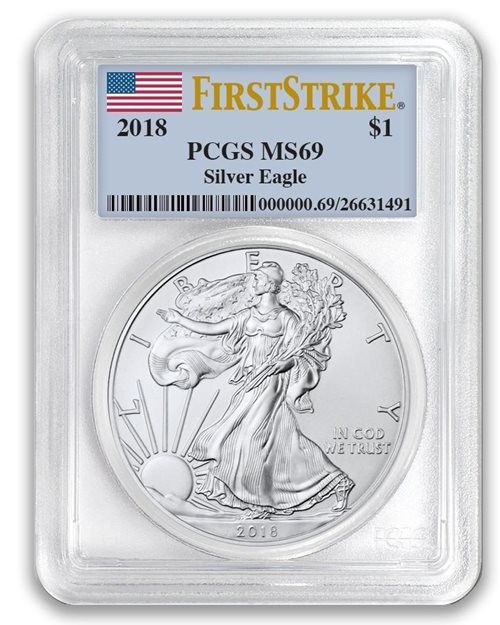

Silver Eagles on the market have grow to be one of the maximum sought-after bullion cash among both novice and pro investors. Their reliability, purity, and government-subsidized authenticity make them a desired method to spend money on precious metals. These coins represent extra than simply financial fee; they signify consider and security in an unpredictable monetary panorama. Investors frequently view Silver Eagles as an extended-time period shield against inflation and marketplace volatility. Their steady demand provides to their liquidity, making them a bendy asset for portfolios.

Understanding the Value of Silver Eagles

Silver Eagles for sale aren't merely collectible objects but are tangible assets that preserve value through the years. For individuals aiming to put money into treasured metals, those coins offer a physical method of storing wealth. Unlike digital or paper investments, silver coins offer ownership that isn't tied to any 1/3-party entity. Their weight and silver content ensure that cost isn't always simply perceived but actual and measurable. Silver Eagles also appeal to traders because of their international reputation and smooth convertibility into cash or items when wanted.

Why Physical Silver Matters in Today’s Economy

Amid growing digital developments, the physicality of Silver Eagles holds unique importance. As tangible assets, these coins function a hedge at some point of monetary downturns. When you spend money on treasured metals, you are choosing some thing with intrinsic really worth that doesn’t rely upon fiat currencies or virtual infrastructure. Silver has long been prized for its commercial and financial utility, giving Silver Eagles a multidimensional enchantment. The consolation of keeping actual wealth for your palms adds a degree of protection that many current belongings can’t offer.

Silver Eagles vs. Other Silver Bullion

While there are numerous silver funding options available, Silver Eagles for sale stand out because of their nice and agree with component. They are synthetic below strict specifications, making them best for individuals who desire to put money into precious metals with confidence. Unlike regular silver rounds or bars, Silver Eagles have felony gentle fame and consistent weight and purity, which appeals to both collectors and traders. Their resale cost is also generally better due to their recognizability and marketplace trust.

How to Start Your Investment with Silver Eagles

For beginners questioning a way to put money into treasured metals, beginning with Silver Eagles is a trustworthy and clever move. These coins are broadly available, clean to apprehend, and offer a clean route into the arena of silver investing. You don’t want a complex setup to begin; a simple steady storage space and a dedication to sluggish accumulation are often all that’s required. The stability and ease of Silver Eagles cause them to a favourite access factor into precious metallic investments.

The Role of Silver Eagles in Portfolio Diversification

One of the key techniques in constructing a robust funding portfolio is diversification. Silver Eagles for sale provide an super opportunity to put money into treasured metals at the same time as spreading economic threat. Their performance tends to move independently from shares or real property, supplying stability all through economic shifts. This makes them an important hedge and provides resilience for your investment method. Incorporating physical silver into your portfolio gives you an aspect in opposition to marketplace unpredictability.

Collectibility vs. Investment: What Matters Most

Silver Eagles are valued each as collectible cash and investment assets. While their inventive and historical factors appeal to creditors, their silver content material is what genuinely appeals to those seeking to put money into valuable metals. Knowing your priorities enables in selection-making—whether you’re after appreciation via rarity or value thru silver content material. Either way, Silver Eagles provide dual advantages, making them a unique asset class. The key is understanding your aim and buying thus.

