Market Overview:

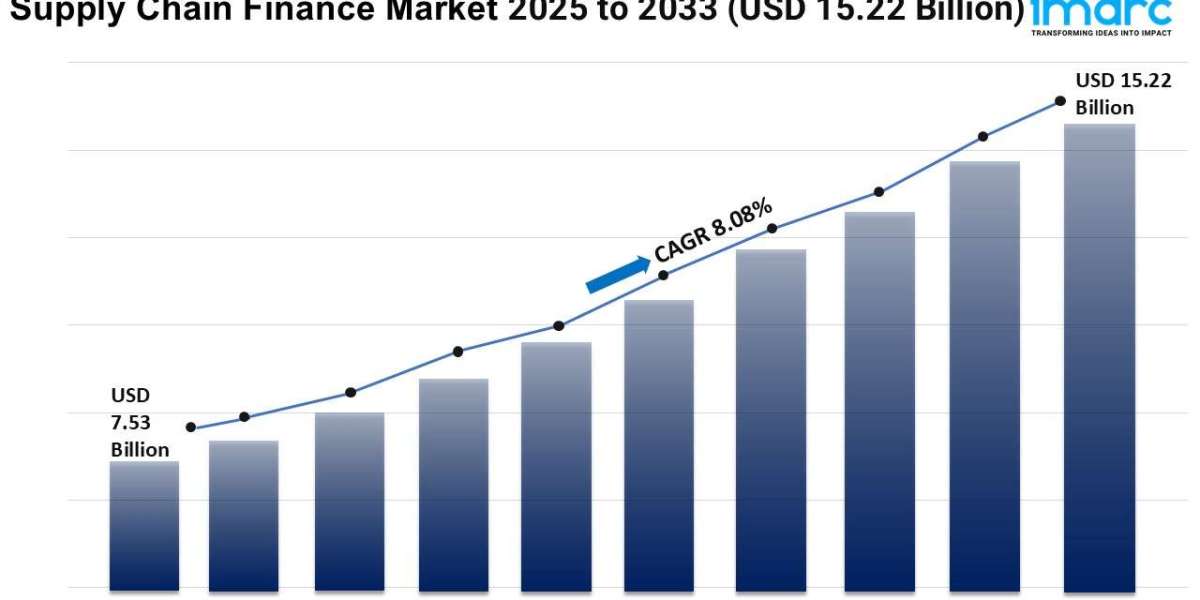

The supply chain finance market is experiencing rapid growth, driven by digital transformation and technology adoption, rising demand for working capital optimization, and globalization and complex supply chains. According to IMARC Group's latest research publication, “Supply Chain Finance Market Size, Share, Trends and Forecast by Provider, Offering, Application, End User, and Region, 2025-2033”, The global supply chain finance market size was valued at USD 7.53 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.22 Billion by 2033, exhibiting a CAGR of 8.08% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/supply-chain-finance-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Supply Chain Finance Market

- Digital Transformation and Technology Adoption:

The rapid adoption of digital technologies is a significant growth factor for the global supply chain finance market size 2024. Businesses are increasingly leveraging advanced platforms, such as blockchain, artificial intelligence (AI), and cloud-based solutions, to streamline financial processes and enhance transparency. For instance, platforms like Taulia and C2FO use AI-driven analytics to optimize invoice processing and dynamic discounting, enabling suppliers to access early payments efficiently. Blockchain ensures secure, tamper-proof transaction records, fostering trust among stakeholders. These technologies reduce manual processes, lower operational costs, and improve liquidity management, making SCF more accessible to small and medium enterprises (SMEs). As companies prioritize efficiency, digital transformation continues to drive market expansion by offering scalable, user-friendly solutions.

- Rising Demand for Working Capital Optimization:

The need for efficient working capital management is fueling growth in the SCF market. Companies across industries face cash flow challenges due to delayed payments or supply chain disruptions. SCF solutions, such as reverse factoring and dynamic discounting, allow buyers to extend payment terms while enabling suppliers to receive early payments, thus bridging liquidity gaps. For example, a global retailer like Walmart uses SCF programs to support its suppliers, ensuring they maintain cash flow without straining buyer-supplier relationships. This mutual benefit encourages more businesses to adopt SCF, especially in industries like manufacturing and retail, where tight margins and long payment cycles are common, driving market growth.

