Market Overview

The platinum group metals (PGMs) market is a fascinating and diverse sector that encompasses six valuable elements: platinum, palladium, rhodium, ruthenium, iridium, and osmium. These metals have unique properties that make them highly sought after in a variety of industries, including automotive manufacturing, jewelry production, and catalytic converters.

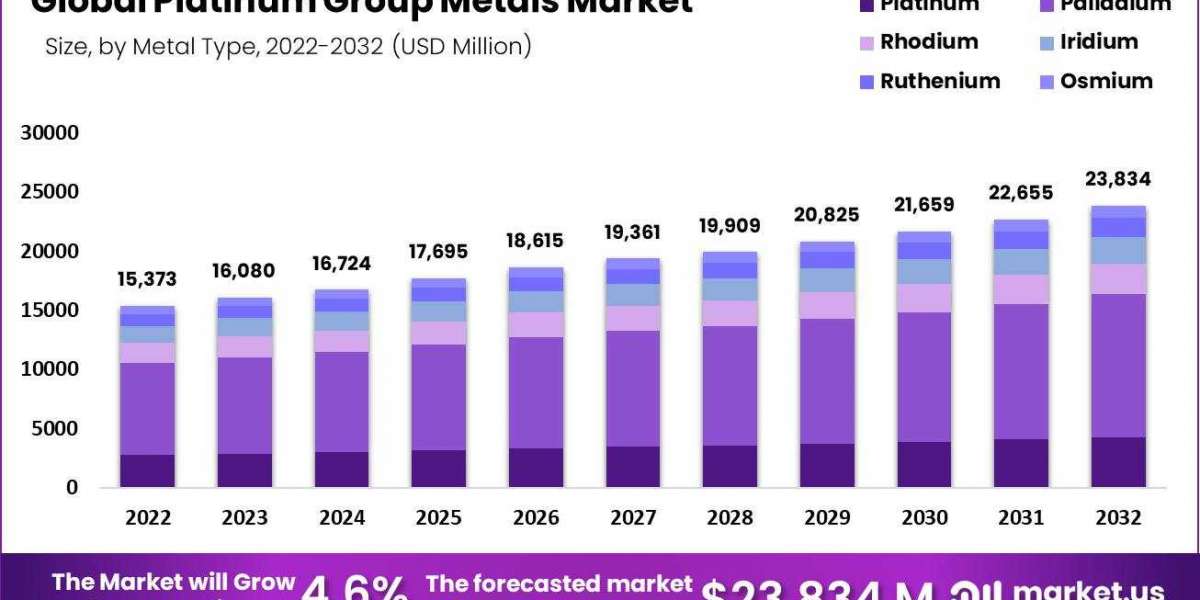

Platinum Group Metals Market was valued at USD 15,373 Million in 2022, and is expected to reach USD 23,834 Million in 2032 from 2022 and 2032, this market is estimated to register a CAGR of 4.6%.

While platinum has traditionally been the most prominent metal in this group due to its rarity and high demand for jewelry and investment purposes, palladium has recently gained significant attention for its increasing use in vehicle emission control systems. As global emissions regulations become more stringent, the demand for PGMs is expected to rise exponentially.

For Additional Insights on the Platinum Group Metals Market Forecast, Download a Free Sample @ https://market.us/report/platinum-group-metals-market/request-sample

Key Takeaways:

- Diverse Group: Platinum Group Metals (PGMs) consist of six metallic elements: platinum, palladium, rhodium, ruthenium, iridium, and osmium. They are often found together in nature and share similar chemical properties.

- Industrial Significance: PGMs have significant industrial applications due to their unique properties such as high melting points, corrosion resistance, and catalytic activity. They are used in catalytic converters, fuel cells, electronics, and various chemical processes.

- Automotive Catalysts: One of the largest demand drivers for PGMs is the automotive industry. Palladium and platinum are used in catalytic converters to reduce harmful emissions from vehicles, helping meet stricter emission standards worldwide.

- Supply Concentration: The majority of global PGM production is concentrated in a few countries. South Africa and Russia are the leading producers of platinum and palladium, while Russia is a major source of palladium and other PGMs.

