Market Overview

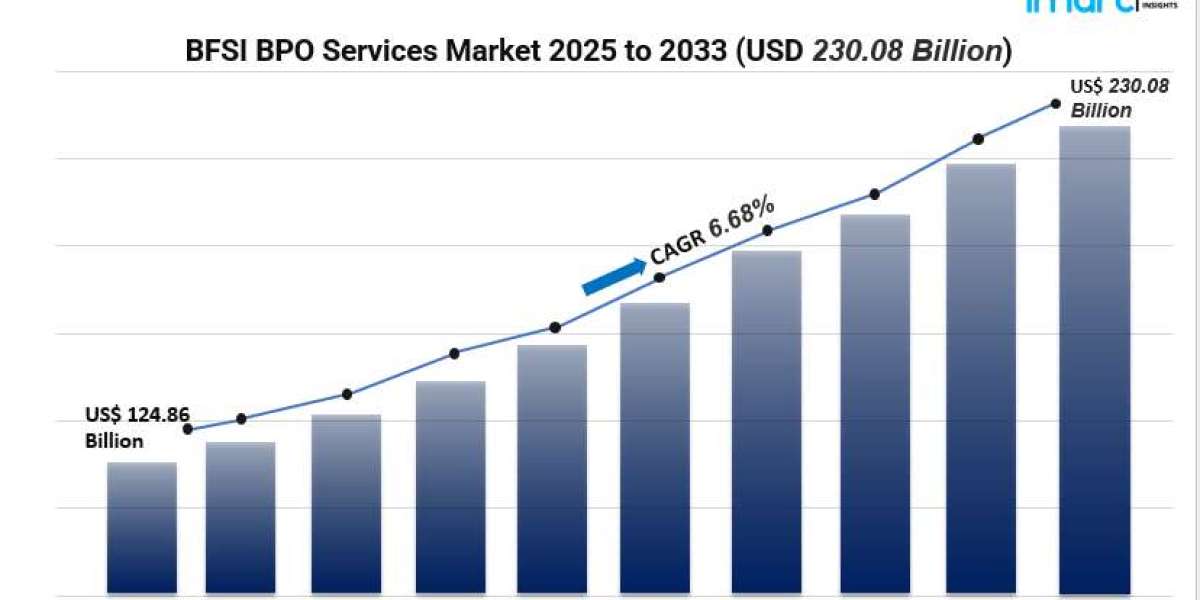

The global BFSI BPO services market reached a valuation of USD 124.86 billion in 2024 and is projected to surge to USD 230.08 billion by 2033, growing at a CAGR of 6.68%. Fueled by stringent regulatory mandates, rising cybersecurity needs, and the fintech-driven push toward digital transformation, the sector is revolutionizing customer engagement and operational efficiency. Key drivers include AI‑powered automation, cloud‑based risk and compliance solutions, and a growing focus on enhancing the overall customer experience .

Study Assumption Years

- BASE YEAR: 2024

- HISTORICAL YEAR: 2019–2024

- FORECAST YEAR: 2025–2033

BFSI BPO Services Market Key Takeaways

- Market Size & Growth: Valued at USD 124.86 B in 2024, estimated to reach USD 230.08 B by 2033 at a 6.68% CAGR .

- Regional Leadership: North America leads, holding ~36% market share in 2024.

- Service Segmentation: Covers customer services, finance & accounting, HR, KPO, procurement & supply chain, and more.

- Enterprise Size: Both large enterprises and SMEs are extensive adopters, driven by cost efficiency and scalability.

- End Users: Serving banks, capital markets, insurance, and other financial sectors .

- Technology Trends: Increased adoption of AI, automation, ML, cloud, NLP, IoT, blockchain, and RPA to boost efficiency and security .

- Risk & Compliance Focus: Demand for cybersecurity, fraud detection, and regulatory compliance services is accelerating market expansion .

Market Growth Factors

1. Digital Transformation & Fintech Disruption

The surge of fintech and digital-first banking has sparked an increasing demand for outsourced process solutions. Fintech companies are turning to BFSI BPO providers to enhance fraud prevention, payment processing, and customer service through scalable and secure infrastructures. Technologies like AI, machine learning, and cloud-based platforms play a crucial role, allowing for real-time analytics, strong cybersecurity, and improved customer personalization. Agile BPO partnerships enable financial institutions to quickly enter new markets, refine credit assessments, and bolster regulatory compliance—all while keeping costs in check and transitioning to a service-oriented model.

2. Cybersecurity & Regulatory Compliance

With the rise of cybercrime and strict financial regulations, institutions need to ensure top-notch data protection and compliance. For instance, banks in North America often outsource essential functions like risk monitoring, fraud analytics, and regulatory audits to specialized BPO providers. These experts utilize AI-driven threat detection and machine learning-based anomaly detection to dynamically strengthen defenses and maintain compliance. As regulations change worldwide, institutions depend on BPOs to refresh controls, minimize penalties, and ensure accurate regulatory reporting, making cybersecurity and compliance vital pillars for growth.

3. Automation & Operational Efficiency

Technological advancements—particularly in AI, robotic process automation (RPA), and natural language processing (NLP)—are revolutionizing traditional back-office operations. Routine tasks like data entry, document reconciliation, and handling inquiries are increasingly managed by digital workers, significantly reducing errors and costs. Virtual agents and chatbots manage high volumes of customer interactions, while predictive analytics aid in strategic financial decision-making and risk detection. Cloud-based platforms improve real-time collaboration among global teams. This blend of automation and analytics empowers BFSI players to streamline operations, enhance scalability, and provide exceptional service—key elements driving strong growth in the BPO market.

Request for a sample copy of this report: https://www.imarcgroup.com/bfsi-bpo-services-market/requestsample

Market Segmentation

- By Service Type:

- Customer Services

- Finance and Accounting

- Human Resource

- KPO

- Procurement and Supply Chain

- Others

- By Enterprise Size:

- Large Enterprises

- Small and Medium‑sized Enterprises

- By End User:

- Banks

- Capital Markets

- Insurance Companies

- Others

· Breakup by Region

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Regional Insights

North America is set to lead the way in 2024, capturing around 36% of the market share. This impressive position is fueled by strong regulatory frameworks, significant investments in cybersecurity, and a swift embrace of digital technologies. The region boasts a well-established fintech ecosystem and a growing appetite for AI-driven BPO services, which together support its ongoing, above-average growth.

Recent Developments & News

Lately, we've seen BPOs incorporating AI and machine learning to enhance fraud detection and strengthen operational resilience. There's also a clear shift towards cloud-native and virtual service models, enabling effortless scalability and global reach. As online banking continues to gain traction, companies are ramping up automation in customer support and risk management. These changes highlight a larger trend in the market towards tech-savvy BPO solutions that blend efficiency, flexibility, and compliance with regulations.

Key Players

- Accenture PLC

- Cognizant

- Concentrix Corporation

- Genpact

- IBM Corporation

- Infosys Limited

- Mphasis Limited

- NTT Data Corporation

- Tata Consultancy Services Limited

- Wipro Limited

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=7203&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: +1-631-791-1145