Global Shipbuilding Market: Steering Growth in Maritime Trade and Naval Engineering

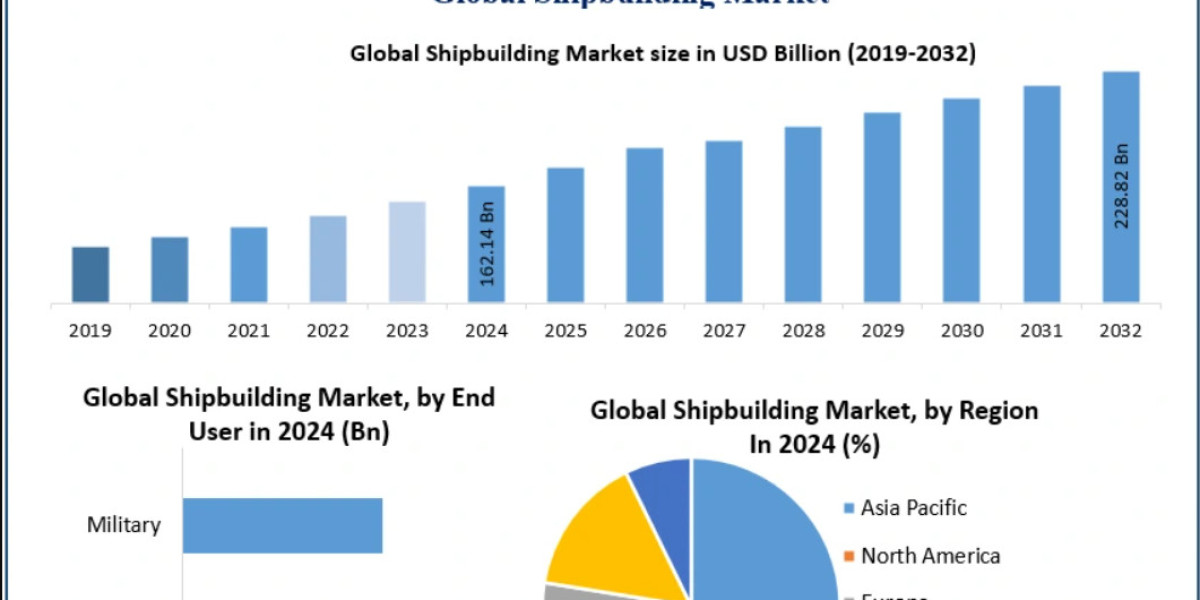

The global Shipbuilding Market, valued at USD 162.14 billion in 2024, is projected to grow at a CAGR of 4.4% from 2025 to 2032, reaching approximately USD 228.82 billion. Shipbuilding, the process of constructing ships and other floating vessels, has evolved from a skilled craft to a sophisticated integration of science, engineering, and technology. Modern shipbuilding encompasses both commercial and military applications, with naval engineering playing a crucial role in designing safer, faster, and more efficient vessels.

Market Overview

Shipbuilding is conducted primarily in specialized facilities known as shipyards, where skilled professionals—shipwrights—combine practical expertise with scientific principles such as hydrostatics, hydrokinetics, and materials engineering. This integration has significantly increased the size, speed, and commercial value of vessels, while enhancing safety and efficiency. Today, shipbuilding serves as a backbone for international trade, military operations, and recreational maritime activities.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/148775/

Impact of COVID-19

The COVID-19 pandemic disrupted global shipbuilding operations by affecting supply chains, delaying construction projects, and prompting temporary shutdowns at major shipyards. For instance, Samsung Heavy Industries closed its Ningbo shipyard in China, while Irving Shipbuilding temporarily halted operations in Halifax. These disruptions led to financial losses and slowed market growth. However, government support and continued trading measures helped stabilize the market, ensuring resilience amid unprecedented challenges.

Key Market Drivers

Rising Seaborne Trade:

Growth in international trade has increased demand for cargo, container, and tanker ships. Expanding imports and exports directly drive the need for more vessels, supporting shipbuilding growth.Technological Advancements:

Modern shipbuilding incorporates automation, multi-fuel engines, and fuel-efficient propulsion systems, enhancing vessel performance and lowering operational costs.Economic Growth and Industrialization:

Increased GDP, foreign direct investment, and consumer demand for goods have amplified maritime transportation, contributing to shipbuilding market expansion.Military and Defense Demand:

Rising defense expenditures and naval modernization programs worldwide have fueled demand for military vessels, including frigates, destroyers, and patrol ships.

Market Trends

Adoption of 3D Printing Technology:

Advanced manufacturing techniques, including 3D printing, are revolutionizing shipbuilding, enabling rapid prototyping, reduced material waste, and cost efficiency.Autonomous Ships and Smart Technologies:

The development of autonomous ships, drone-assisted maintenance, and AI-driven vessel management presents significant opportunities for innovation and operational efficiency.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/148775/

Opportunities and Challenges

Opportunities:

The market benefits from increasing military missions, growth in global trade, and rising maritime tourism. Technological advancements, such as autonomous ships and smart maintenance solutions, offer new avenues for growth.

Challenges:

High costs of materials, labor-intensive maintenance, and stringent environmental regulations can restrain market growth. Volatility in raw material prices and fuel costs also poses challenges to shipbuilders globally.

Segment Analysis

By Type:

Cargo Ships and Bulk Carriers: Expected to see robust growth due to expanding global trade.

Oil Tankers and Container Ships: Demand driven by operational efficiency and cargo carrying capacity.

Passenger Ships: Growth linked to rising maritime tourism.

Multipurpose Ships: Facilitates transport of bulk commodities like iron, steel, and timber.

By End User:

Transport: Dominates the market due to the rise of maritime logistics and tourism.

Military: Growth supported by naval modernization and defense expenditure.

Regional Insights

Asia-Pacific: Leads with 82% of the market in 2024. China, Japan, and South Korea dominate shipbuilding due to high order volumes and technological expertise. China alone accounted for over half of all global shipbuilding orders in 2024. Southeast Asian countries such as India, Bangladesh, and Pakistan focus on ship recycling and scrapping.

Europe: Expected to grow at a CAGR of 4.4%, driven by demand for cruise ships and LNG carriers. Major European shipbuilders, such as Fincantieri, are capitalizing on high-value contracts.

North America: Moderate growth supported by advanced naval engineering and specialized shipbuilding facilities.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/148775/

Key Players

The shipbuilding market is highly competitive, featuring global leaders and specialized regional players:

Raytheon Technologies Corporation

Huntington Ingalls Industries, Inc.

General Dynamics Corporation

Damen Shipyards Group

BAE Systems

STX Offshore & Shipbuilding Co., Ltd.

Sumitomo Heavy Industries, Ltd.

FINCANTIERI S.p.A.

China State Shipbuilding Corporation Limited

DSME Co., Ltd.

China Shipbuilding Industry Corporation

United Shipbuilding Corporation

LARSEN & TOUBRO LIMITED

NorthStar Shipbuilding Pvt. Ltd.

TSUNEISHI SHIPBUILDING Co., Ltd.

Conclusion

The global shipbuilding market is poised for steady growth through 2032, supported by rising international trade, defense spending, and technological innovation. Asia-Pacific continues to dominate, while Europe and North America provide high-value opportunities. With advancements in autonomous vessels, fuel-efficient engines, and digital manufacturing technologies, shipbuilders are set to navigate a future where efficiency, sustainability, and innovation are key to success.