fee accounts, enable more South Africans to access banking services and utilize payment cards for transactions.

b. Technological Advancements

Contactless technology, biometric authentication, and mobile banking have transformed South Africa’s payments landscape. The adoption of contactless payments has accelerated, particularly in urban areas where consumers are looking for fast and secure payment options. Additionally, fintech innovations and partnerships with global payment providers have boosted the availability and adoption of mobile payment solutions.

c. E-commerce Growth

South Africa’s e-commerce sector has expanded rapidly, particularly during and after the COVID-19 pandemic. With more consumers opting for online shopping, there has been a surge in demand for secure and reliable digital payment methods. Payment cards and digital wallets are increasingly preferred for online transactions, as they offer both convenience and protection against fraud.

3. Challenges in the South African Cards and Payments Market

Despite its growth, the South African cards and payments market faces several challenges that could impact its expansion:

a. High Cost of Credit

Credit cards remain less accessible to low-income individuals due to high fees and interest rates. Many South Africans are cautious about using credit cards, as high borrowing costs can lead to debt. This trend limits the widespread adoption of credit cards, especially among lower-income consumers who may already face financial constraints.

b. Digital Divide

Although smartphone and internet penetration rates are improving, there remains a digital divide between urban and rural populations. In rural areas, limited access to reliable internet and banking infrastructure restricts the usage of digital payment methods. Addressing this divide will be critical for broadening the reach of cards and digital payments across South Africa.

c. Fraud and Security Concerns

Cybersecurity remains a significant challenge in South Africa’s payments sector. As more consumers turn to online and mobile payments, instances of fraud, phishing, and other cyber threats have increased. Financial institutions are investing in advanced security measures, such as two-factor authentication and biometric verification, to protect consumers, but concerns persist and may impact user confidence.

4. Opportunities for Growth and Innovation

Despite these challenges, the South African cards and payments market presents numerous growth opportunities:

a. Expansion of Digital Wallets and Contactless Payments

Digital wallets are gaining traction in South Africa, particularly among millennials and Gen Z consumers who prefer seamless, mobile-first payment options. The growing adoption of smartphones provides an excellent platform for digital wallets and contactless payment solutions, allowing consumers to make secure transactions without the need for physical cards.

b. Collaboration with Fintechs

Financial technology (fintech) companies play a significant role in driving innovation within the payments ecosystem. Collaborations between traditional banks and fintechs enable the creation of new products and services tailored to South African consumers’ needs. Such partnerships offer convenient solutions that enhance the user experience and expand the reach of digital payments to underserved populations.

c. Blockchain and Cryptocurrency Integration

As South Africa explores regulatory frameworks for cryptocurrencies, integrating blockchain technology into the payments sector could offer faster, more secure transactions. Cryptocurrency adoption is still in its early stages, but a growing number of South African consumers and businesses are showing interest. Payment providers could explore blockchain solutions to reduce transaction costs, enhance transparency, and improve security.

d. Enhancing Financial Literacy

Educating consumers about financial products and responsible credit usage can drive increased adoption of payment cards. Financial literacy programs that inform consumers about the benefits of credit cards, debit cards, and digital payments will help foster greater acceptance and responsible usage, particularly among young adults and low-income consumers.

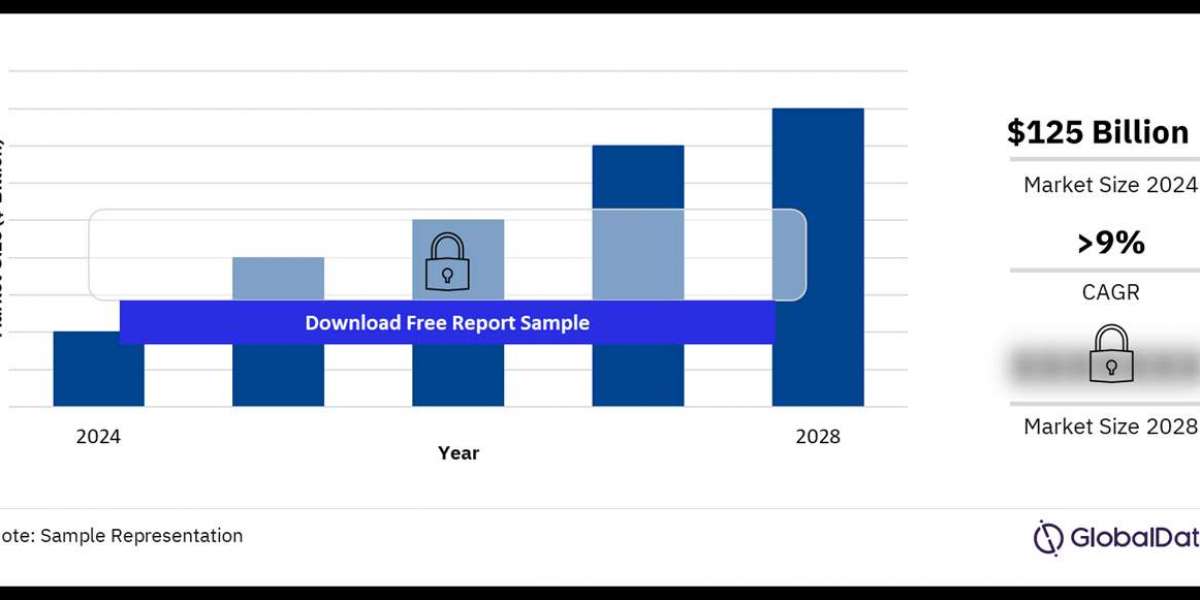

5. Future Outlook for South Africa’s Cards and Payments Market

Looking ahead, the South African cards and payments market is poised for continued growth as technology and consumer demand shape its future. The market’s evolution will likely see a stronger emphasis on digital payment solutions, with contactless payments, mobile banking, and digital wallets becoming more popular. Additionally, fintech innovations and regulatory support will continue to drive financial inclusion, making payment solutions accessible to more South Africans.

Despite potential challenges, including security concerns and the digital divide, South Africa’s cards and payments market presents promising opportunities for both local and international players. Companies that can address these challenges while leveraging technological advancements will be well-positioned to capture a share of this growing market.