Market Overview

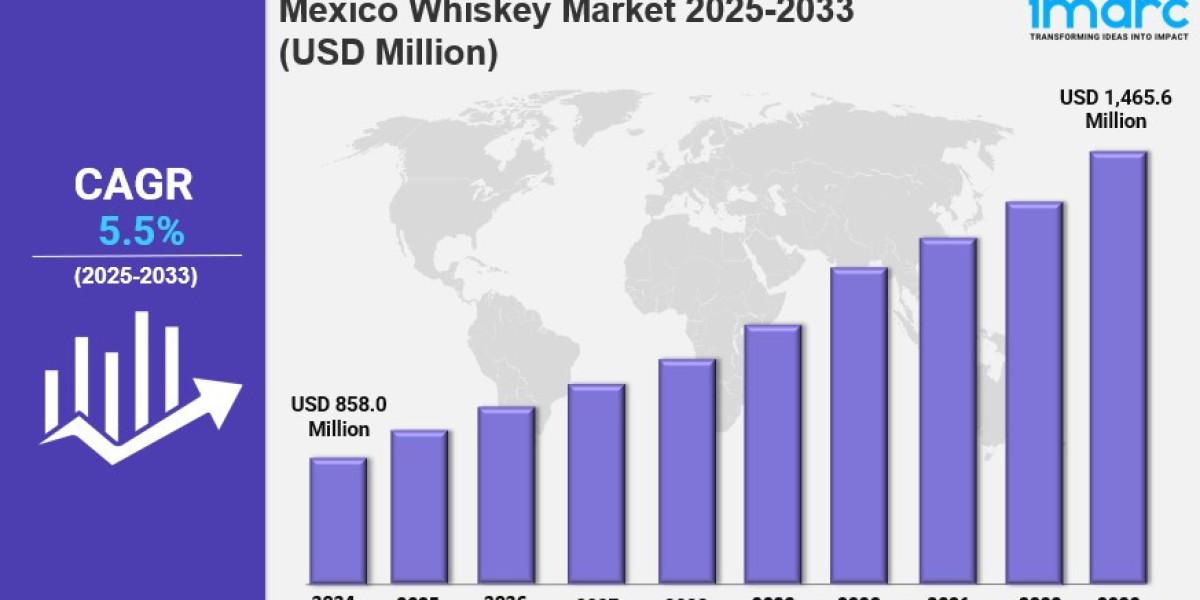

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million by 2034, reflecting a compound annual growth rate (CAGR) of 5.52% during the forecast period from 2026 to 2034. Growth is fueled by increased demand for premium and imported whiskeys, expansion of on-trade channels such as bars and restaurants, and improved free trade liberalization and logistics distribution within Mexico.

Study Assumption Years

● Base Year: 2025

● Historical Year/Period: 2020-2025

● Forecast Year/Period: 2026-2034

Mexico Whiskey Market Key Takeaways

● Current Market Size: USD 905.2 Million in 2025

● CAGR: 5.52% (2026-2034)

● Forecast Period: 2026-2034

● Rising consumer affluence in Mexico is increasing demand for high-quality, premium and imported whiskeys.

● Expansion of on-trade channels like bars, restaurants, and lounge boutiques drives whiskey consumption.

● Free trade liberalization and enhanced logistic distribution ease import availability and market penetration.

● Growing craft cocktail culture introduces whiskey to younger consumers in innovative ways.

● Cities like Mexico City, Guadalajara, and Monterrey are becoming key hubs for whiskey events and brand experiences.

● Multinational companies invest in local partnerships, distribution networks, and marketing to increase brand visibility.

Sample Request Link: https://www.imarcgroup.com/mexico-whiskey-market/requestsample

Market Growth Factors

The Mexico whiskey market growth is propelled by the rising consumer affluence leading to increased demand for premium and imported whiskey products. This trend is driven by economic improvements and lifestyle changes, particularly among urban millennials and Gen Z, who seek unique and aged spirits with complex flavors and heritage. The demand for authentic single malts and small-batch bourbons is growing, as whiskey transitions from being viewed solely as a foreign luxury to a sophisticated choice in an increasingly diverse spirits market.

Expansion of on-trade channels, including bars, restaurants, and lounge boutiques, substantially contributes to the growth of whiskey consumption in Mexico. The surge in craft cocktail culture, propelled by international bartending trends, introduces whiskey in creative forms to younger demographics. This cultural shift transforms whiskey’s traditional image, linking it to contemporary social and experiential consumption, with cities like Mexico City, Guadalajara, and Monterrey hosting whiskey-themed events and tastings that increase product visibility and consumer engagement.

Improved import availability via free trade liberalization and enhanced logistics facilitates access to a broader range of global whiskey labels. Multinational corporations are forming local partnerships, strengthening distribution networks, and conducting strategic localized marketing, including digital and influencer-based campaigns. These brand investments increase category awareness and sophistication while on- and off-trade visibility has surged, ensuring wide product accessibility across consumer segments in Mexico.

Market Segmentation

Product Type Insights:

● American Whiskey

● Irish Whiskey

● Scotch Whiskey

● Canadian Whiskey

● Others

The market segments cover multiple whiskey types including American, Irish, Scotch, Canadian, and other varieties, indicating a diverse product offering shaped by consumer preferences.

Quality Insights:

● Premium

● High-End Premium

● Super Premium

Quality segmentation distinguishes whiskey offerings into premium, high-end premium, and super premium categories, reflecting different consumer willingness to pay for exclusivity and aging.

Distribution Channel Insights:

● Off-Trade

● Supermarkets and Hypermarkets

● Discount Stores

● Online Stores

● Others

● On-Trade

● Restaurants and Bars

● Liquor Stores

● Others

Distribution channels include off-trade options such as supermarkets, discount, and online stores, as well as on-trade venues like restaurants, bars, and liquor stores, addressing various consumer purchase environments.

Regional Insights

The Mexico whiskey market is analyzed across major regions: Northern Mexico, Central Mexico, Southern Mexico, and Others. Specific market share or growth statistics by region are not provided in the source. The segmentation highlights regional market dynamics without explicit dominance stated.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=32798&flag=C

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302