- Globalization and Complex Supply Chains:

Globalization has led to increasingly complex supply chains, creating a strong demand for SCF solutions. As companies source materials and services across borders, they face challenges like currency fluctuations, varying payment terms, and regulatory differences. SCF programs help mitigate these issues by providing flexible financing options tailored to international trade. For instance, HSBC’s supply chain finance solutions support cross-border transactions by offering localized financing for suppliers in emerging markets. This enables smoother operations and reduces financial risks for both buyers and suppliers. As global trade continues to expand, SCF’s ability to address these complexities positions it as a critical tool for multinational corporations, driving market growth.

Key Trends in the Supply Chain Finance Market

- Integration of ESG Considerations:

Environmental, Social, and Governance (ESG) factors are becoming a prominent trend in the SCF market. Companies are integrating sustainability into their financing programs to align with corporate social responsibility goals. For example, sustainability-linked SCF programs incentivize suppliers to adopt eco-friendly practices by offering better financing rates for meeting ESG criteria, such as reducing carbon emissions. A case study from Unilever shows how its SCF program rewards suppliers adopting sustainable practices, enhancing supply chain resilience while promoting environmental goals. This trend reflects growing consumer and regulatory pressure for sustainable business practices, encouraging SCF providers to innovate and integrate ESG metrics into their offerings, transforming the market landscape.

- Growth of Fintech-Driven SCF Platforms:

The rise of fintech companies is reshaping the SCF market by introducing innovative, accessible platforms. Unlike traditional banking solutions, fintechs like PrimeRevenue and Demica offer user-friendly, cloud-based SCF platforms that cater to businesses of all sizes. These platforms use real-time data analytics to assess credit risk and facilitate faster onboarding of suppliers. For instance, Demica’s platform allows SMEs to access SCF with minimal paperwork, democratizing access to liquidity. This trend is disrupting traditional SCF models, making them more agile and inclusive. As fintechs continue to innovate, their platforms are expected to drive competition and expand market reach, particularly for underserved segments.

- Increased Collaboration Between Stakeholders:

Collaboration among banks, fintechs, and corporates is a key trend shaping the SCF market. These partnerships combine the strengths of financial institutions’ capital and regulatory expertise with fintechs’ technological agility. For example, CitiBank collaborates with fintechs like Orbian to offer integrated SCF solutions that streamline processes for large corporates while ensuring compliance. Such collaborations enable seamless data sharing, faster transaction processing, and customized financing solutions. This trend fosters innovation and scalability, allowing SCF programs to cater to diverse industries, from automotive to pharmaceuticals. As stakeholder collaboration grows, it enhances the efficiency and reach of SCF, making it a vital tool for modern supply chains.

Leading Companies Operating in the Global Supply Chain Finance Industry:

- Asian Development Bank

- Bank of America Corporation

- BNP Paribas

- DBS Bank India Limited

- HSBC

- JPMorgan Chase & Co.

- Mitsubishi UFJ Financial Group Inc.

- Orbian Corporation

- Royal Bank of Scotland plc (NatWest Group plc)

Supply Chain Finance Market Report Segmentation:

Breakup By Provider:

- Banks

- Trade Finance House

- Others

Banks exhibit a clear dominance in the market due to their established trust, extensive financial networks, and access to capital, which are essential for providing large-scale supply chain finance solutions.

Breakup By Offering:

- Letter of Credit

- Export and Import Bills

- Performance Bonds

- Shipping Guarantees

- Others

Export and import bills represent the largest segment as they are crucial in international trade, providing immediate liquidity for cross-border transactions.

Breakup By Application:

- Domestic

- International

Domestic holds the biggest market share because companies prioritize managing cash flow and reducing risk within local supply chains.

Breakup By End User:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises account for the majority of the market share since they rely heavily on supply chain finance to manage extensive supplier networks and optimize cash flow, giving them a substantial share.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific dominates the market attributed to its strong trade environment, regulatory support, and financial infrastructure.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145