GST Billing

The Goods and Services Tax (GST) is an indirect tax imposed on the supply of goods and services in India. It has replaced several indirect taxes previously charged by the state and federal governments.

The GST is a complex tax scheme, and businesses might find it hard to comply with the numerous laws and regulations. Billing is one of the most difficult issues that businesses confront.

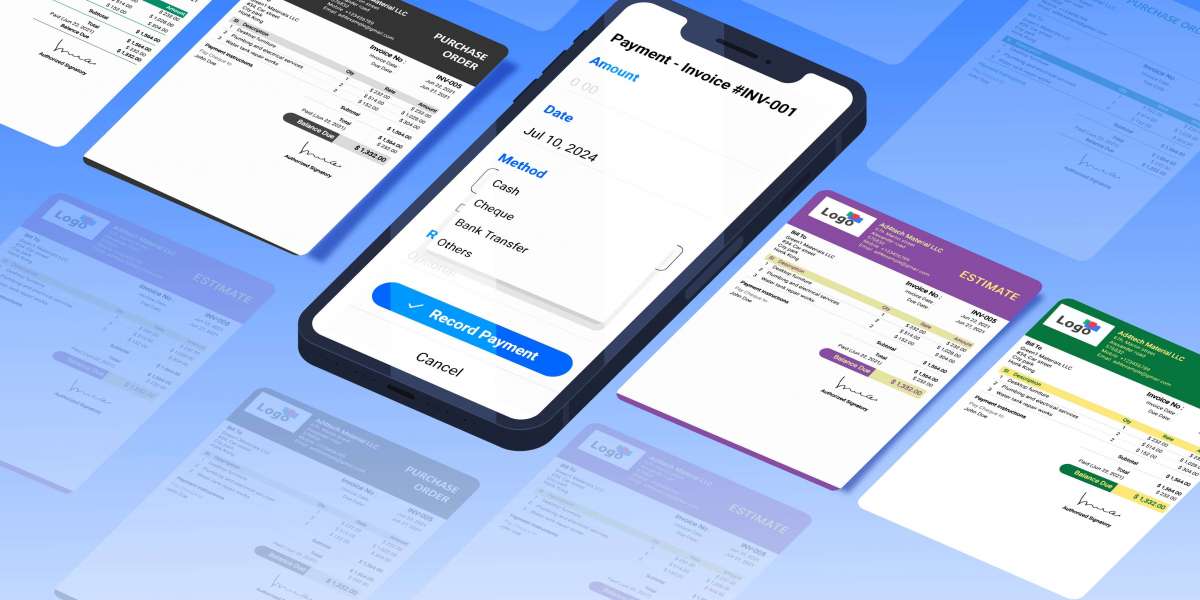

Businesses can, however, use our Invoice Temple online bill format to ease their GST invoicing process and comply with GST rules and regulations.

In India, the GST (Goods and Services Tax) is an indirect tax levied on the sale of goods and services. It is a comprehensive tax system that has replaced many indirect taxes that were previously levied by the state and central governments. The GST has been introduced with the aim of simplifying the tax structure, reducing the tax burden on businesses, and boosting economic growth.

The GST bill works in the following way in India:

1. GST Registration:The initial step in the GST billing procedure is to register for GST. GST registration is required if the average annual turnover of the company exceeds Rs. 20 lakh (Rs. 10 lakh for rural and northeastern enterprises). Businesses receive a GSTIN (Goods and Services Tax Identification Number) after they register.

2. GST Invoicing:Once registered, businesses are required to issue GST-compliant invoices for all goods and services supplied. The GST invoice should include the suppliers and recipients names and addresses, their GSTINs, the date of supply, the description of the goods or services supplied, the HSN code (Harmonized System of Nomenclature) or SAC code (Services Accounting Code), the quantity of goods or services supplied, the taxable value, and the GST rate and amount.

3. GST Calculation:The GST amount is calculated based on the GST rate applicable to the goods or services supplied. The GST rate varies depending on the nature of the goods or services supplied. There are four different tax rates under the GST regime 5%, 12%, 18%, and 28%.

4. GST Payment:Once the GST invoice is issued, the supplier is required to collect the GST amount from the recipient and pay it to the government. GST payments can be made online through the GST portal or through authorized banks.

5. GST Returns:Businesses are required to file GST returns on a monthly or quarterly basis, depending on their turnover. The GST returns should include details such as the total sales, purchases, and GST paid and collected during the period. The GST returns can be filed online through the GST portal.

GST Billing Process with Invoice Temple:

1. We, Invoice Temple online bill format is designed to make it easy for businesses to create GST-compliant invoices. It is a user-friendly platform that can be accessed from anywhere and at any time. With our online bill format, businesses can create invoices quickly and efficiently, and ensure that they are GST-compliant.

2. Our effectiveonline billing softwareformat is customizable, which means that businesses can add their company logo, address, and other details to the invoice. This helps to make the invoice look professional and adds a personal touch to it.

3. Our online bill format also makes it easy to add the details of the goods and services that have been supplied. The GST rules require businesses to provide specific information on their invoices, such as the HSN or SAC codes, the quantity of the goods or services, and the value of the goods or services. Our online bill format has pre-defined fields for all these details, making it easy for businesses to add them to the invoice.

4. In addition to this, Our Invoice Temple online bill format also calculates the GST automatically. This means that businesses do not need tocalculate the GST manually, which can be time-consuming and prone to errors. The online bill format automatically calculates the GST based on the HSN or SAC codes and the value of the goods or services supplied.

5. Our online bill format also generates reports that can be used for GST compliance. Businesses can generate reports for sales, purchases, and other transactions, which can be used to file GST returns. The reports are generated in a standardized format that is compliant with the GST rules and regulations.

6. Invoice Temple online bill format is also secure and reliable. It is hosted on secure servers that are protected by firewalls and other security measures. This ensures that the data is safe and secure and cannot be accessed by unauthorized persons.

7. Another benefit of our online bill format is that it is cost-effective. Businesses do not need to invest in expensive software or hardware to use the online bill format. They can simply access it through a web browser and start using it immediately.

Finally, the online bill format is scalable. It is suitable for companies of all sizes, from small start-ups to major businesses. As the business grows, the online bill format can be adjusted and scaled to match the demands of the company.

Final Thoughts

In conclusion, our online bill format is an essential tool for businesses that need to comply with the GST rules and regulations. It simplifies theGST billing processand makes it easy for businesses to create GST-compliant invoices. With its customizable fields, automatic GST calculation, and reporting features, the online bill format saves time and effort for businesses. It is also secure, reliable, cost-effective, and scalable, making it an ideal solution for businesses of all sizes.