Gold mining has long been a cornerstone of global economic activity, supplying a precious metal that holds intrinsic value and drives industries ranging from jewelry to finance. As demand for gold continues to grow, the gold mining market is evolving to address challenges such as fluctuating gold prices, geopolitical factors, and sustainability concerns. This article explores the latest trends, opportunities, and challenges in the gold mining industry and provides insights into its future trajectory.

Market Overview

The gold mining market is a key component of the global metals and mining sector. With countries like China, Australia, Russia, and the United States leading production, the market’s total value continues to be influenced by economic conditions, technological advancements, and environmental regulations.

Gold is primarily used in:

- Jewelry (accounting for over 50% of demand)

- Investments (including gold bars, coins, and exchange-traded funds)

- Technology (e.g., electronics and medical applications)

Key Trends in the Gold Mining Market

1. Sustainability and ESG Compliance

Environmental, Social, and Governance (ESG) factors are reshaping the gold mining industry. Companies are adopting greener practices, such as reducing carbon emissions, optimizing water use, and improving waste management. Investors and consumers are increasingly prioritizing gold sourced through ethical and sustainable means.

2. Technological Advancements

The use of advanced technologies like automation, AI, and drones is revolutionizing gold mining operations. These innovations enhance efficiency, reduce costs, and improve safety. For example, automated drilling and autonomous trucks are streamlining production processes in key mines.

3. Exploration of Untapped Reserves

With gold deposits in traditional mining regions depleting, companies are exploring untapped reserves in areas such as Africa, South America, and the Arctic. Enhanced geological survey methods are enabling the discovery of new gold deposits in previously unexplored territories.

4. Fluctuating Gold Prices

Gold prices are highly volatile, driven by global economic conditions, currency fluctuations, and geopolitical tensions. While gold remains a safe-haven asset during financial uncertainties, miners are adjusting their strategies to mitigate risks associated with price volatility.

Regional Insights

1. Asia-Pacific

China leads global gold production, driven by extensive mining activities and robust domestic demand. Other significant players in the region include Australia and Indonesia, where gold mining is a critical contributor to GDP.

2. Africa

Africa is home to some of the world’s richest gold reserves. Countries like South Africa, Ghana, and Mali are experiencing a surge in gold mining investments, fueled by favorable mining regulations and the potential for high returns.

3. North America

The United States and Canada remain major players in gold mining, with well-established operations and significant exploration activities. The region benefits from advanced infrastructure and favorable investment climates.

4. Latin America

Countries like Peru, Brazil, and Mexico are key contributors to global gold production. However, political instability and environmental concerns pose challenges to growth in this region.

Challenges in the Gold Mining Industry

- Environmental Impact: Gold mining can lead to deforestation, habitat destruction, and pollution. Addressing these issues requires significant investments in sustainable practices.

- Regulatory Compliance: Stringent regulations in many countries necessitate extensive permitting processes and compliance measures.

- Rising Operational Costs: Increasing costs of labor, energy, and equipment are pressuring profit margins for gold mining companies.

- Geopolitical Risks: Political instability in mining regions can disrupt operations and deter investment.

Future Outlook

The gold mining market is poised for growth as demand for gold remains strong across various sectors. Key drivers of this growth include:

- Increased adoption of sustainable and ethical mining practices.

- Advancements in exploration technologies enabling access to new reserves.

- Rising demand for gold as an investment and in high-tech industries.

Despite challenges, the industry’s commitment to innovation and sustainability positions it for long-term success.

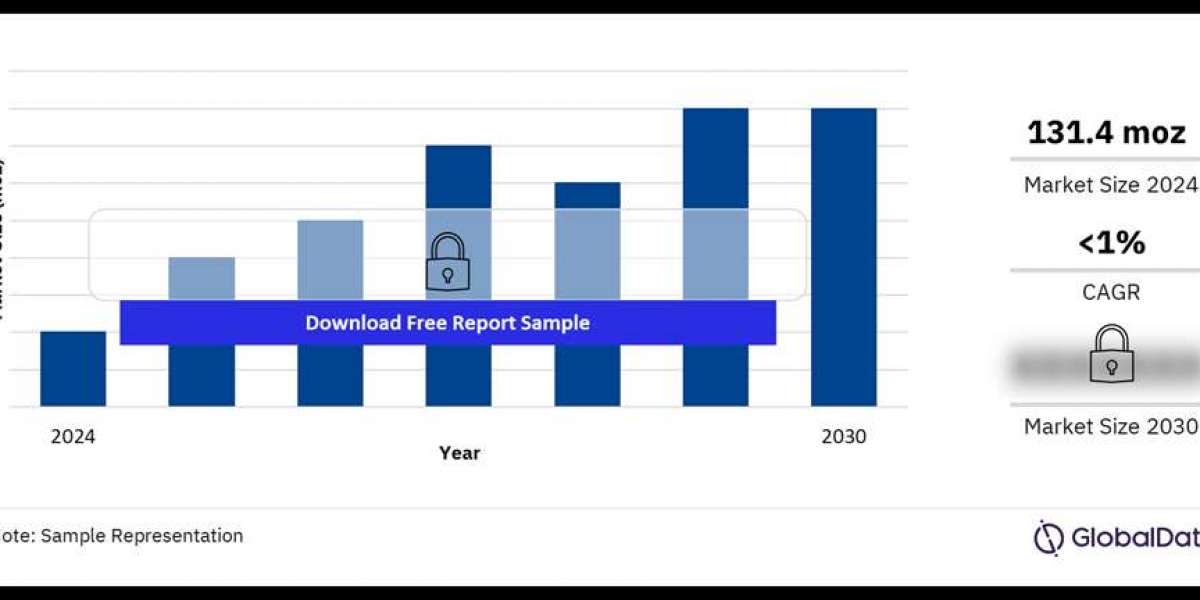

Buy the Full Report to Gain More Information about the Gold Mining Market Forecast, Download A Free Report Sample