Silver Eagles as a Long-Term Investment

When considering Silver Eagles on the market, it’s vital to think lengthy-time period. These cash aren’t commonly sold and offered for brief-time period earnings however held to build up cost steadily. Investors who spend money on precious metals apprehend the importance of staying power, and Silver Eagles praise those who preserve them over years in preference to months. Their potential to keep and develop in cost over the years makes them a pillar of conservative investment approach, perfect for constructing enduring wealth.

How Global Economic Trends Influence Silver Prices

The international financial system has an immediate effect on the fee and call for for silver. Events like inflation, geopolitical anxiety, and commercial demand shifts can all influence Silver Eagles on the market. Those seeking to invest in treasured metals want to live informed approximately worldwide financial signs. Silver, in contrast to fiat foreign money, has intrinsic fee that responds to deliver and demand, making it a barometer of economic stability. Understanding these influences enables traders make greater knowledgeable choices.

Silver Eagles and Inflation Protection

Inflation erodes the shopping energy of paper currency, but Silver Eagles act as a hedge against this phenomenon. When you put money into treasured metals, you're setting your believe in some thing that traditionally maintains its fee for the duration of inflationary intervals. Silver's balance offers reassurance for the duration of uncertain economic times. Silver Eagles are specifically popular at some point of periods of excessive inflation due to the fact they are widely depended on and provide liquidity along side intrinsic worth.

Storage and Security for Your Silver Eagles

Owning Silver Eagles on the market entails considering steady storage solutions. Whether you keep them at domestic in a safe or in a secure deposit field, protecting your investment is essential. People who spend money on treasured metals often adopt both bodily and insured garage techniques. It’s not just about obtaining the cash, however additionally about making sure they’re secure and available when wanted. Taking precautions in storage preserves your funding's cost and offers peace of thoughts.

The Liquidity of Silver Eagles within the Market

One of the motives traders choose Silver Eagles is their excessive liquidity. These cash are broadly recognized and clean to sell or change. For those who put money into treasured metals, having a liquid asset means being able to convert it to cash or goods efficiently. The large reputation of Silver Eagles in each home and worldwide markets ensures they can be monetized quick when necessary, making them a versatile part of any portfolio.

Silver Eagles and Tax Considerations

Understanding the tax implications of purchasing and selling Silver Eagles is vital. When you invest in valuable metals, it’s critical to be aware of local regulations surrounding capital gains and reporting necessities. While this aspect can vary by using place, right documentation and attention can help traders manipulate their assets greater efficaciously. Silver Eagles aren't just a bodily asset however additionally a economic one, and treating them as such includes information their tax impact.

Timing Your Purchase of Silver Eagles

Market timing can affect the fulfillment of your silver funding. Watching marketplace trends and monetary signals can help determine the exceptional moments to shop for Silver Eagles on the market. People trying to invest in valuable metals regularly display silver charge charts and financial forecasts. While predicting marketplace conduct isn’t foolproof, being knowledgeable facilitates mitigate dangers. Buying strategically in preference to rapidly ends in better long-term gains.

Educating Yourself Before You Buy

Before diving into the marketplace for Silver Eagles, instructing yourself is a clever step. Reading articles, looking expert statement, and knowledge silver market dynamics ensures a nicely-knowledgeable purchase. To invest in treasured metals wisely, one should pass beyond surface understanding and understand both ancient and modern marketplace behaviors. Being knowledgeable facilitates you apprehend fee, keep away from scams, and construct a valid funding approach focused on tangible, lasting wealth.

Conclusion: A Secure Path to Wealth with Silver Eagles

Silver Eagles for sale provide an available and reliable manner to invest in precious metals. Their constant purity, sizable reputation, and tangible nature cause them to a favored asset in instances of each balance and uncertainty. From protecting against inflation to diversifying your investment portfolio, Silver Eagles offer benefits that few other assets can healthy. They are not just cash, but lengthy-term commitments to monetary resilience and independence. As financial landscapes keep to shift, owning physical silver in the form of depended on bullion stays a smart and secure way to protect wealth for the destiny.