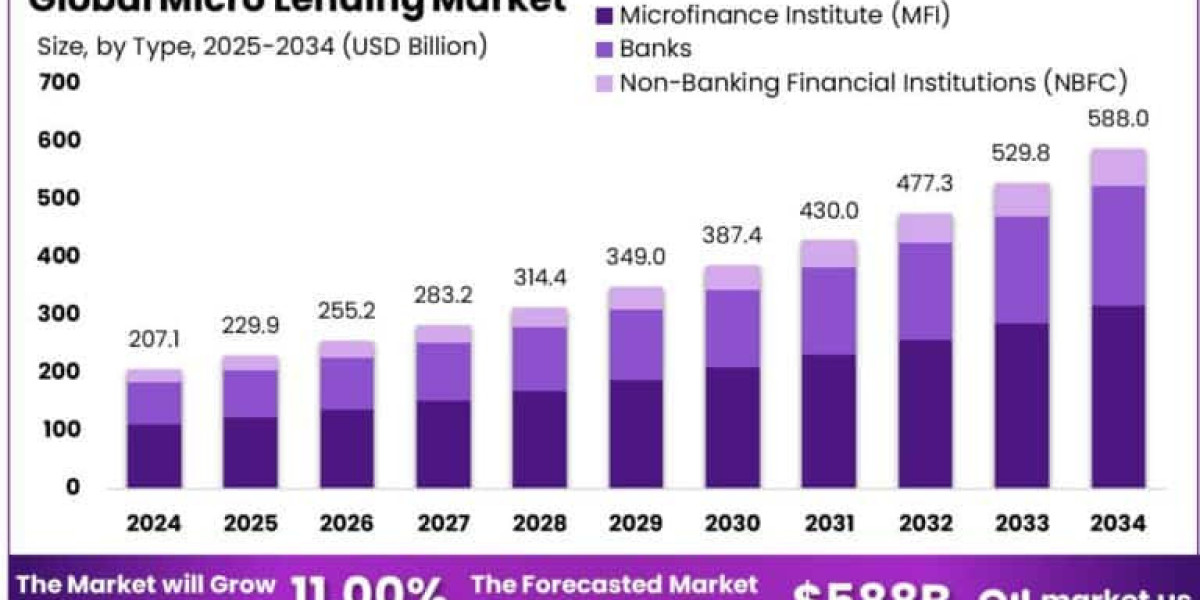

The Micro Lending Market refers to a specialized segment of financial services where small loans, typically provided without collateral, are offered to individuals or small businesses that lack access to traditional banking services. This market plays a crucial role in promoting financial inclusion, particularly in underserved regions. It is often driven by microfinance institutions, fintech companies, and non-banking financial corporations that focus on empowering low-income populations, entrepreneurs, and women-owned businesses. As of now, the market is experiencing strong upward momentum, thanks to growing awareness about the importance of inclusive finance and the rise of digital platforms

Read more - https://market.us/report/micro-lending-market/

One of the top driving factors behind the growth of the micro lending market is the rising demand for accessible credit options in developing regions. Many individuals still operate outside the formal financial system, and micro lending offers them a lifeline. Additionally, the increasing penetration of mobile phones and internet connectivity has made it easier for lenders to reach remote borrowers, further propelling market expansion.

Demand analysis shows a steep rise in borrowing among micro-entrepreneurs, especially in rural and semi-urban areas. These borrowers are seeking small loans to support daily business operations, fund inventory, or address unexpected expenses. The demand has remained resilient even during economic slowdowns, underscoring the importance of micro loans as a critical financial tool for survival and growth.

There is also a notable increase in the adoption of digital technologies like AI-driven credit scoring, blockchain for secure transactions, and mobile lending platforms. These tools have reduced operational costs and improved loan disbursal speed and accuracy. Fintech startups are leading the charge, using data analytics to assess creditworthiness, even in the absence of traditional credit histories.

Borrowers and lenders are embracing these technologies for key reasons such as faster approvals, lower default rates, and enhanced transparency. On the borrower’s side, minimal paperwork and quick access to funds are major incentives. For lenders, it’s the ability to scale operations while maintaining low risk levels that makes these innovations appealing.

Investment opportunities in this space are also heating up, particularly in emerging markets. Investors are showing growing interest in fintech-based micro lenders that can offer high returns by tapping into underserved populations. There’s also a surge in social impact investing, where funds are directed not only for financial returns but also for socio-economic development.