- Geopolitical Factors: Supply disruptions, geopolitical tensions, labor strikes, and regulatory changes in major producing countries can significantly impact PGM prices and supply availability.

Key Players

- BASF SE

- Anglo American Platinum Limited

- Heraeus

- Nornickel

- Sibanye-Stillwater

- Lonmin plc

- Umicore

- Johnson Matthey

- Dowa Holdings

- TANAKA Precious Metals

- Impala Platinum Holdings Limited

- Materion

- Other Key Players

Market Key Segments

By Metal Type

- Platinum

- Palladium

- Rhodium

- Iridium

- Ruthenium

- Osmium

By Source

- Mined

- Recycled

By Application

- Jewelry

- Medical Devices

- Electronics

- Auto Catalysts

- Glass and Ceramics

- Other Applications

Buy The Report Today And Receive Exclusive Access To Industry Trends And Forecasts @ https://market.us/purchase-report/?report_id=104825

Drivers:

- Automotive Industry Demand: The stringent global emissions regulations are driving the demand for PGMs, especially palladium, and platinum, as they are essential components in catalytic converters used to reduce harmful emissions from vehicles.

- Green Technologies: The shift towards renewable energy and hydrogen fuel cells is increasing the demand for PGMs in applications like electrolysis and fuel cell catalysts, contributing to sustainable energy solutions.

- Industrial Applications: PGMs' unique properties, such as high melting points and catalytic activity, make them vital for industrial processes like petrochemical refining, electronics manufacturing, and chemical production.

- Supply Constraints: PGM production is often concentrated in a few countries, leading to potential supply disruptions due to geopolitical tensions, labor strikes, and regulatory changes, which can push prices higher.

- Investor Interest: The scarcity of PGMs and their potential for price appreciation attract investors looking for opportunities in commodities, driving demand for these metals.

Restraints:

- Price Volatility: PGM prices can experience significant fluctuations due to changes in supply-demand dynamics, macroeconomic trends, and market sentiment, making investments in this market inherently risky.

- Substitution and Recycling: Advances in technology might lead to reduced reliance on PGMs in certain applications, and increased recycling efforts could impact demand for newly mined PGMs.

- Environmental and Ethical Concerns: PGM mining can have negative environmental and social impacts, leading to increased scrutiny and potential restrictions on mining operations.

- Economic Factors: Economic downturns and reduced consumer spending can affect industries like automotive and electronics, impacting demand for PGMs.

Trends:

- Green Revolution: The push for cleaner energy sources and technologies is propelling the use of PGMs in green applications, such as hydrogen fuel cells and renewable energy systems.

- Technological Advancements: Ongoing research is focused on developing more efficient and cost-effective catalytic converters, fuel cells, and electronic components, potentially altering PGM usage.

- Circular Economy: Increasing emphasis on sustainability is driving efforts to improve recycling methods for PGMs from end-of-life products, reducing the need for virgin material extraction.

- Ethical Sourcing: Consumers and investors are demanding greater transparency in the supply chain, pushing for ethically sourced PGMs to mitigate environmental and social concerns.

Opportunities:

- Green Technologies Expansion: The growth of hydrogen fuel cells and renewable energy systems presents opportunities for increased PGM demand in emerging applications.

- Innovation in Catalysis: RD efforts to develop advanced catalytic converters and other catalytic processes could drive demand for PGMs in new applications.

- Sustainable Mining Practices: Developing environmentally responsible mining techniques could enhance the reputation of PGM mining companies and secure long-term supply.

- Investment Potential: Despite price volatility, PGMs can offer opportunities for investors seeking diversification in commodities and potential capital appreciation.

In conclusion, the Platinum Group Metals market is influenced by a complex interplay of drivers and restraints, while being shaped by trends in technology, sustainability, and consumer preferences. There are opportunities for growth, particularly in green technologies and innovative applications, but challenges such as price volatility and environmental concerns also need to be navigated.

Contact us

Global Business Development Team: Market.us

Market.us (Powered By Prudour Pvt. Ltd.)

Send Email: inquiry@market.us

Address: 420 Lexington Avenue, Suite 300 New York City, NY 10170, United States

Tel: +1 718 618 4351, +91 78878 22626

Website: https://market.us/