The Wood Based Panel Market encompasses the production, distribution, and sales of engineered wood products made from various wood-based materials, including plywood, particleboard, oriented strand board (OSB), and medium-density fiberboard (MDF). These panels are manufactured by binding wood particles, fibers, or veneers with adhesives under heat and pressure, resulting in versatile building materials used in construction, furniture, packaging, and interior design. The market is driven by the demand for sustainable and cost-effective alternatives to solid wood, advancements in manufacturing technologies, and the increasing emphasis on environmentally friendly and renewable resources. Wood based panels offer durability, strength, and design flexibility, making them a preferred choice in various industrial and residential applications.

Key Market Players:

Dongwha Malaysia Holdings Sdn. Bhd.

Klenk Holz GmbH

Kronospan Limited

Dare Panel Group Co., Ltd.

SGS Industrial Services

Starbank Panel Products Ltd

EGGER Group

Norbord Inc.

Kastamonu Entegre

Georgia-Pacific

ARAUCO

Canfor

Robert Burkle GmbH

Pfeifer Gruppe

Sonae Industria SGPA, S.A

An Cuong

Evergreen Fiberboard Berhad

Mieco Chipboard Berhad

Green River Holding Co., Ltd.

HeveaPac Sdn. Bhd.

Robin Wood

Vina Eco Board Co. Ltd

VRG

West Fraser Timber Co. Ltd.

Timber Products Company

Dongwha Enterprise Co., Ltd.

Duratex

Freres Lumber Co., Inc.

Other Key Players

Click here for request a sample : https://market.us/report/wood-based-panel-market/request-sample/

Product Type Analysis:

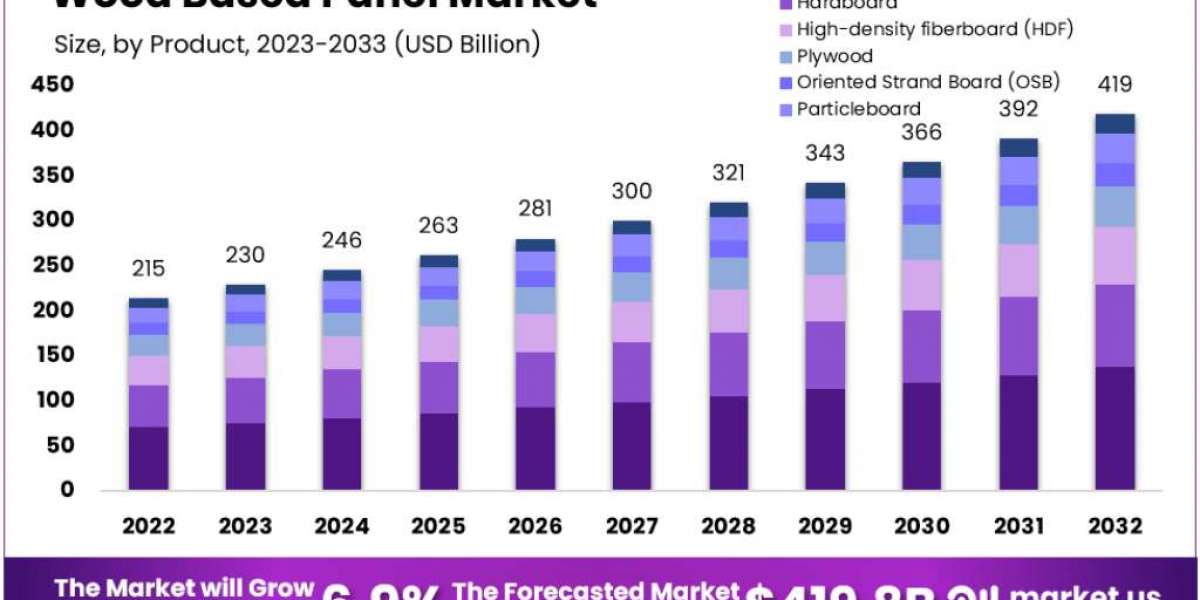

In 2023, Polyolefin dominated the wood-based panel market with a 33.6% share, highlighting the segment's growth driven by its strength, durability, and resistance to fire and chemicals. Medium-Density Fiberboard (MDF), valued at USD 25.6 billion in 2019, is expected to grow at a 6.4% CAGR due to its uniformity and strength, making it popular in furniture. Hardboard is noted for its density and versatility, while High-Density Fiberboard (HDF) offers enhanced strength for high-requirement applications. Plywood, the most popular category in 2019, is favored for its robustness and resistance to various elements, driving demand in construction and furniture. Oriented Strand Board (OSB) is projected to grow at a 7.8% CAGR, driven by its manufacturing process that provides greater strength. Particleboard, valued for its density and versatility in flooring, roofing, and furniture, is gaining traction. Softboard, used for insulation and soundproofing, continues to be valuable in construction and interior decoration.

Application Analysis:

In 2023, the Construction segment led the wood-based panel market with a 47.6% share. In packaging, wood-based panels are favored for their strength and eco-friendliness, driving demand for sustainable packaging solutions. The furniture sector sees growth with wood-based panels used in both large and small pieces, including Ready-to-Assemble (RTA) furniture, appreciated for durability and aesthetic appeal. In construction, the application of wood-based panels in China was valued at USD 19.23 billion in 2019, with a forecasted 9.8% CAGR. The construction segment's growth at an 8% CAGR is fueled by increased consumer purchasing power, low interest rates, and investments in new commercial spaces, with panels preferred for their versatility and range of options.

Key Market Segments:

By Product

Medium-density fiberboard (MDF)

Hardboard

High-density fiberboard (HDF)

Plywood

Oriented Strand Board (OSB)

Particleboard

Softboard

By Application

Packaging

Furniture

Construction

Drivers:

The rising demand in the furniture industry is boosting the wood-based panel market, particularly in Asia-Pacific regions like China and India, where consumers spend significantly on kitchen furniture. Home renovations and increased consumer spending on furniture, projected to reach $485 billion in 2023, further drive demand. Additionally, balanced global trade among Europe, North America, and Asia, coupled with rising population and housing needs, contributes to market growth.

Restraints:

Cost fluctuations due to rising petroleum-based fuel prices impact the manufacturing and distribution costs of wood-based panels. This price volatility poses challenges to market growth as energy-intensive alternatives become more competitive.

Opportunities:

Technological advancements and urbanization are opening new markets, as seen with IKEA’s partnership with Alibaba. Urbanization in China fosters new brands and consumer bases with strong purchasing power. Significant investments in residential construction in North America, particularly the U.S., indicate a healthy market trajectory for wood-based panels.

Challenges:

Supply chain disruptions, especially in the European home furniture industry, introduce vulnerabilities. The shift to sourcing from neighboring countries to mitigate these disruptions highlights the adaptability but also the challenges faced by the industry.

Trends:

Eco-friendly packaging solutions are driving demand for wood-based panels due to their strength and durability for long-distance transport, aligning with environmental consciousness. The shift to remote work has increased demand for multifunctional, durable, and aesthetic furniture, prompting manufacturers to innovate with wood panels. Additionally, investments in decorative and structural applications, such as China's sixty-story wooden building, showcase the material’s versatility and growth potential.