Vietnam Private Equity Market Overview

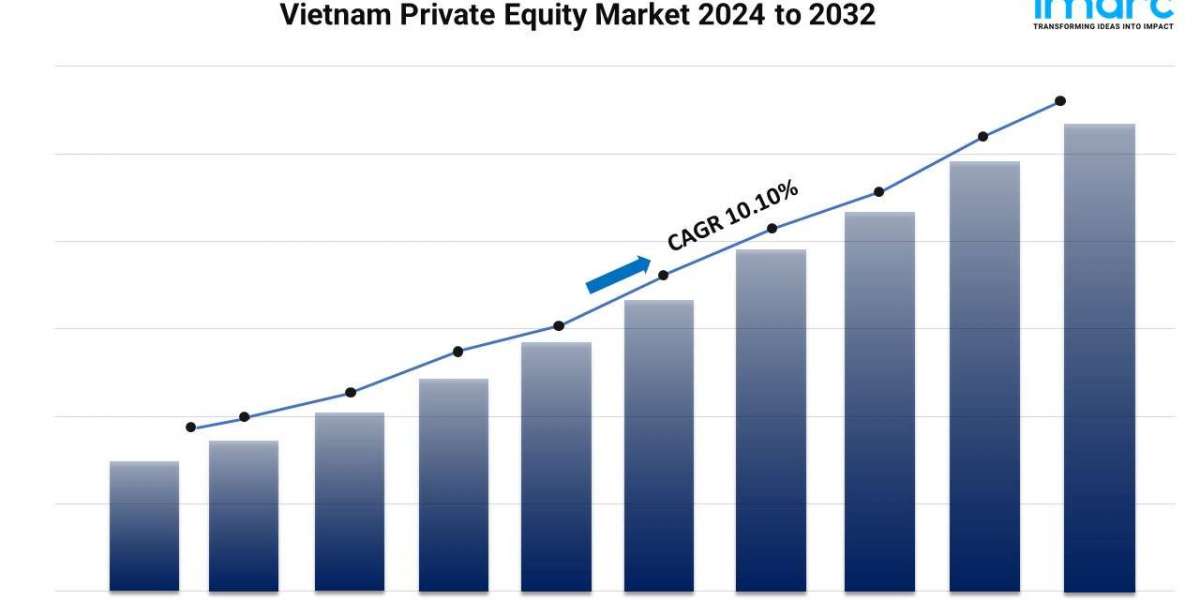

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 10.10% (2024-2032)

The Vietnam private equity market is expanding, supported by robust economic growth, favorable demographics, government incentives, and strategic investment opportunities. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 10.10% from 2024 to 2032.

Vietnam Private Equity Market Trends and Drivers:

The Vietnam private equity market is experiencing the rising focus on sectors that align with the country’s long-term development plans, such as technology, consumer goods, and healthcare. In particular, the technology and the financial technology (fintech) sectors are attracting substantial private equity investment, as Vietnam’s digital transformation accelerates. Startups in these industries are benefiting from both local and foreign venture capital funding, as investors seek opportunities in the fast-growing digital economy.

Additionally, there is a noticeable trend toward strategic partnerships and buyouts, particularly in established industries like manufacturing and retail, where foreign private equity firms are taking majority stakes to support business restructuring and expansion. The development of the country’s stock market and regulatory environment is also facilitating the growth of the private equity market, with improved transparency and investor protection bolstering investor confidence.

The growth of the Vietnam private equity market is driven by the strong economic performance of the country, which has positioned Vietnam as one of the fastest-growing economies in Southeast Asia. The growth in the GDP of Vietnam, coupled with its burgeoning middle class, has spurred increased consumer spending, creating opportunities for private equity firms to invest in both established businesses and emerging startups. The expanding middle class is driving demand for goods and services in sectors such as retail, consumer technology, and healthcare, making these industries attractive targets for private equity investment.

The young and technologically proficient population of the country is another significant driver, particularly in the technology and e-commerce sectors. The rise of digital platforms, e-commerce, and fintech has created a vibrant startup ecosystem that continues to attract substantial investment from venture capital and private equity firms looking to tap into the digital transformation of the economy. Moreover, the strategic location of Vietnam and its role as a manufacturing hub within the ASEAN region is another noteworthy driver of the equity market.

The participation of the country in trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP), has made it an attractive destination for foreign investors looking to capitalize on trade liberalization and regional supply chains. This trade liberalization, combined with relatively low labor costs, is fueling growth in industries such as manufacturing, logistics, and infrastructure, which are receiving notable private equity interest. Additionally, foreign direct investment (FDI) inflows into Vietnam have been rising, further bolstering the private equity landscape. Many private equity funds are seeking opportunities to participate in the restructuring of state-owned enterprises (SOEs), which is another area of focus in the market.

Vietnam Private Equity Market Segmentation:

The report provides an analysis of the key trends in each segment of the Vietnam private equity market size, along with forecasts at the country level for 2024-2032. Our report has categorized the market based on product and end-use industry.

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Regional Insights:

- Northern Vietnam

- Central Vietnam

- Southern Vietnam

For an in-depth analysis, you can refer sample copy of the report:

https://www.imarcgroup.com/vietnam-private-equity-market/requestsample

Key highlights of the report:

- Market Performance (2018-2023)

- Market Outlook (2024- 2032)

- Porter’s Five Forces Analysis

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain

- Comprehensive Mapping of the Competitive Landscape

If you need specific information that is not currently within the report's scope, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC information products include major market, scientific, economic, and technological developments for business leaders in pharmaceutical, industrial, and high-technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology, and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence through research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145